Hello,

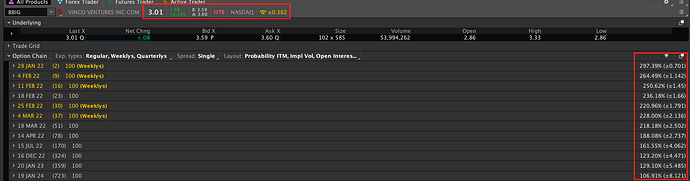

I’m trying to find that sweet spot for IV% when eyeing a put position. I’ve heard anything around or under 200% is decent. My question is; does this depend on different variables? I’m looking at BBIG Put weeklies and the IV on my strike price is 340%+. How would one determine whether or not IV is too high?

IV in general is inflated right now because of the market conditions, so the normal strategy for deciding your trade based on IV is more difficult. As I write this response it looks like there was a large move in after-hours which is further skewing the data.

Typically, you would want to check the expected move on the contracts and try to help use that to determine relative pricing, but in this case, IV and expected is actually higher on the closer contracts than the further away contracts.

1 Like