Just wanted to add this to the forum to save some information. Was discussing JAZZ (and their drug, Xyrem) being a direct competitor to the drug AVDL is looking to get approved (FT218). According to their latest quarterly report, Xyrem itself accounted for a little less than half their revenue (334M out of 752M, about 44.4%). JAZZ’s current market cap is 8.63B vs. AVDL’s market cap of 584M, so long term (after approval), maybe AVDL’s market cap could grow 10x. Not saying this is the price target for after approval, since I’m sure there are several other factors involved here, but just wanted to throw some potential numbers together for people to look at.

I thought AVDL’s big thing was that they are 1 dose and the only current treatment available is 2 doses per night.

Am I off?

No that’s correct, but that is a huge deal.

I do appreciate seeing the comps. Good looking out OP.

It gets even better than that.

Jazz has two oxybate products - Xyrem, (sodium salt of GHB) and Xywav, (a mixture of sodium, potassium, and calcium salts of GHB). I think it’s fair to include both in the comparison to Avadel as it’s Jazz’s intention to switch all of their Xyrem patients to Xywav because their patent expiry on Xyrem. If you include the sales for Xywav their revenue increases to 458mm, or 61%. Also - in 2020 alone, Xyrem had 1.7bn in sales, or 71% of revenue.

The difference between Xyrem and Xywav is a significant reduction in sodium. A therapeutic dose of Xyrem contains 1,640mg of sodium, while the same dose of Xywav contains just 131mg. The American heart association recommends a daily intake of less than 1,500mg of sodium, so you’re essentially already over that limit without eating anything. Both of these medications are taken in twice nightly dosing, once before you go to sleep 2 hours AFTER your last meal, and another in the middle of the night ~4 hours after your first dose.

Avadels formulation FT218 is a sodium salt of GHB with a micropump delivery system that allows for once nightly dosing without the restrictions on meal timing. But here’s the caveat - it’s not the perfect solution either, because it’s not low sodium.

Enter JZP-324. Once nightly formulation of sodium, potassium, and calcium salts of GHB. This would be the gold standard - currently in Jazz’s pipeline in phase 1 clinical trials. But here’s the thing - the FDA already granted Avadel orphan drug designation for once nightly dosing, which means if it’s approved they will have 7 years of exclusivity, meaning the FDA in theory may not approve Jazz’s JZP-324 for 7 years.

So what do I think? I think that at the end of the day the studies on Xyrem (high sodium) have shown that it’s not really a concern for most patients, and that a once nightly formulation would be a much greater advance in compliance and efficacy than simply a low sodium version. Low sodium is great, but once nightly is better. Once nightly low sodium would be the best, but we’re years away from that.

Long story short - if Avadel gets their approval, I believe there may be a likely scenario in which Jazz purchases Avadel. Given the revenue generating possibilities of a once nightly formulation and the fact that Jazz is on track to have 2bn cash on hand at the end of the year, I think it’s one possible scenario. Who knows. It’s been a fun rollercoaster ride.

FDA notified the company that the review of the NDA (New Drug Application) for FT218 is still ongoing. Action likely won’t be taken in October.

New target action date wil be provided ASAP.

Does anyone know when their earnings are? Is the market still going to respond negatively to bad earnings, eventhough it will be anticipated from a one drug in the pipeline company. Today might be a good dip buying opportunity though.

That’s an interesting scenario you present. I wonder why JAZZ would bother to wait on purchasing AVDL, although I guess shareholders would have to approve the deal. I may pick up a little more shares, probably no options, unless I see something inexpensive for some time next year.

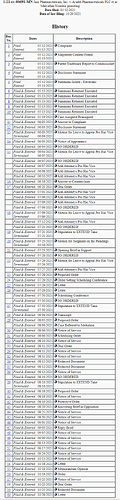

One risk on this play, JAZZ is suing AVDL for patent infringement. I’ve started to pull some of the documents on the court case from PACER, still trying to digest them. It seems, from the last memorandum available, that the case basically can’t proceed (or at least the preliminary injunction proceedings) until FDA actually says if this is approved or not, which I guess makes sense, since there aren’t actually any damages to JAZZ yet.

Document 1.pdf (212.5 KB)

Document 11.pdf (224.0 KB)

Document 21.pdf (51.5 KB)

Document 28.pdf (215.6 KB)

Document 29.pdf (146.2 KB)

Document 36.pdf (2.5 MB)

Document 37.pdf (181.0 KB)

Document 42.pdf (304.8 KB)

Document 43.pdf (236.4 KB)

Document 43 - Exhibits.pdf (3.6 MB)

Document 47.pdf (71.2 KB)

Document 55.pdf (191.5 KB)

Document 56.pdf (117.1 KB)

Document 59.pdf (216.2 KB)

So AVDL has earnings next week (Nov. 8th). Based on some of the court filings I was looking through, it appears they had also committed to not selling FT218 until January 2022 to allow for time to deal with the preliminary injunction issues associated with the Jazz lawsuit. They made this deal back in August before the FDA delay, so I don’t know how this might be effected with the delay in approval.

