$BABA

Charlie Munger, vice chairman of Berkshire Hathaway bought 165,320 shares in Q1 of 2021 into Alibaba, the first time he has touched his portfolio since 2014. As Alibaba suffered more from the CCP’s tech crackdown, Charlie added more $BABA shares to his portfolio in Q3 2021, another 136,740 shares

Financials

-

Alibaba’s CAGR over 10 years for Revenue, Free Cash Flow, Assets, and EPS all at around 60%

-

Current PEG Ratio 1.06 compared to Internet-Commerce industry average of 3.21

-

P/E ratio of 22.07 with a trailing PE of 16.39X, compared to industry average 47.21X. This means that analysts are expecting a decrease in earnings for Alibaba, this is expected as I am also expecting Q3 2021 Earnings to be lower than last year.

-

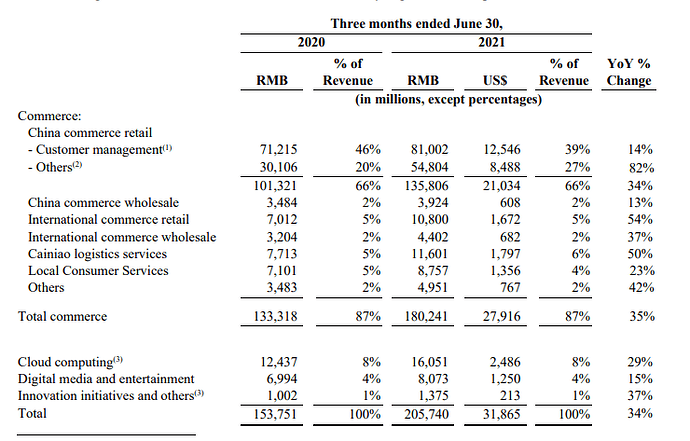

Every single area of Alibaba’s business is up by double digits percentage YoY

-

They have 1.18bn global active annual customers, and are aiming to grow to 2bn by 2036

-

China Single’s Day Record Sales of $84.5bn

Moat

Alibaba has a wide moat and what is called the Iron Triangle

Iron Triangle

- Alipay: online payment method/platform

- Cainiao: logistics company

- Ant Group (Ant Financial) stake

This particularly makes it hard for international markets (such as AMZN) to penetrate their market

Section’s of Alibaba’s Business

- Ecommerce

- With just their ecommerce financials alone, Alibaba’s intrinsic value is still higher than the current trading stock price

- Cloud computing

- They are essentially break even on cloud, does not affect them significantly on profit

- Ant Group

- Blocked IPO by CCP and attempting to be broken apart

However, even with the predicaments of their cloud and Ant Group, I consider those as an “extra” in the pile when you invest into Alibaba, with the main focus on their ecommerce value.

[center]Risk Section[/center]

What is the #1 reason why the share price is dropping?

- CHINESE GOVERNMENT

- Blocked IPO of Ant Group

- Slapped a $2.8bn Antitrust Fine on Alibaba

- Jack Ma pledged $15.5bn to common prosperity in China

- The big one, COMMUNISM, however it is a “Chinese characteristics Communism” in which there is still free market allowed

- End goal of China is to prevent monopolistic businesses and achieve common prosperity, this poses risk to Alibaba as it means they will have to change many things in their business model such as Alipay and the way its set up, and Jack Ma will have to pay that $15.5bn somewhere down the road

However, Xi Jinping announced that he will set up a stock market in China for Small to Medium enterprises for them to have a better way to access capital, sure, the capitalist is still not in control of the system, but that is just a part of THEIR way of doing things, and part of it is ensuring it’s not a capitalist driven system.

Furthermore, China is not trying to destroy business growth, and the sentiment from the western side is that because the capitalist is not in control, it is a bad system, and we will assume all the worst for it’s growth in the business side of things. China is different, but they are not stupid, and they are surely not going to go back to the old methods of communism given the fact that the methods they are using right now are effective and China is growing as a result. Alibaba winning means China wins, too.

Here is an article by Ray Dalio that gives a better insight on China’s moves in its capital markets

End thoughts

- Hong Kong negative sentiment, selling, etc. seems to not have an effect and SHOULD not have a negative effect on $BABA’s share price

- It is a fact that Alibaba is a strong, consistent, and large company that should not be undervalued as if it were dying (I do not understand how some people listed waiting for it to drop to $100 and $120)

- American market overreacting, adding propaganda aspect to it makes it seem worse than it really is

- The Chinese Government IS going to let business flourish, they may not do the things the same way we do here in America (and yes, I do prefer America, but it is also natural to think that the way your country does things is the best and not everybody can be the best) however, no country in the history has brought their citizens out of poverty in the way China has (and they did it very fast), and I doubt if they fully adopted the capitalist mindset they could have done it, because they were extremely poverty-stricken.

- Short term swinging is too unpredictable, this is a long-term hold

- Due to inflation, 5"10 is now 6" tall

Position: 20 shares @ 164.01 and 175C Dec172021

I appreciate any contributions and opposing/supporting ideas on this thread and I hope I can be of benefit to this community!