I’m doing a trade journal bc I think I’m important enough that everyone in Valhalla should know what I’m doing. Actually, the reason I’m doing this to force myself to analyze my trades with the wisdom of hindsight. (But also bc I’m important. My mom says so.)

My trading philosophy is that before I enter any position I ask myself the immortal words of Tom Haverford “Is it a banger?”. If so, then I buy it. If it isn’t, then I don’t buy it. The best strategies are the simplest to understand. Additionally I have a few new rules for myself.

- Look sharp, ya dumbass! Don’t YOLO. Take smaller positions and either scale into them, or just stay grateful for the size you got. The 2 times I’ve blown my account up was because I jumped in with both feet like a moron and didn’t bother looking down. You can do everything perfectly and still lose bc there’s a million variables you don’t control.

- Take your time and take profit. I can’t get rich overnight because I’m not that lucky or gifted. This is a slow grind and I need to lean into that. So take profit and don’t try for baggers with every trade.

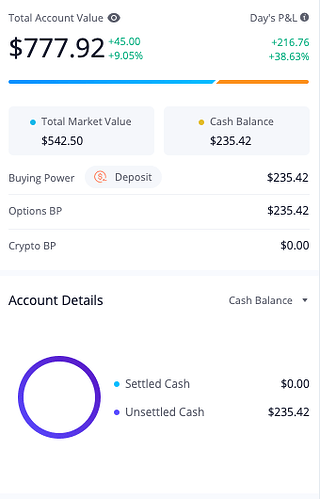

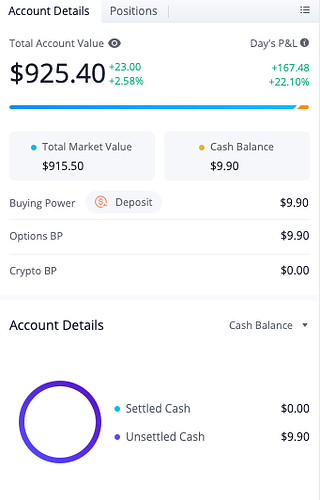

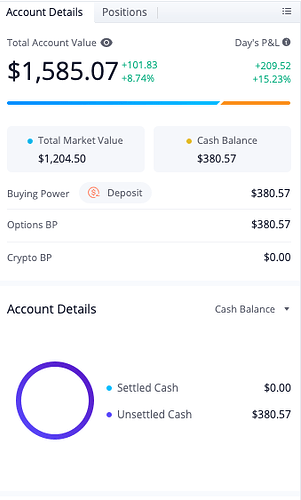

I started an account with $200 because that is the proper amount to start an account with. (My wife says so). I’m using a cash account on Webull bc that’s the best type of account to use. (Conq says so.). I’m trading pretty hesitantly right now because I’ve only ever blown accounts up, and I’m trying to change that. So far it’s going pretty well. Here’s my results after 2 days of trading:

Day 1 Trades

BX 18Feb22 $139 call

Cost basis - 0.88, sold at 1.20

SENS 18Feb22 $4 call

Cost basis - 0.22, sold at 0.26

SPY 09Feb22 $452 put

Cost basis - 0.18, sold at 0.07

Day 1 Recap

I found a very simple strategy for playing BX. Buy at the end of the day when it has a green HA. This is a bullish trend that lasts a few days. If I had a larger account I would have held longer, but I told myself that no matter what, DON’T SCREW UP. So when I saw some decent profit I took it. It’s impossible to blow up your account if you take profit. (Lots of people say so.). With SENS I was trying to trade the trend during the day and once again, I took profit. Looking back I could have held SENS longer and captured more of the upward movement but I’m still feeling things out here. I had decided that I wasn’t going to hold these overnight for two reasons: I don’t want to wake up in the morning wondering if my profits have evaporated overnight and I’m in a cash account so if I have to cut them in the morning then I’ll have to sit out for the day waiting on cash to settle. In hindsight, this was absolutely the right call. The SPY trade was bad and good at the same time. It was bad bc it didn’t work. I bought at the channel resistance expecting it to fall but it didn’t. It was good bc I set a stop loss and cut my losses. Sure, it was only $9 and it felt like a hollow victory, but I think the lesson was more important. Sometimes you have to take losses, and you have to TAKE them. Don’t let the market decide how much you are going to lose, tell the market how much you will lose and then take it like a champ. I’ll take my $9 back, you SPY turdburger and you won’t get anymore from me!

Day 2 Trades

BX 18Feb22 $139 call

Cost basis - 1.22, sold at 2.44 (FIRST 100% BANGER!)

SENS 18Feb22 $4 call

Cost basis - 0.24, still holding

SENS 18Feb22 $3.5 call

Cost basis - 0.40, still holding

Day 2 Recap

My BX strategy paid off handsomely again. I held longer this time bc the momentum was there, but I found myself in a bit of a pickle (as sandwich enthusiasts say). I needed to go to a lunch meeting and I still had the position open. So I set a limit sell at 100% and went to lunch. It executed at lunch at the perfect time as it was just about the top for the day. I consider myself lucky on this one. I learned that even if you have a profitable position, you need to set some stops/limits bc sometimes you can’t watch all day. Additionally, even if you buy at the right time, selling at the right time is just as important if not more so. Now the bad news. I opened a SENS position and it lost money, so I tried averaging down and picked up some more at .40. I thought, hey I got the same price as Conq! Woke up this morning to the bad news. So today I guess I’ll be figuring out what the heck to do. Cut my losses or hold for a rebound. This is why I don’t like holding overnight on these small cap stocks that can make huge moves to the downside at the drop of a feather. In this case that feather was more of a shit-sandwich of an earnings report. The good news is I don’t have a large position bc of rule number 2: Look sharp, ya dumbass! Don’t YOLO.

Journal Entry 1 Summary

Starting Account Balance: $200

Ending Account balance: $369.79 (SENS losses not showing up yet)

Percentage gain/loss: 85%