Based on AVDL not actually getting to sell anything this year, my plan is to get out of my December calls and pick up some 2022 calls (maybe March or later). I may wait to get those calls until after earnings ( maybe I get one now and wait for more after).

I still have some November calls I picked up after the delay announcement, so I’ll probably keep those through earnings, and possibly add some puts to build a long strangle (or straddle depending on where this goes). I’ll likely hold my shares until this decision happens and the lawsuit is resolved. Obviously this is not investment advice and you should DYOR, etc.

Thank your for your updated, greatly appreciated.

Ok, so I skimmed through the documents I uploaded to my post above, here is my “I am not a lawyer” summary of what I think is going on:

-

May 12, 2021 - JAZZ filed a complaint against AVDL for patent infringement. The suit basically lists out five patents that it alleges AVDL has or will have to infringe upon to manufacturer and sell FT-218 (AVDL’s drug). The first patent listed “963” is for a “drug distribution system”, seems like it is basically a database to track who prescribes the drug, the other four are patents for actual drugs. Note that the “963” patent is anticipated to expire on December 17, 2022. The other four are anticipated to expire in 2031. Note that these four had applications that were filed between 2018 and 2020.

-

June 3, 2021 - AVDL responded to JAZZ’s complaint. Basically says we deny everything, but to the “real” issues at hand, they basically say that in their opinion the “963” is not a valid patent and should get thrown out (referencing Jazz Pharms., Inc. v. Amneal Pharms., LLC, 895 F.3d 1347 (Fed. Cir. 2018)., which seems to indicate that the the patent is not valid because of publicly accessible prior art - also patenting a database system seems like bullshit, but what do I know?).

-

June 3, 2021, continued - Regarding the other patents, AVDL filed a patent for FT-218 on July 21, 2017, which was filed prior to all the patents that JAZZ claims AVDL is infringing. Oops get fucked JAZZ, since 2013 first to file has priority. The patent that JAZZ was working off of before it filed all those patents has already expired (or abandoned? not sure what the difference is).

-

July 23, 2021 - AVDL requests partial judgment on removing the '963 patent from the Orange Book (I guess this is something that holds drug related patents), but it is subsequently denied because "To engage in the claim construction process upon review of a motion to dismiss [or, here, a motion for judgment on the pleadings] would be to go beyond the scope of a court’s traditional gatekeeping role in reviewing such a motion; it would instead amount to a more in-depth evaluation of the merits of a plaintiff’s case.” Makes sense, so this is still “active”, but based on Item 2 above, really should be a non-issue.

-

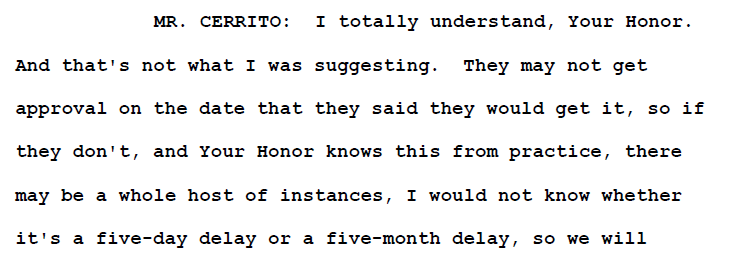

July 30, 2021 - AVDL, JAZZ, and the Court have a teleconference. At issue is that a preliminary injunction (PI) may be required to stop AVDL from selling its product if it gets approved, but JAZZ can’t (or won’t) file a preliminary injunction unless AVDL actually has approval. There is some bullshit back and forth, and the judge at one point basically says stop fucking around, she isn’t going to go through the four different infringement patents (it was agreed that a decision on the '963 patent is not an issue at this point) and with 80 different claims (with 11 different defenses) for a PI, JAZZ pick your best claim, AVDL pick your best defense, and we’ll decide the PI based on that. I haven’t poured through the various patents, but assuming that AVDL’s patent covers everything they need to make FT-218, JAZZ isn’t getting that PI. And if they aren’t getting the PI, AVDL will take over their market once they actually start selling the drug, while they are still in court trying to decide if JAZZ actually has a case.

-

August 12, 2021 - AVDL sends a letter regarding PI scheduling to the Court. JAZZ also sent a letter, but I don’t think there is anything interesting in that one. One thing that I found interesting in AVDL’s letter is that they committed to not sell any product before January 2022, in order to allow for enough time to review/decide on the preliminary injunction. So two interesting things about this, 1) this was committed to back in August, when they still thought they were going to get approved in October, and 2) does this commitment get pushed back with the potential approval date getting pushed back as well? If that’s the case, they may not be selling product until Q2 2022.

