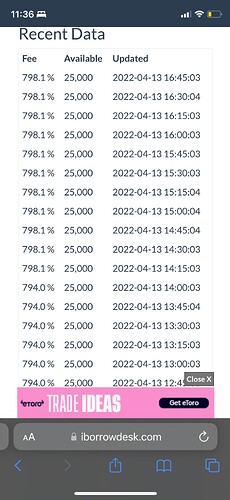

Not sure whats going on with the CTB.

https://twitter.com/SweepCastApp/status/1517237872339918849

The deep ITM calls that don’t show up on OI the next day have begun…

This happened on SST numerous times correct?

Yes 2 weeks before SST hit $37, there were these giant deep ITM calls being purchased everyday. The theory is that MM’s buy these calls and exercise immediately as a way to amass a large amount of shares without changing the underlying price. Hence why the calls don’t show up in the OI the next day. They then dump the shares in chunks as an attempt to bring the price of the ticker down. They would do this frequently with SST, sometimes dumping 1/8th or so of the daily volume in the last minute of trading, tanking the price largely right before close.

It pissed me off to no end and was a large reason why I exited my SST position before the squeeze (so I guess their strategy works haha)

This is a theory that was floated, but obviously I don’t know 100%. It could be an individual purchasing these calls. But personally it is what I believe is happening.

There aren’t a lot of calls ITM on this right now, so this is a bit confusing to me as why they are purchasing these already. Perhaps they are preparing in case the 12.5’s get ITM any time soon.

Can someone smarter than me explain how this happens or what this means?

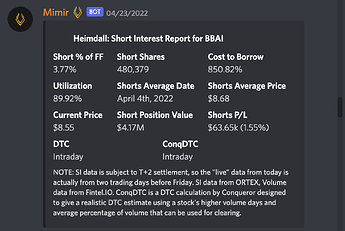

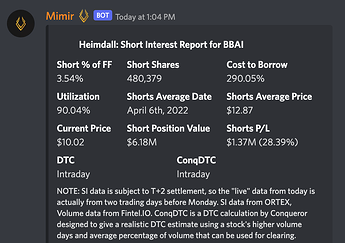

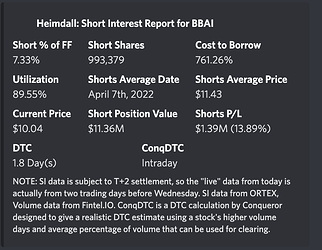

Short average price changes from $8.68 to $12.87 while the amount of shares shorted remains the same. Thank you.

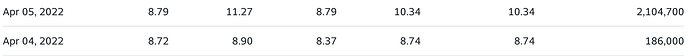

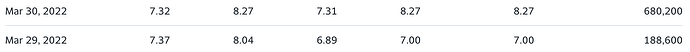

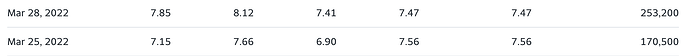

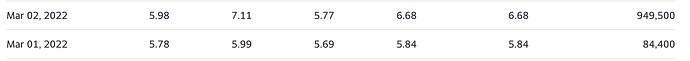

A bit of random idiot pattern charting. Low volume days like today (<200,000 volume) since March 1 are usually followed by pretty big volume spikes next trading day. Nothing meaningful just interesting I guess.

I haven’t had time to look for the source but on Twitter and StockTwits people are saying there is a new short report out and the shares shorted are 993K. That would be double recent SI and roughly 95% the free float. It was about 900k shares shorted around the time of the spike to $16.

For reference SST was like 250% of the free float shorted before squeeze iirc.

New SI:

Seems like the new short shares were probably added during the bloody -30% Friday. Volume seems to be drying up, while shares short has doubled or so, I think it’s intriguing. If volume continues to be flat we could see the DTC increase soon. Although, idk how much stock to put into the DTC because it’s not like we haven’t seen >1M volume days on this stock before.

Potential catalyst if this comes before the S1. Earnings was SST catalyst as well.