First Republic Bank (FRC) is down about 90% from concerns that it might keel over from the ongoing concerns around upsized deposit withdrawals and bad asset-liability management. It got emergency injection of deposits from other banks, and took loans out from the Fed facility, to the tune of over $100B. After losing > $70B to withdrawals. (Decent smattering of articles on SA, if one wants more details.) The Fed loans need to be paid back in 60 days, which almost forces FRC to come to some kind of arrangement.

Unless something shocking happens, I think it’s a little unlikely that the bank just keels over and dies, at this point. Partly because it has been able to stabilize things, and partly because the Fed really does not want there to be additional contagion. Also could not find anything egregious about its accounting or other dealings, unlike other banks that are struggling similarly.

I see three possibilities, two in the next two months, and one longer term:

-

FRC limps along and is in a worse state by mid-May, when the Fed loans need to be paid back. The uncertainty punishes the stock price, but doesn’t take it down another 90%.

-

FRC gets bought out. Maybe by JPM, which has been leading the charge on the bank consortium side to keep it afloat. Earnings are out on Apr 14 so we will know the current book value (i.e. assets - liabilities) for sure shortly. As of Dec 2022, assets were $213B to $195B of liabilities. Current market cap is $2.5B, but it’s entirely possible it has negative book value at this point. So I kinda expect a CS treatment if it gets bought.

-

Then, there is the possibility that FRC makes it, and comes out on the other side ok. Not back to its glory days, but half way back? Even a quarter of the way there? This will need time though, and we might not know for many months.

I express these scenarios using spreads as follows:

- 5/19 12.5P/11P bearish put spreads for $0.71, for the eventuality that FRC bleeds for the next two months.

- 5/19 7.5P/5P bearish put spreads for $0.55, for the eventuality that FRC gets bought out at half the market cap of where it is now.

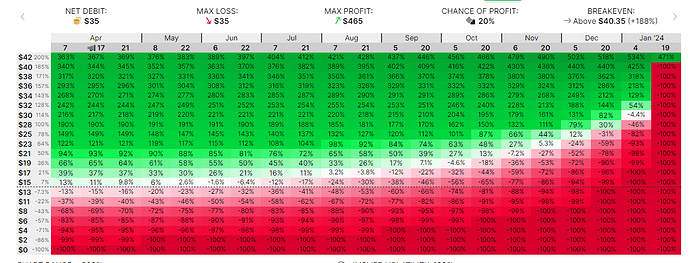

- 1/19/24 40C/45C bullish call spread for $0.35, for the eventuality that FRC makes it

The puts are 43DTE, the calls are 288DTE. Am assuming that if something bad happens, it happens in the next two months because of the Fed loan trigger. And there’s about equal $$ value in calls and puts.

Btw the 40C/45C might seem a little absurd, but the good news is we can lock in decent profits way before then. For example, $25 by August gets us 180% return.

What do you think? Other than FRC not collapsing by May but then collapsing before the end of the year, how else might this trade blow up?