-

Actually one other interesting thing in the teleconference transcript (held on July 30, 2021), JAZZ basically saying they are going to get AVDL’s approval delayed five months?? :tinfoil:

So given all this, here are my thoughts:

-

JAZZ isn’t going to win this lawsuit

-

I personally think that approval of AVDL’s FT-218 is likely, but I have no idea when the FDA will actually approve it. I believe there has been some discussion on it being January at the latest, since that would have given FDA 10 months for the review, which is what their typical maximum is.

-

After (the assumed) FDA approval, JAZZ is going to file for a preliminary injunction against AVDL. Based on AVDL’s previous commitment, I think it is likely that they will not sell FT-218 for at least 75 days after receiving FDA approval.

In terms of how I am going to play this (disclaimer, I have no idea what I’m doing):

- I will likely exit most of my December calls (I might keep 1) as they are up pretty significantly. I am not sure when I will do this, I might wait until the day of earnings for the IV bump. I am going to hold my shares (125).

- I have November calls that I picked up after the FDA delay announcement, that I will hold on to through earnings next week (November 8th). I highly doubt that they will have news that will move them ITM, but you never know. I’m going to buy November puts on AVDL as a strangle. My prediction is that they say something about the lawsuit and commitment to not selling right away (at least Q2 2022), which drops the price, but who knows

.

. - After earnings, I’ll consider getting March or June 2022 calls, or maybe more shares.

- After FT-218 (assumedly) gets FDA approval, I will likely buy some puts that day. I anticipate that JAZZ will file for a PI within a week of the FDA approval, which will probably make algos or other people dump the stock. I might add to my position (calls/shares) at that point, targeting when they actually start selling the product (at least 75 days from FDA approval).

- As I indicated earlier, I have no idea what a price target is here for any of these movements, but from a quick and dirty fundamentals perspective, if AVDL consumes JAZZ’s market capitalization for Xyrem, reaching $80-100/share wouldn’t be out of the question (as a very long term target).

- And it should go without saying, that with the above, I have no idea when the FDA will actually approve this. I could be missing out on a bunch of gains by selling out of my December calls early (or maybe I’m just getting decent profit on them because they will eventually expire worthless), but given that they are up a bunch already, I’m ok taking that profit.

One other thing - I know I had mentioned this to Dakk in a previous chat, but the orphan drug designation is also a really really big deal, according to my wife who is a health outcomes research scientist - it means that the drug addresses a medical need that is not currently being addressed by any drug on the market - probably why Jazz is so intent on stopping it.

I feel pretty good about not getting screwed by the FDA here, unless they somehow get something to AVDL first thing Monday morning before earnings.

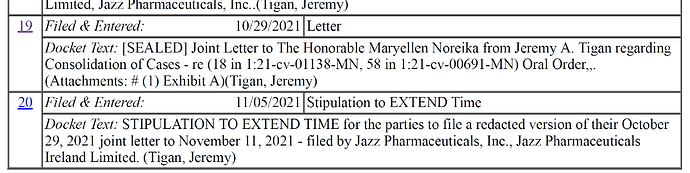

I checked the case file, and the only thing that has been filed as of EOD today is an extension to file a redacted version of a sealed letter, which was about combining two lawsuits JAZZ has against AVDL. The second lawsuit just claims patent infringement for another patent that JAZZ has, which also was filed after AVDL’s patent for FT-218.

JFC. @DakkJaniels you get an A++ on your book report.

I’ve also included a few other interesting reads below for info on the lawsuit. The REMS patent is complete BS and there is already precedent there, as you pointed out w/Amneal. You’re certainly correct about the orphan drug designation also.

https://www.bu.edu/bulawreview/files/2017/10/CARRIER-2.pdf

Given Jazz’s licensing deal with Hikma, I REALLY think a Jazz buyout is on the table. Another supporting piece of evidence for this theory is the fact that Avadel still hasn’t given FT218 a name - but they have started a marketing program to collect patient and provider information. I think they are preparing for a buyout but also have a contingency plan of a full self rollout in the instance that Jazz doesn’t buy them out.

Again, Bravo for all of your insane research.

Wow impressive thread, well done all contributors very high quality info in here.

Looking at the options for March 2022, thinking of getting a mix of 12.5/17.5 calls. Will wait til after earnings hopefully heads back down abit after it’s recent upsurge.

