Ticker: BBY, AKR, RPT, SITC

Description of why you are requesting DD: This Will Meade tweet caught my eye, and I’m looking at exactly what he suggests. I’m sure some of you have seen this and I think its worth looking into further.

This is in anticipation of BBYs potential chapter 11 and the collateral damage it can have on its suppliers and REIT lease holders.

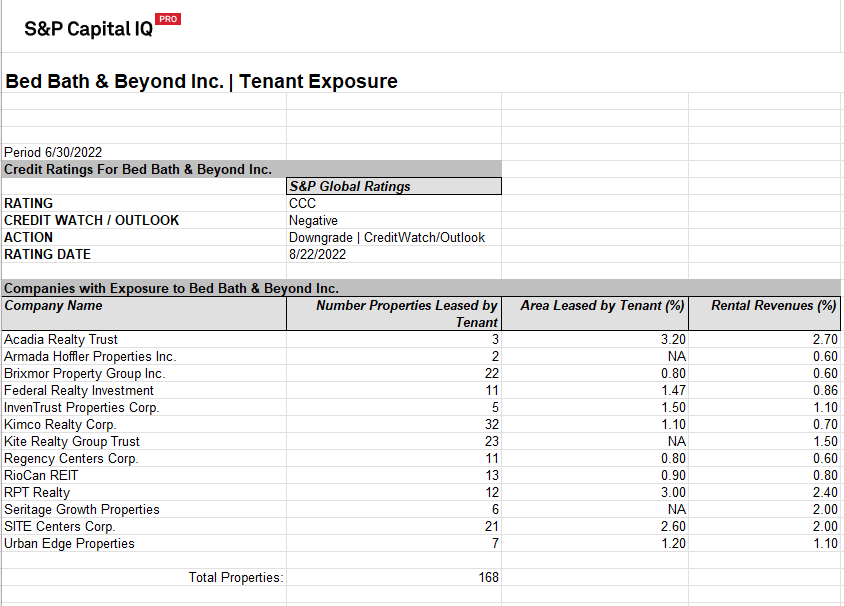

This is the part I’m more interested in at the moment. From what I’ve found, these REITs have the most exposure to BBBY.

Acadia (AKR) and RPT(RPT) realty have the largest % of rental revenues from BBBY. Kimco(KIM), Kite (KITE), Brixmor (BRIX), and Site (SITC) have the largest by property count. I’m bearish on 2023, and while BBBY accounts for a pretty small % of rental revenues overall, it’s making me look closer at these REITs and their exposure to other businesses that won’t fare well in a recession. Some of their valuations seem extremely high, RPT for instance has a P/E of 345.

For suppliers, I’ve found Helen of Troy (HELE) has alot of BBY exposure. BBBY has had problems paying suppliers in the past. I’m still reading into all of this so it’s a work in progress, I just want to put it out there if anyone would like to take a look. Appreciate any insights. Thanks.

Applicable links to news articles or Reddit analysis:

https://www.barrons.com/articles/bed-bath-beyond-reit-trouble-51673052704