So, Vinco Ventures lists several unrelated brands that make it look like they’re acquiring straight up garbage and trying to spin it as golden investments.

I know they had a leadership change a few months ago timed with the last BBIG run and was surprised to see people in those leadership positions leading Cryptyde (and the random-ass packaging company) so I started to do a little digging.

Ferguson Containers is a packaging business based in Alpha, NJ. It is run by Kevin Ferguson currently. You may know Christopher Ferguson as the former CEO of BBIG.

Both were involved in a company by the name of Edison Nation, Inc. An “innovation marketplace” (think - like those inventors ideas infomercials that offer guidance/mentorship for inventors).

Edison Nation, Inc had several subsidiaries according to a 2018 SEC Filing (former ticker: EDNT - https://www.annualreports.com/HostedData/AnnualReportArchive/e/NASDAQ_EDNT_2018.pdf pg 14).

As of December 31, 2018, Edison Nation, Inc. had five wholly owned subsidiaries: S.R.M. Entertainment Limited (“SRM”), Ferguson Containers, Inc. (“Fergco”), CBAV1,

LLC (“CB1”), Pirasta, LLC, and Edison Nation Holdings, LLC. Edison Nation, Inc. owns 72.15% of Cloud B, Inc. and 50% of Best Party Concepts, LLC. Additionally Edison

Nation Holdings, LLC is the single member of Edison Nation, LLC and Everyday Edisons, LLC. Edison Nation, LLC is the single member of Safe TV Shop, LLC. Cloud B,

Inc. owns 100% of Cloud B UK and Cloud B Australia.

On September 30, 2017, SRM and Fergco were acquired by the Company in exchange for an aggregate of 3,000,000 shares of the Company common stock and notes payable

aggregating $2,996,500. This transaction between entities under common control resulted in a change in reporting entity and required retrospective combination of the entities

for all periods presented, as if the combination had been in effect since the inception of common control. Accordingly, the consolidated financial statements of the Company

reflect the accounting of the combined acquired subsidiaries at historical carrying values, except that equity reflects the equity of the Company.

These are all listed as “brands” of BBIG right now.

However, this lawsuit (https://www.govinfo.gov/content/pkg/USCOURTS-paed-5_20-cv-06577/pdf/USCOURTS-paed-5_20-cv-06577-4.pdf) reveals that at least some of their acquisitions, namely Cloud B, aren’t going too well. Its other brands seem all but defunct as well. You can actually trace a lot of them though old announcements that Edison Nation made.

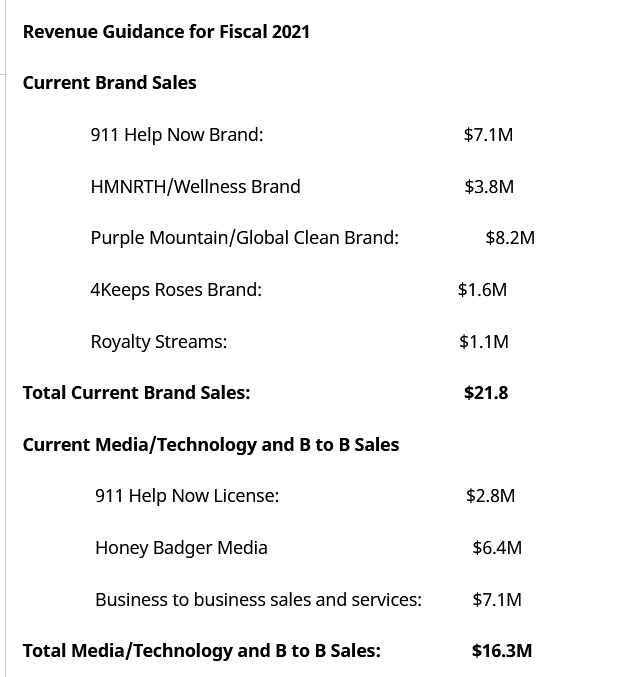

Their posted revenue is nothing to write home about.

The kicker for me was when I read this press release Vinco Ventures, Inc. announces deal with OPTEC International, Inc.. I became curious why Markets on Main wasn’t mentioned by Vinco at all. Did they sell it? Was it a spectacular failure? It’s hard to know how we ended up with Markets on Main as a Global Technologies brand, but this press release just seemed so similar to BBIG/Cryptyde to me. Global Technologies, Ltd. to Spin-Off its Wholly Owned

Anyway, the point of me doing this is to showcase how much BBIG/Vinco is exaggerating its successes and how little hope Cryptyde has of working out. Additionally, Markets on Main being spun into its own company with a dividend is just a little too coincidental for me. This shit won’t be a successful company, but it will be a very successful Netflix docuseries one day.

Looking forward to riding the retail zerg up and down!