Edit- replaced 15 with 12.5 to give better coverage

AVDL released earnings press release - nothing special, no outlook/guidance included, Q3 beat Webull’s EPS estimate slightly at -0.38 vs. Webull’s estimate of -0.39. Doesn’t really include anything else, as far as I can tell, that we didn’t already know. https://investors.avadel.com/static-files/134cf578-0616-46c2-b7da-c0d9a076eb4d

I’m considering calling into conference call and seeing if I can ask when they anticipate selling product, given their lawsuit with Jazz and the potential for a preliminary injunction (but I probably won’t).

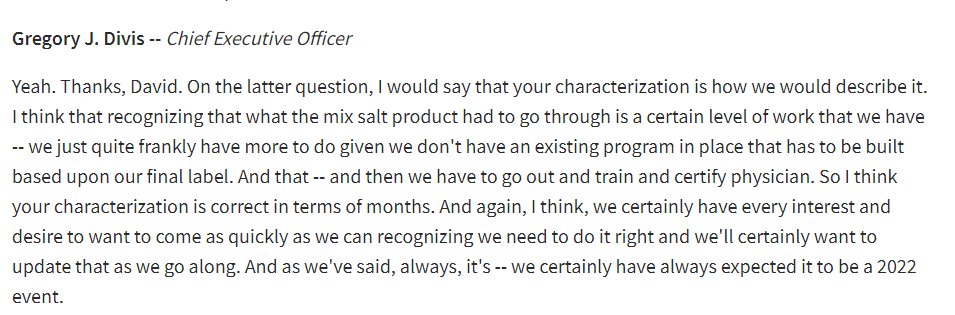

Listened to a good portion of the call. As I write this, AVDL is down about 2.5%, I still wouldn’t be surprised if we see a further drop in the share price in AVDL over the next few days. They basically said they don’t know when this is getting approved and product won’t be available for sale for a few months after approval occurs because there is still a bunch of work that has to occur once the approval has been granted. No salesforce has been hired as well (which may also tie into potential buyout opportunity). Still seems like a good long term play, but in the short term, I expect a drop due to this uncertainty.

Edit: Now AVDL up around 7 9%. Not really sure why, since there isn’t any news as far as I can tell, and the call was neutral at best.

AVDL ended up 4.99% today. Earnings call transcript here: https://www.nasdaq.com/articles/avadel-pharmaceuticals-plc-avdl-q3-2021-earnings-call-transcript

I sold a few of the calls I was still holding today, and I’m still holding my puts. I still think this may drop within the next week, since they have a multi-month timeframe to get the product to market, even after they get approval, and they indicated multiple times during the call that they have no idea when that approval is going to be:

Hopefully this is how it plays out since I do want to get back into my long/bullish position.

I listened to the whole call. While I thought it was positive, I was surprised at the price action, it topped $11.42 at one point!

My takeaways were:

-

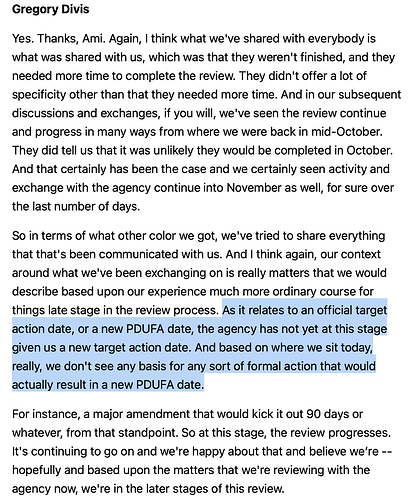

Everyone kept asking about the FDA approval and timeline, and Gregory finally shut them down by essentially saying that “from where they sit today” the FDA is not going to issue a new PDUFA date or any “major amendment” to the timeline. The way I took this - and I think markets reflect this - is that the FDA is just going to issue their approval without announcing a new date, and hopefully sooner rather than later.

-

In regard to the REMS program, I don’t know, it might just be me, but I got the impression that they plan to contract out as much of this program as possible. I am here to tell you that there is a very long list of things they could be working on right now, without an approval, to get the REMS program going, but they were pretty mum on any specific plan. Think about this: they already started a patient marketing website, but not a distribution strategy? Sounds like they already have a distribution plan. Would I be crazy to think that they might consider working with Jazz and using their existing REMS program? In my opinion the most costly, arduous, and valuable, part of the REMS program is the provider certification. You need certified providers to be able to write prescriptions for your product, and something tells me that there does exist a world in which Jazz and Avadel could get along enough when they each possess something that the other requires. A book of business with a network of providers certified and ready to prescribe is worth a hefty sum without any patent. Maybe this was Jazz’s plan all along? It is essentially what they ended up agreeing to do with Hikma for the generic of Xyrem, after all. If you can’t stop your competitor from releasing a new product, you might as well get paid a fee to distribute it for them rather than get 100% of $0.00.

In any case, super bullish, super excited. If I had to guess I’d anticipate approval this year but no sales until 2022.