This theta gang warrior helps explain what’s going on. If Jake Freeman sold and Cohen potentially, I’d say the play is over.

Unfortunately BBBY dumped to 12 after hours just now and it is confirmed Cohen sold over the last few days. The thread above has many callouts on various signs why the play was dead or dying. Please take the time to review and read. Initial reason is the past runs it went to 25 to 30 max, many could use that to guess where it might run this time or if it happens again. The initial start seems to be around 8/1 or 8/5 so we were also a few weeks into it pushing, volume died on 8/17 to almost half the previous day and today volume was half of that. Another sign of a dying play is volume dies. Once it lost that 18-20 support is another red flag. It bounced but most “squeezes” have one good bounce then traps people or gives everyone a 2nd chance to sell (not all of them do this). My thoughts for now but we can analyze more and this is mostly from top of head.

[Conqueror] mentioned this too

Word of caution, AH runs into a chain expansion is usually what kills these movements.

I want to add a couple of my observations of this run so that perhaps they can be used to our advantage here.

Firstly, the rise of BBBY was proceeded by an observable and sustained rise in call premium. I noted this because dibbles was monitoring stocks for wheeling and noted that BBBY’s premium to price ratio was elevating, leading up to him selling and recycling his wheel on BBBY. By the math, this is naturally the case when a lot of buying is going on in either the underlying or contracts. What stood out was that this period lasted since late June (again, due to dibbles posts about his CC on TF). I feel like this sustained favorable movement in options pricing despite the early non-movements of underlying could be some type of indication of later movements. This follows what we know about sentiment which always lag behind what is currently ‘hot’. More and more people pile on, OI goes up, IV goes up, shorts gets underwater, etc etc the same sequence we already know.

Next is regarding the dump on 8/16, before any news of RC selling came out. Out of all the meme stocks, BBBY was always kind of a sympathy run compared to the other memes, therefore I feel like it has had more of these up and down cycles compared to others and each time it peaked around $30. The cycle of going up to 30 and followed by the fall should have been a pretty obvious one for us.

Regarding the final fall today. My feeling is that this fall would have come with out without RC selling. Sure RC selling accelerated the fall, but even if he does not sell or he sold slowly, the price should fall regardless. The marketplace is a large place with tons of participants, there are TONs of bag holders at previous runs (especially at around $30 mark) where they were waiting to unload the first chance they can. As with the meme runs, large sells trigger subsequent sells, RC himself could be also following the initial dump at $30 rather than leading the sell orders.

Lastly regarding how to try to take advantage of this cycle. Using what I mentioned at the start, the option price premium as a hint, I think in addition to selling a CSP when the premium is good, I would sell the CSP and buy a call using the CSP premium. If CSP fails and I have shares, start the wheel. Keep repeating the CSP as long as this behavior continues and either add on more calls or more CSP+calls. If the CSP succeeds but your call expires worthless, nothing’s lost. Worst case scenario in these cases would be you own some BBBY shares where you can wheel on, but best case scenario your position will make you some good money. Depending on how much faith you have on the run based on si/float/dtc, it would be your choice to further put money in calls.

Taking advantage of the fall without selling naked calls is a bit tricky because of IV. In the case where price falls rapidly like today, sure you’d be making money even if you buy a put at high IV. But mostly I anticipate a steady decline with some bigger red candles here and there followed by small bounces. I have gone through multiple times where I buy a put and get IV crushed even though the price is dropping. In this scenario, bear spreads of any types should be able to capture the IV or at least some of it. On one way directional bets, it’s safer to position after IV calms down then take a longer dated put but you’d be missing the IV. I personally think the fall is easier to predict than the rise, and I am a lot more confident on taking bear positions in this manner after something runs up.

Whatever happens, start shorting BBBY at 30!

oh, hey…

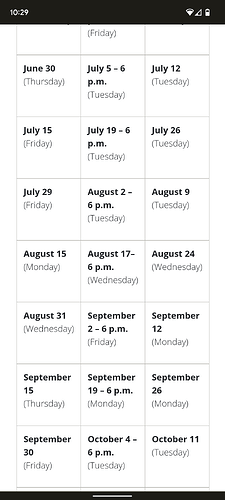

This is one of the few good things RH does as a broker giving easy access to this info the night before because TOS hadn’t updated for me til the morning. If I recall correctly, I think when this chain extension happened for ESSC and TSLA after huge bumps is when they ran out of steam so going to keep an eye out for this next time and play cautiously. Another learning moment for a future play ![]() (for reference I did not play BBBY for various reasons).

(for reference I did not play BBBY for various reasons).

I’m completely out of BBBY and was profitable on the recent run. RIP to the apes that held. I was browsing through reddit and found this really interesting post. Have a read and give me your opinion on whether or not it gives you any “value”:

Apes are getting hyped again but who knows. I’ll be eyeing some calls if there’s movement.

