Bath & Body Works

Everyone knows what B&BW is and most have gone to it but what lays beyond the clean smelling retail space is a well-fueled machine of candles, body wash, shampoo, and money. To start telling its future I will begin with the past. Up until a few months ago Bath & Body Works and Victoria Secret were in a parent group called L brands who had a CEO who was known to be incompetent and drove Victoria’s Secret into the ground and B&BW was on the other end of this marriage wasting away. Thankfully B&BW was jolted to life by the bull run bounce off pandemic lows and back in August Victoria Secret and B&BW separated into two separate public companies. Now B&BW stands on its own and has been having a strong run in the 1.6k stores it has nationwide.

What B&BW Has done right

The stock had a great run from September last year to June this year and this was based on the boom that B&BW has seen, Q4 2020 revenue surpassed Q4 2019 revenue even though they rely on shopping mall traffic as half of the locations are inside them. In personal experience (yes not real evidence) the stores are always busy. Where B&BW is making a lot of ground from what I’ve seen is in growing its audience on social media and in different age groups. B&BW products are gaining status from what I have seen and are getting recognizable, they have pushed into the body wash space aggressively and are focusing on candles. Hand soap was the biggest seller in 2020 for obvious reasons and it seems that they have effectively driven customers to the other original brands they own.

It has so many Instagram followers that I had to block out the profiles of people that I follow that follow them it was six people I only follow about 270.

Also, B&BW has multiple overseas accounts and stores as it spreads its brand worldwide. This is no run-down fragrance store in a shopping mall, not anymore.

I spent a lot of time browsing the busy Reddit page for the company and its social media accounts and it seems like these products are well known, people have favorites, it can be seasonal. Its all very well rounded with hygiene products and fragrance products and its making this ecosystem of products that have followings.

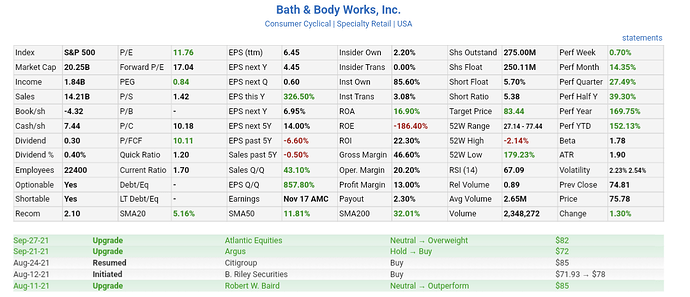

Numbers are what matter so here they are.

Revenue in Q2 2021 was 1.704 Billion

Revenue in Q1 2021 was 1.469 Billion

Both beat estimates

EPS last quarter was 0.77

Sales and revenue is up and importantly the company has gotten rid of 2.2 billion in debt during the last 12 months.

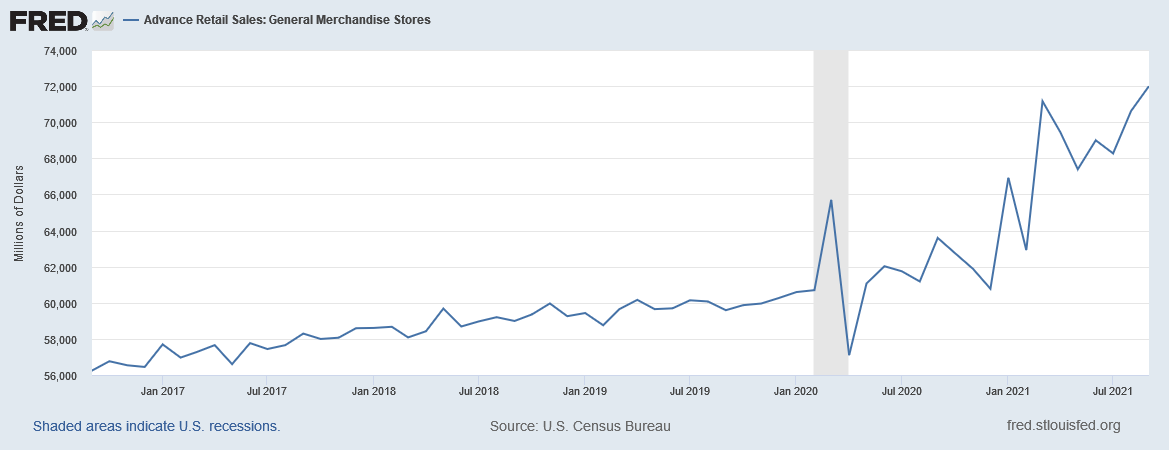

Consumer spending has been moving up fast and this return to the stores is helping B&BW and i am of the opinion that this upcoming q4 could be the best in the companies history, people are going to the malls again and are spending more than ever even as prices rise. B&BW could after this quarter be swimming in money and that means stock go up. And thankfully most of the products are made domestically so supply chain problems aren’t as big a deal.

Currently, B&BW is on its way to getting the majority of its store to be outside of malls in an effort to be away from the dependency of mall traffic and be able to utilize both malls and individual stores.

The big-brained analysts have price targets ranging from 75 to 100 and the future is starting to look clear for the company as it pays off debt, reaches new markets, and continues this sales growth.

Yes it has an ER today

I am not making this as an ER callout but the earning whisper rating is bullish and I will play some small positions but regardless of what comes out of this ER, I am very bullish on the company. If it drops I think that is a good dip-buying opportunity and if it runs then I will be happy.

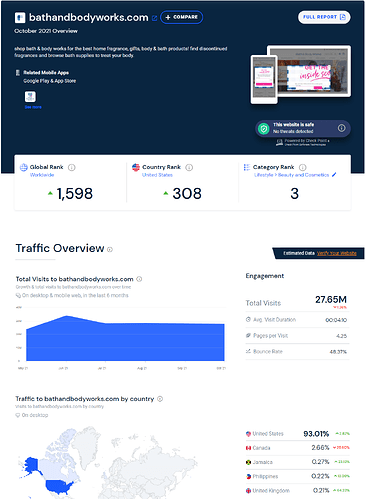

The website traffic has been mostly flat but it stands near the top of the industry and has risen the ranks globally and nationwide.

Summary

Despite what the gay bears think the market isn’t going to go down just because “stocks too high”. If this economic growth continues and consumer spending keeps booming then B&BW is in a perfect position to benefit from a surge of holiday shopping and positive earnings. We will see what is to come from them in the months ahead. I am in some mid-term leaps (May) and I just like the stock, this management team and company has run through the pandemic and launched itself to new heights and in my opinion, its run will continue deep into the future.

Here are some links to articles that helped my brain process all this and can help yours too.

https://seekingalpha.com/article/4461212-the-momentum-investor-spotlight-on-bath-and-body-works