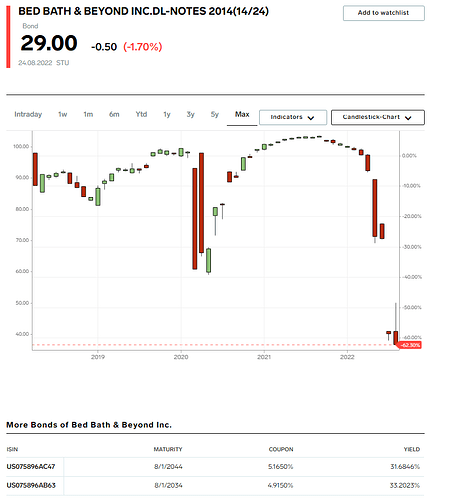

I wonder what the terms of the loan are… since their current bonds are just about pricing in near-bankruptcy. At current rates, the pound of flesh in interest expenses may not leave much of whatever meat that remains on the bones.

Short interest volume is officially up by 5 percent but how much of the float still hard to know as RC and Freeman both sold after Aug 15.

At the current price it’s pretty reasonable to assume a short squeeze isn’t in play. Recent volumes also kinda rule it out as DTC has cratered to intraday.

Yup, that was the last bit of data I thought could cause some FOMO if it came in high.

I think we’re all done here.

So announced is on Aug 31 at 815am ET.

Personally I don’t feel it will he anything more than some fancy slides made my a consultant, so a lot of talk about what they plan to do, but market won’t reward them unless they have real action

Saying that, I think this can be a classic buy the rumour sell the news event so I I think there could he some run up to the 31st and hence I will keep my options going and take profits on the 30th.

Side note it is climbing after hours today and FOMO might be strong tomorrow

IBKR had a million shares to borrow on Friday, now down to 5k. I assume that explains some of the volume to start the day.

Saying that I am still sticking to my plan of mainly liquidating on Tuesday night.

Corporate announcements rarely live up to the hype.

15 is def hard area for BBBY to get over, just follow previous resistance callouts. I think it was 17 to 17.50 big area next but don’t think it will go to that.

Lots of volume in the chain today.

If this pulls back and finds support around 12.5 and we get a lot of options volume tomorrow I’ll buy a couple.

The daily chart (which is kinda silly to look at rn) looks like a little dead cat bounce.

Be careful out there.

Benzinga says it has 110% SI. I can’t verify if that’s true, but it’s corresponds/makes sense with the number of shares available to borrow.

bad baths “strategic decision” is being announced tomorrow. the hype built behind this feels like it will lead to a buy the rumor sell the news once it hits. id imagine its nothing spectacular just like every other meme stock announcement, completely overhyped, overbought, and then dumps as soon as the news drops. ill be looking to enter month out exp puts once i see a clear tale sign on a rejection once the news hits.

No way it’s true. They are probably defining float as non institution float which can be mis leading. Plus Cohen and freeman added another 17m into the market after they sold.

Saying that even 50 percent float is high

Agreed with this.

I plan to exit most of my positions tonight and leave the less on stop losses for tomorrow around the announcement. The hype is crazy, which means almost guaranteed disappointment.

These guys are expecting some thing real and I feel all we will get is some PowerPoint slides with bullet points

I dont think we could consider the SI part of the play rn, alot of short piled in from 30 down.

As stated above this is all hype and when its done itll come down hard.

Reminder that news drops Wed morning, so if you hold overnight and its bad or even mediocre, the morning will most likely be rough.

If somehow this gets back near or above 30 after the news we could reconsider the SI, but looking at the way it played out last time i will be looking at a put even with the high IV. Kinda wanna see if i can catch the top and play the downside. Kinda crazy it hit 30 on the nose, not 30.01 or 29.9something but rite on the money. Alot of people had the same thought.

Correction: I think the most recent nasdaq SI data was everything below 15, I’d just be careful with calculated rolling SI like ortex.

Just a little update, this did not hold 12.5 and i did not enter a position. Im trying to be consistent with my initial thought process, good or bad ill stick to it.

We’ll see how the news plays out tomorrow. Ill drop it in here.

I may try to play this intraday tomorrow if the news is really good. Honestly im terrible at trading anything daily. ive been really good about letting this thing run in the morning and waiting till late in the day to avg my position. Usually when i play weeklies i get hammered.

If the news is really good and it finds support in the afternoon i will start to build a position.

Really its all about volume in the stock and volume on the chain. OI is great but what ive seen in this so far is the real time hedging when the ATM volume is serious. Thats really what ill be watching for. All these other “catalysts” are just the runway for that to happen. Chain volume has been a little far OTM lately so well see how this plays out.

There’s alot of things that have to go right for this to do anything fun. With where the market has been headed in the last few trading days i feel its even less likely to really move.

It’s been holding a relative hard 15.50 resistance. I built vertical spreads aimed downward with that in mind. So far it’s paying off.

An entry should’ve been made when this dropped below $10 last week, but IV was high so I stayed out. Shares would have been the better play.

News is out.

Offering

Loan

Store closings

Power point (somebody called that)

Bravo to anyone who played the downside that’s a nice move.

This is the much vaunted “strategic statement”: https://bedbathandbeyond.gcs-web.com/news-releases/news-release-details/bed-bath-beyond-inc-announces-strategic-changes-strengthen-its

Borrowing this Tl;dr from Reddit:

- filing to sell up to 12m shares

- EVP of BBBY and EVP of buy buy BABY announced

- continuing to search for a new CEO

- sales down -26% from same quarter last year

- $500m loan, JPM involvement

- 3 of 9 store brands dropped from lineup

- significantly reduced remaining 6 store brands

- restructuring and reduced costs from $400m to $250m

- new strategy

Nothing bullish, really. Just the usual stuff a struggling company goes to make it to the other side.

So we were all spot on this play. Well done group. Buy into the hype and sell before the announcement. The brave ones got puts.

We can close this and celebrate,. Well played all

First lets make sure and not flood our discord with BBBY. Try to push everyone to this thread etc. Common stock offering, lowering guidance, cutting staff. All bearish signs and typical of a struggling business. Play is over and may run down to that 7.50 then 5 support area if it loses the 8.50 support it has had during this run. 10 big resistance now. Biggest help on these runs is watch how SPY trends. Notice when it dumped, so did BBBY. Almost all pumps die when the market goes red and it kills these plays. I always recommend trading a small amount of shares and learning market data and trends and how these runs go (we have been seeing them for years). Then get used to learning support and resistance areas. Read my post history on this play and others. If you down bad now you either average down at support areas and hope people pump it up to maybe 11 or 12 or cut your losses and learn from this. Also watch the market calendar to see the data come out and learn how it will effect your plays and market. Some could try a bounce on calls if it drops to 8 or 7.50 and you will have better entry or cost than most if you think it will get a small pop again. Watch IV on the calls though as that could kill you if it’s crazy high. Risky play though at these levels as again it’s over. Trying to help most of you to stay green.