Is anyone who made money on that BBBY run-up looking to reposition for this anticipated announcement EOM? A lot of speculation about them announcing bankruptcy or Cohen buying buy buy baby

The original play I had a ton of conviction. Sentiment, momentum, volume, volume in the chain. Once the fuckery happens the conviction is gone and the play is dead. Everything else after is hopium. I’m not saying i wont play this if i feel there is conviction but i don’t see a drastic movement at this point. Playing this now is very risky and pure speculation. I’m bummed as well, i felt if the fuckery didn’t happen this would have been a ton of fun but here we are. There’s always another play.

What fuckery exactly?

Cohen selling his stake. It changed the conviction. Maybe fuckery is the wrong word but basically anything that changes sentiment in risky plays.

Got it. Yeah Cohen’s filing effectively confirmed the play was dead, but I think it was on the decline anyway. Sentiment was gutted with that, though.

I wouldn’t touch it right now.

Edit: actually after digging some more, this “announcement” seems to be more of just an update. It could very well be nothing. It was trotted on reddit as something positive, but honestly I can’t find anything specific that would give that idea.

There will always be another big play coming down the line. Just be patient and look elsewhere is the safer bet.

Reddit believes Cohen is still invested in BBBY via Dragonfly investment, in which they invested just before he did in April.

They’re really just grasping at straws now.

So I went and read through some stuff on WSB.

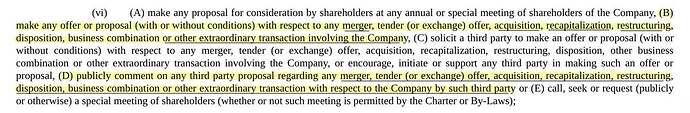

From the filings it does look like he would not be able to have any ownership in the company if he was going to make an offer to buy baby. This would make a little more sense.

To me this is just a short term bailout, and another piece of the original play.

The part that is interesting is if GME buys baby. Honestly I don’t think this will happen but this is the only bull case I see in there, and it’s for GME.

Here we go, really trying hard to crawl back from the dead. Loan deal news drops the night before SI reports come out.

They don’t make it easy to keep that tinfoil hat off.

No dollar amount disclosed in the news. We’ll see some SI data tomorrow

Should include more than a few days of some pretty serious volume, it’ll be interesting to see what effect that had on the SI.

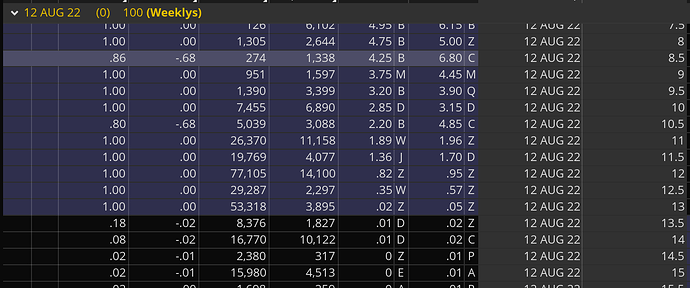

We know retail is still nuts deep, I’ll be watching to see if we get some crazy numbers, market sentiment changes and this starts trending up. I’ll be watching the chain to see if volume ATM and a couple strikes ITM gets to the 30-50k range. If we get there I’ll assume it’s game on, again.

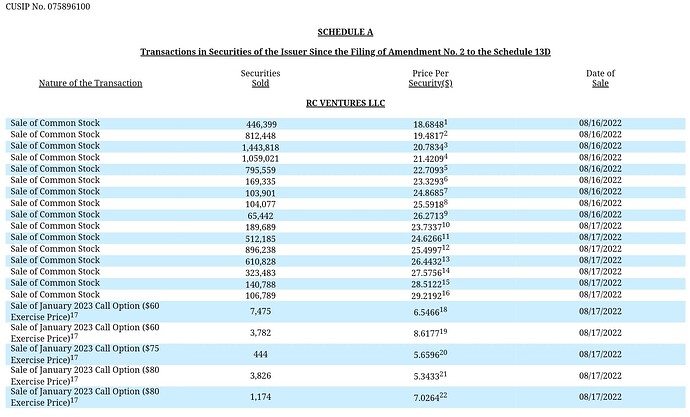

Pic below, the chain the week of August 12th I added way earlier in this thread.

I am not really sure what would be bullish here other than people thinking it’s a sub sector of GME. Like get your youngest a stroller and grab your oldest an XBOX game.

You are likely right that it would be hoped all over by retail and some new conspiracy theory would develop about the king of apes saving both companies from the depths of bankruptcy. However this never lasts most retail gets bored and ultimately knows that neither of those companies are worth a shit. I’d put the likelihood of a BBBY run again at slim. However if it does we can all profit off it again. Appreciate you keeping this up to date. Always good to be ahead of the game.

I was just thinking market cap with GME. If baby is really valued at 3-4b its a decent bump. Still dont think it will happen.

ill keep poking and updating. Im here for the volatility and ill be gone when its gone.