With demand destruction happening we should start grooming through company’s earnings report and look at their debt to cash ratio / debt . We should compile a list of such possible companies that are like Revlon (REV) as this should be arithmetic and looking to see if their sector is in danger of demand destruction. Using this as start of conversation so we can all pitch in on the DD.

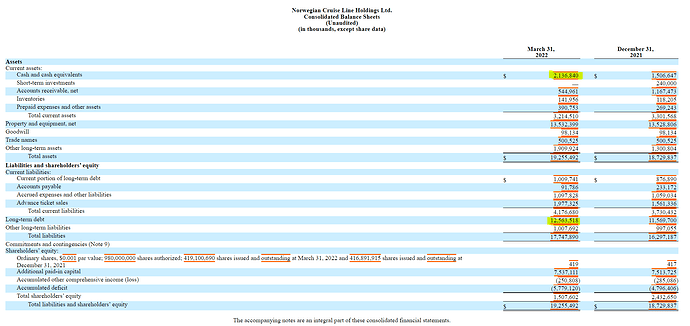

Was just doing a quick browse through the internet for high D/E (debt to equity) and NCLH ( Norwegian Cruise Line) popped up.

Obviously need to dig into it more but I would think that as we go deeper into recession we get less demand for going on cruises?

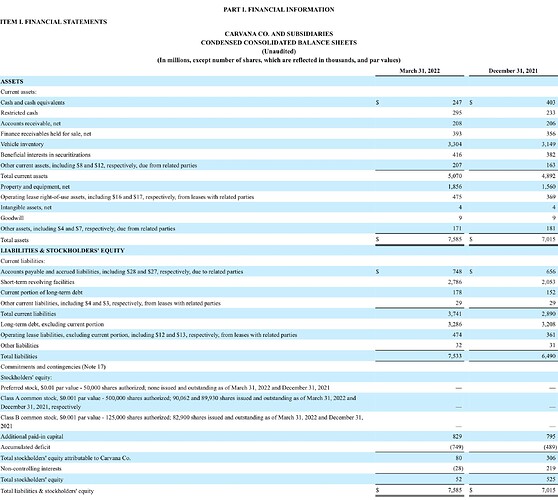

CVNA

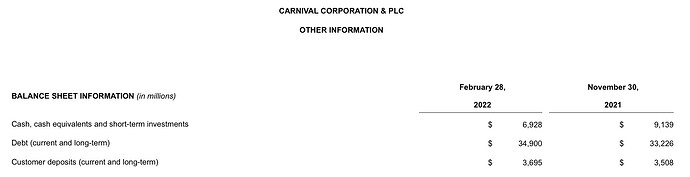

CCL

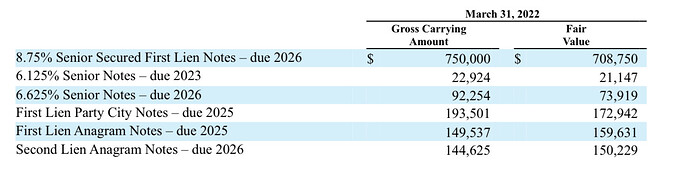

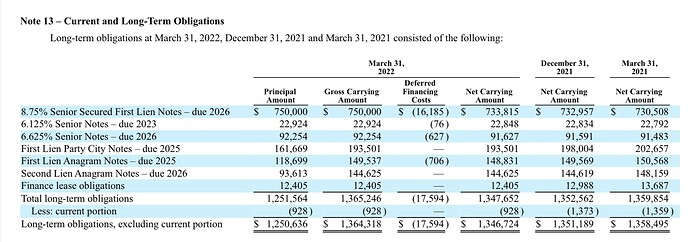

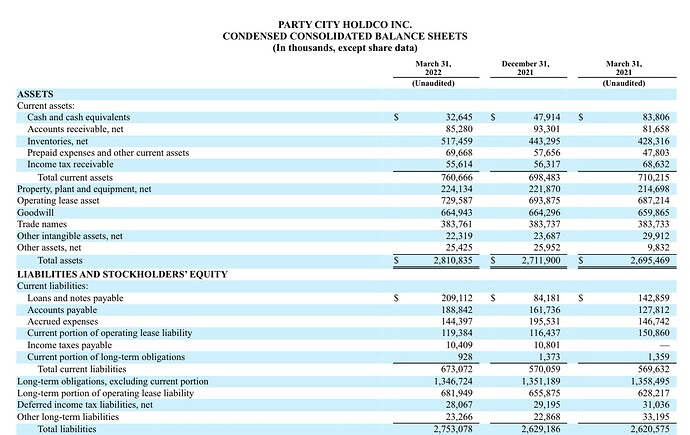

PRTY

Two points here: (1) this is an excellent idea and I fully support this; and (2) because of my job I will not be able to contribute anything to this thread. If anyone has a general question about how something in bankruptcy works or whatever, feel free to reach out. Also, if a company does file and I’m not involved in the case in any way, I might be able to help explain what is going on and what is likely to happen. Best of luck!

Right now im going throuh the concepts and seeing if there is a scanner I can use ie TradingView , Finfiz , that can scan through all the tickers based on N conditions. Need to also confirm how accurate said financial data is on each scanning platform vs a manual check. If someone is good at using scanners and can help with this.

Going to add MSTR here from the BTC discussion. To quote @Machetephil, “they might be proper fucked”

One of the most important things to understand about bankruptcy generally is that, while a chapter 11 bankruptcy is often used to reorganize, there’s this nasty little thing called the absolute priority rule that gets in the way. That means the shareholders don’t get to keep their equity in the company unless all creditors get paid in full or consent. That is why 99.999% of all reorganizations happen by cancelling all existing stock and creating new stock in the reorganized debtor.

The TLDR version is don’t buy shares of a company you think is going to file bankruptcy. If you own shares, the odds are they will eventually be cancelled.

Going to drop this here as another catalyst on the banking side in coming weeks.

Putting this here for bank stress test results. Those playing The financial sector may be able to lend more here. Banks generally dropped the day report came out. But I don’t follow that market much

These stress tests largely are meaningless for a few reasons: (1) banks can’t file bankruptcy (as in the law specifically prohibits banks from doing so); (2) the Fed doesn’t determine bank solvency for actionable purposes, banks are regulated by the Federal Deposit Insurance Commission (FDIC) and the Office of the Comptroller of Currency (OCC), and neither of those agencies conducts these stress tests; and (3) if a bank were to be determined to be insolvent, it is in the sole determination of the FDIC or OCC (not the Fed).

There are a lot of other reasons why these tests are meaningless (they are basically designed for banks to pass them because to fail would mean chaos), but those are the big ones.