Hey guys I would like to bring your attention to $BBAI which is reporting it’s earnings after market close on Monday 5/8. I believe a good report can be a key catalyst for some retail interest and short covering, which in turn can get the mechanics of a squeeze going.

To get a good idea of what to expect on Monday, I went through some of BBAI’s old report numbers. This isn’t really a deep-dive, I just skimmed through past reports to get an idea of what the company is going through.

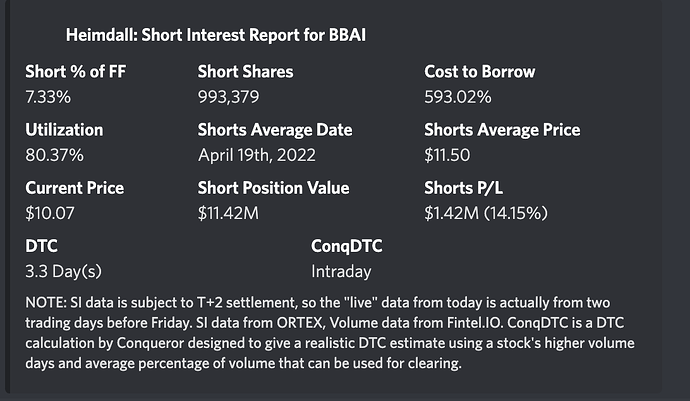

First, for those uninitiated, here are some of the up-to-date squeeze stats.

S1 is not official yet, it could drop at any time keep that in mind. If the shorts are just waiting for the S1 to drop, a positive earnings and potential run could give them a reason to cover instead of just waiting it out.

Float

1,048,504 shares

https://www.reddit.com/r/SqueezePlays/comments/u2s5vd/big_bear_ai_the_final_countdown_on_this_rare/

https://www.reddit.com/r/wallstreetbets/comments/u20nvc/bbai_big_bear_or_big_bull/

SI

993,379 shares (94.7% of free float), ~600% CTB (fluctuates daily)

