[size=5]Prelude[/size]

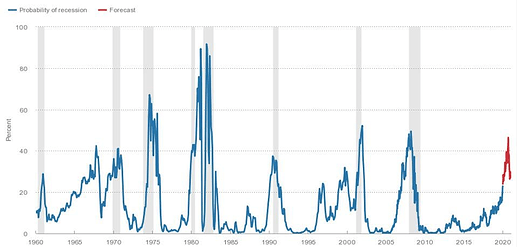

On May 23rd of 2019, the 3-month Treasury yield became higher than the 10-year yield, and the yield inverted. The yield stayed inverted until October 10th. The market rose throughout this period very slightly as wall street began to fear a coming recession. The probability of recession rose throughout 2019. The Cleveland FED bank put the odds of recession at 47% by August 2020, the clouds were getting darker.

In January of 2020, videos from China of barricaded apartments and body piles became viral memes and headline new stories for a few weeks. These stories calmed down into February, until March when the fear of what was newly named Covid-19 skyrocketed. You know the rest of the story, but what is important is what happened to the consumer and business.

Across America, thousands of businesses shut their doors, and millions of workers were stuck and home or laid off. The unemployment rate in April 2020 reached 14.7% the highest since the Great Depression. The government could see the economy crumbling down and took action immediately. Every tax-paying American received thousands in direct stimulus payments, cash relief was being thrown at any business that claimed to need it, and the Fed increased its balance sheet. The money printer went burrrr and we survived the pandemic. In the months that followed the job market bounced back, housing prices soared, business reopened, and Americans went back to work building the strongest economy we had ever seen.

The economy was euphoric, and this is where the problem began. The reaction to covid may have grown the economy but the reality of covid was inflation, inventory shortages, backlogged orders, and growing debt. What had saved the economy was also harming it, action had to be taken to reduce the ballooning inflation. Unfortunately, the best way to stop inflation is by going after the consumer and businesses by tightening access to credit and draining cash. This is exactly what the Fed did.

On March 16th, 2022 the Fed rose the interest rate from 0% to 0.25% and since then has risen it all the way to 5%. In that time inflation has declined but not as much as they would hope. The job market has remained fairly strong, housing prices have declined but not tanked, and inventories are filling. They have succeeded in making it to 5% but they have not reached the inflation rate that they originally set as a goal. And now at the start of April 2023 a year later, we have begun to see the cracks form in the economy.

And of course, because of the chaos of the last three years, everyone forget about what was supposed to be coming. They forgot about 2019.

[size=5]The Stagnation[/size]

Before beginning discussion on the current to future state of things I want to remind everyone that interest rate hikes have not truly affected the economy yet. Traditionally it takes a few months for rate hikes to affect loan rates and takes about 12-18 months to affect the broad economy. With the first rate hikes having been in mid March, we are only at the start of the wave.

^Info on the length of time before rates take effect^

This last week we have seen multiple reports on the current job market. For months we have had record lows in unemployment and the amount of open jobs has been above 10 million. This is beginning to change, there are a few data points from the jobs reports that are the most important to remember. These points would be the labor force participation rate, layoffs, and the rate of new job creation.

In March 236,000 jobs were added, this is the smallest monthly gain since a decline in December 2020. Excluding the losses seen during the first year of the pandemic, it’s the smallest monthly jobs gain since December 2019. Which of course is the same time that we were heading into a recession which means we are now in pre-pandemic territory and have lost the power of the late 2020 through 2021 economy.

We have now seen from the JOLTs report that last month the number of available jobs in the United States dropped to 9.93 million, the lowest number since May 2021. This is now below the 10 million openings that had remained steady for so long. However, there is still room to go until we reach pre-pandemic levels which would be in the 6 million range.

The labor force participation rate also rose last month as more Americans are unable to avoid working and savings declined. This rise has brought us back to pre-pandemic levels as well.

When it comes to average hourly earnings there was a 0.3% increase for last month, coupled with the modest revisions to January and Februarys reports, this means that wages rose at a 3.8% annualized rate in the first quarter, the smallest increase since Q4 2019, excluding the initial period of Covid chaos.

However, unemployment has fallen to 3.5%, I think it would be wrong to assume just off unemployment that everything is fine because there is a reason unemployment is so low. In my opinion, unemployment fell because participation rose. The last few Americans who have dipped out of the job market are getting in before it downturns.

All of these data points indicate that the post covid economy is gone, all of the job growth has now stagnated into a pre-pandemic environment, and yet… it is only 13 months since the very first of the rate hikes. We undeniably are going to see further job loss in the quarters ahead, as conditions for corporations tighten from the wave of hikes taking effect job creation will continue into stagnation.

[size=5]A Glass House[/size]

Debt is what makes America so powerful, we have a finance industry that dwarfs any other on Earth and the promise of the dollar and the American system is what keeps debt a healthy part of our economy.

Consumer Debt has ballooned over the post-pandemic era to levels unseen not since the pandemic but EVER. The current amount of credit card debt is $986 billion. The amount of Student Loan debt is $1.6 trillion. The amount of Car debt is $1.55 trillion. Debt is always thrown around as a panic word and an attempt to drive fear into readers, it gets clicks. But debt can be truly dangerous for an economy if it is not being paid off or if the jobs that consumers work for income to pay that debt are gone.

Credit card delinquencies have been rising, for five quarters straight however as still near historic lows. But where the danger can come is if income cant match the amount of credit card debt. Consumers spent massive amounts post covid, from buc-ee’s and Disney World trips to new cars and houses. The consumer has gotten greedy and it shows in the amount of debt. Where I see the biggest threat forming is the average hourly wage growth slowing down to 2019 levels. If this debt was justifiable off 2021 income levels how can it be justified in 2019 levels. And if we had a recession how would consumers pay off those debts.