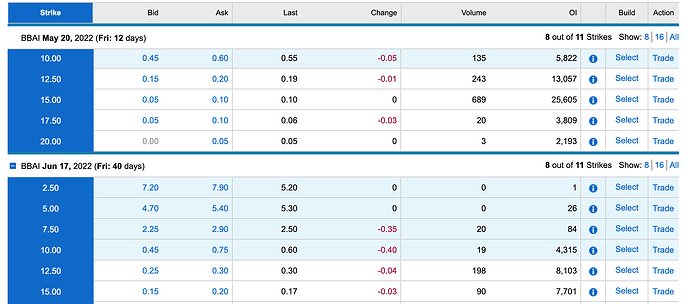

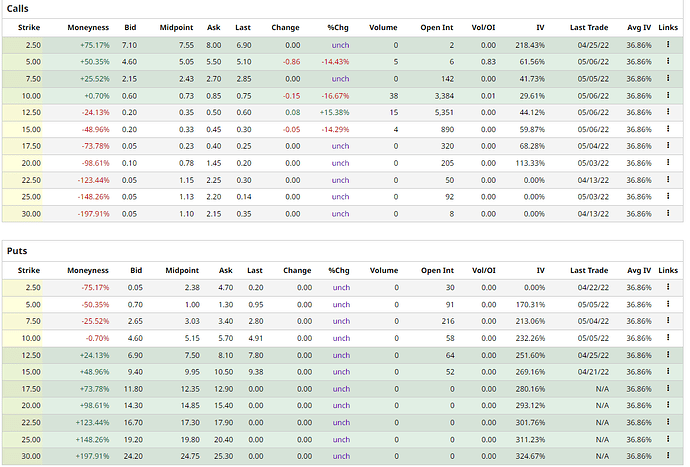

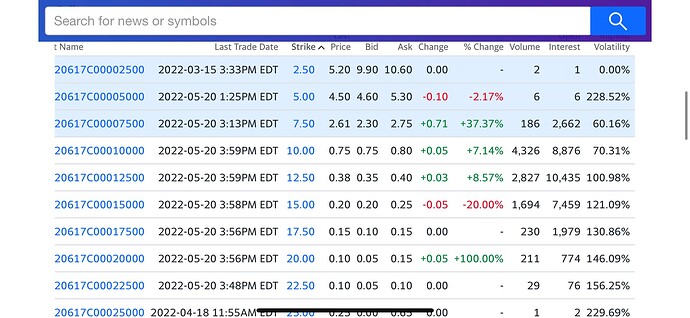

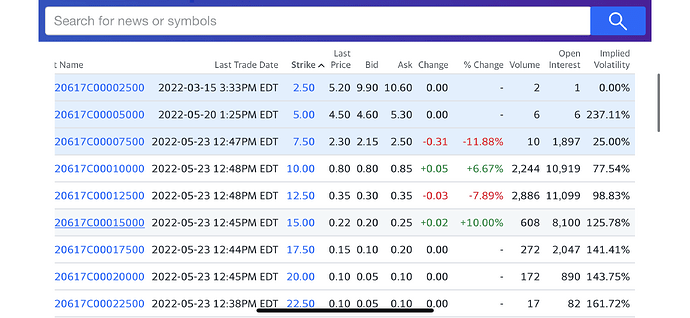

Gamma

$10 strike: 10,137 OI (102.0% of free float) (ITM)

$12.5 strike: 21,160 OI + 10,137 (10’s) = 31,297 OI (315.1% of free float)

$15 strike: 33,306 OI + 31,297 (10’s &12.5’s) = 64,603 OI (650.3% of free float)

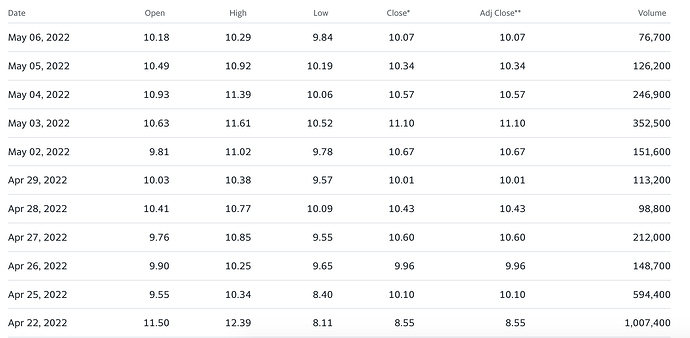

Consolidation of lower than average volume recently.

Juicy numbers, but none of this will matter without a catalyst. So let’s dive in.

First half 2021 financial results: BigBear.ai Announces First Half 2021 Financial Results Including Over $150 Million in New Contract Awards and Strategic Partnership with Virgin Orbit :: BigBear.ai Holdings, Inc. (BBAI)

Q1 & Q2 total revenue: $72 million

Q3 & Q4 projected revenue: Between $88 million and $113 million

Projected full-year revenue: Between $160 million and $185 million

Backlog: $485 million (as of Sept 20, 2021)

REVENUE DELAY: BigBear.ai is revising its previously announced projections for fiscal year 2021 due to COVID-related delays in the timing of select government contract awards. Three contracts, with a combined value of approximately $150 million, were awarded as much as six months later than initially projected, which moved the entire expected period of performance for those contracts correspondingly.

3rd quarter 2021 financial results: BigBear.ai Announces Third Quarter 2021 Financial Results :: BigBear.ai Holdings, Inc. (BBAI)

Q3 Revenue: $40.2 million

YTD Revenue: $112.2 million

Revised full-year revenue projection: Between $150 million and $160 million

Backlog: $485 million (as of Sept 30, 2021) (also they didn’t update this number from last release idk why)

REVENUE DELAY: Due to the Federal Government operating under a Continuing Resolution, several projected Q4 contract awards have been delayed beyond their projected award dates. Due to the associated revenue delay, BigBear.ai is revising its projections for fiscal year 2021

Full year 2021 financial results: BigBear.ai Announces Fourth Quarter and Full Year 2021 Financial Results :: BigBear.ai Holdings, Inc. (BBAI)

Q4 Revenue: $33.5 million

YTD Revenue: $145.6 million (missed original and revised estimates)

Backlog: $466 million (as of December 31, 2022)

2022 revenue projection: Between $175 million and $205 million, including approximately $20 million of commercial revenue

REVENUE DELAY: The Company notes that 2022 projections reflect known impacts from the COVID-19 pandemic based on the Company’s understanding at the time of this news release and its experience to date. Internal analysis of federal solicitations in the Company’s market showed that the time between solicitation and contract award increased from 290 days to more than 600 days between 2019 and 2021. COVID led to delays in government contract awards in 2020 and 2021, and the Company cannot predict how the pandemic will evolve or what impact it will continue to have.

So in their most recent quarter they miss revenue because of “COVID delays”. The quarter before they reduce projections because of “government mumbojumbo”. And the quarter before they do the same thing because of “COVID delays”.

How do you guys look at this? A company using any excuse to explain their poor revenue numbers? Or do you believe these roadblocks were legit and they will be no more in 2022?

Will they keep pushing potential revenue further and further out? Or will it finally be realized in Q1?

So given all this, let’s look at revenue expectations for BBAI in 2022 and see if they are about right. To meet the lower end of their own 2022 revenue projections, they would need approximately a $175/4= $43.75 million revenue Q1

But, by their own account their revenue can be seasonal so let’s account for that too.

From their 10K: “We generally experience seasonality in the timing of recognition of revenue as a result of the timing of the execution of our contracts, as we have historically executed many of our contracts in the third and fourth quarters due to the fiscal year ends and procurement cycles of our customers.”

Even though their Q1&2 revenue last year was essentially equal to their Q3&4 revenue, let’s take them for their word and keep this in mind when we estimate what their Q1 revenue could look like. I will just throw out a random number and estimate they will make 40% of their 2022 revenue in Q1&2 and 60% in Q3&4.

0.40 x $175 = $70/2 = $35. So this would put them right at $35 million for Q1. Which is essentially what the earning estimates I could find have them at.

Well, estimate… this is the only one I could and it has them netting $35.53 million in Q1. BigBear.ai (BBAI) Stock Forecast and Price Target 2024. Again, a $35 million quarter would be them barely hitting the low end of their own yearly revenue projections. If this estimate is accounting for their seasonality perhaps it is a good baseline expectation. If it is not, then this projection feels low. Perhaps their failure to reach their estimates last year is moreso being accounted for instead. Whatever the case, Wall Street expects BBAI to be barely, if at all, on track for their yearly their revenue projections.

Key question: Will their contracts keep getting delayed?

Hard to tell. I think it is more likely that we see their contracts come in towards the end of 2022. If we take their >600 days calculation at face value, then that means their 2020 contracts will be fully realized sometime this year. But then again they are constantly changing their projections so really hard to tell.

I haven’t had time, but it would be interesting to see if PLTR is having similar problems, and how they are addressing them. I don’t follow PLTR, all I know is that it gets beat to a pulp every ER. If anyone knows more about the industry and competitors please join in.

Backlog: “BigBear.ai’s existing funded and unfunded backlog as of December 31, 2021, comprised entirely of contracts that BigBear.ai has already won, accounts for approximately 84% of 2022 projected revenue.”

0.84 x $175 million = $147 million

So if we take their low-end $175 million projection, they expect at least $147 million of that to be from the current backlog. Which means 0.4x$147/2 = $29.4 million of their Q1 revenue should be from funded/unfunded backlog. Out of a possible $466 million.

There are 4 things big things to look for in this earnings report imo.

Revenue beat: Are they still experiencing contracts delays? If no, then good. If yes, then bad.

Backlog progress: Have they added to their backlog and made progress on what is already backlogged?

Increased yearly projections: This will obviously be dependent on the type of Q1 revenue they post. Since their 2022 yearly revenue projections already take into account COVID delays, they will likely increase projections if they beat revenue and the delays are no more.

Significant news/contracts: Haven’t seen any rumors in the news this one is pretty much impossible to predict.

They are also going on a bit of a press tour after this ER so this could be something bullish.

I am a firm believer that a good earnings report would be the catalyst that shoots this stock up or kills it. This stock gets a lot of comparisons to SST, which I also believe wouldn’t have run without its earnings report. Less SI than SST, but more calls. Yeah, it’s just a stock that I feel has gone under the radar a bit in recent weeks.

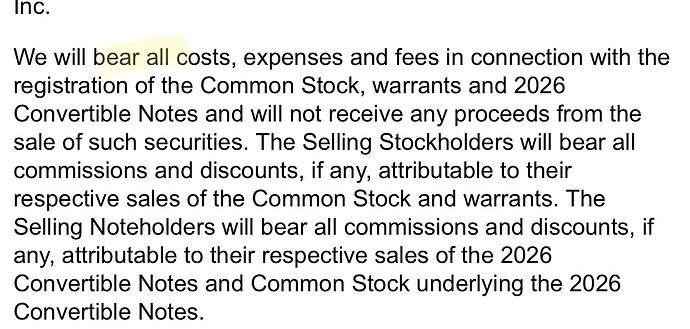

I don’t have all the answers or know the future. If anyone has any insights or thoughts please add to the thread. I don’t really make any conclusions here, just wanted to put the data in one place. I will continue looking into their most recent 10K to see if there is anything else noteworthy. Thank you for reading.