Student Loan Debt is the forgotten ball that is going to drop. For years student loan payments have been paused and the millions that hold the debt have been able to skate by without paying their monthly payments. Instead they went to buc-ee’s and got pajamas, they bought new clothes, they went out to eat. Now come summer when the pause ends and the supreme court inevitably doesn’t cancel the debt, we will see those millions of people receive a bill in the mail that they have not budgeted for. And let’s be honest, the American people are not going to pre-prepare that payment into their budget.

Car loan debt is a massive number but delinquencies again are where we need to look and in them is another problem. Default has risen to above pre-pandemic levels here as well, the rate is now 2.14% amongst millennials compared to 1.66% before the pandemic.

[size=5]The Warehouses[/size]

When covid was at its peak shortages were in everything, we all remember the dozens of cargo ships off the coast of Los Angeles waiting to be able to unload their cargo but being stuck. Across the country lumberyards, Home Depots, Targets, Walmarts, all of them were short on products so they ordered as many as they could. They ordered more than they would normally need to so they could meet demand and restock. But the pandemic was a one time event. Any warehouse built for the pandemic was being built for a one-time event, any over the ordering of goods was for a one-time event, the surplus has been inevitable and a surplus on goods only increases in a tightening economy

[size=5]Inflation[/size]

I want to touch briefly on inflation because it is the reason all of this is happening. I think I may be in the minority when I say inflation is going to continue to decline and will likely do so fairly quickly. We cant have both a declining jobs market, inventory surplus, loan defaults, and inflation at the same time. Everything should fall into place to kill the inflation monster but as I am building to I fear we are trading one villain for the next.

[size=5]The Back End[/size]

Unfortunately, the consumer is not the end-all-be-all of the economy, we have even more to worry about. Corporate profit, credit, bankruptcy, there are reasons layoffs happen and there are causes for concern in the corporate world.

As a brief aside, I think it should be said, there are many workers who should normally be flipping burgers but are currently sucked into the inflated corporate world. Aside over.

Goldman has set their expectations for corporate earnings per share to drop by 7% year over year, this is coming on the eve of an earnings report season. Corporations made a killing in 2021 and 2022 as the bounce between high demand and growing prices gave them a surge in profit and great margins. But for many of these corporations, they were being given borrowed time. Zombie Corporations is a term for companies that should not exist and run off debt and hopes and dreams, think of AMC, BBBY, BBIG. These zombie corps are going to go bankrupt, you know it, I know it, everyone knows it. Yet Zombie corporations have been able to endure because of easy access to credit, risk on investment, and low-interest rates. These conditions are now gone.

https://www.msn.com/en-us/money/companies/corporate-bankruptcies-jumped-in-q1/ar-AA19AoCT

There is no more easy money to be had now. March had the highest monthly bankruptcy tally since July 2020, when the economy was in the initial throes of the COVID-19 disruption. Default rates rose to 2% of outstanding U.S. leveraged debt in February, this is the highest since early 2019. We are not at a crescendoing level yet but we are climbing.

The banking crisis only plays into the potential for corporate failings. With banks lowering their risk levels and rates being so high we are in an environment that makes it extremely difficult for companies that need cash to continue surviving. As financial conditions tighten it becomes sink or swim and the many companies that are living off stimulus and easy money are going to fail.

[size=5]Recap[/size]

In my opinion, we are currently seeing the beginning of a recession. Easy money is gone, the labor market has returned to 2019, and debt is starting to crush wallets. We have had a couple years of historic growth and the bill has come due to pay for it. All the data I layed out in this post to me points towards at the least a downturn. I could go deeper into the financials of zombie corporations and the access to credit but I am not the most qualified to do that.

[size=5]The Market[/size]

This post was far more about the economy than trading SPY FDs. We have seen the stock market fall greatly the last year and that was because it was pricing in the effect of the interest rates and a potential recession. This means we are not going to just see it dump even if we did have a bad recession. Moreso, these events take a long time to play out. Credit cycles and bubbles can last for decades. This specific recession likely unfolds later this year and into next year. But again it may never come.

The bull case for no recession would be that there are so many job openings still available that we can fall and still have a cushion underneath. You could also argue that the amount of profit corporations saw could carry most to a safe and stable future and that we will just clean off some of the worst zombies at the bottom.

Do not read this and full port put leaps, I myself will not play any long term puts because I do not think they even work in recessions there are too many +5% days and -5% days. What I do recommend is researching stocks like MCD, DLTR, DG, and WMT and seeing who preforms when people are hurting. Also look for zombie corporations that are still worth shorting and those who were inflated from Covid.

[size=5]My warning[/size]

House has said the same in his posts and I will in mine. Please prepare however you can for the potential of a recession. It is becoming more and more likely that it will happen. The usually advice would be to have a 6 month emergency fund, I would definitely recommend this but I know for many it is not an option. So for others remember what you truly need, housing, food, water, electricity, and gas. Budget, save, and improvise. Publix bogo deals are the shit. Google tostinos personal pizzas and the amount of calories in a 20 pound bag of rice.

In summary just save whatever you can.

[size=5]The End[/size]

I have wrote down all my thoughts on the future, I hope everyone reads the entire thing but understand if you do not know how to read. Whatever happens, we will be sure to buy the top and sell the bottom. Godspeed Gaymers

![]()

Rp