The Blockchain is transparent, in all ETH and BTC transactions, the sending wallet, the receiving wallet and the amount of coins are completely open and for everyone to see. But does it have to be? I’m sure you have heard of privacy coins that conceil this information but what makes BEAM and its ecosystem unique. It’s not just a coin but it is a whole ecosystem of confidential assets, DAPPs, NFT’s, it all works with privacy as a default! But how is this possible?

MimbleWimble Protocol

BEAM uses the MimbleWimble Protocol to achieve this. As mentioned before, this allows for secure and verified transactions to be made without disclosing the amount or the wallets involved. You can read: Mimblewimble explained like you’re 12 or the original MimbleWimble Whitepaper.

BEAM Mining

BEAM is Proof of Work. BEAMHASH III is the latest mining algorithm used to mine BEAM. BEAMHASH was developed by Wilke Trei a.k.a Lolliedieb, the maker of lolMiner, which is a leading miner for Ethereum and can mine BEAM aswell. Currently it is profitable to mine BEAM.

Ecosystem

The entire BEAM ecosystem is acessible directly through their wallet which is now available on practicly all the operating systems both desktop and mobile. DAPPs, Trading, and the NFT marketplace are acessible directly from the desktop version of the wallet.

DAPPs are locally stored on your device and can be downloaded and opened with the wallet.

“Trading” a.k.a Atomic Swaps, also available directly in the wallet allow for you to swap beam and other cryptos cross-chain directly from inside the wallet. For example swapping your BEAM for BTC.

They have also made a separate website as a marketplace for BEAM NFT’s.

Beam staking was launched October 21st in which, using a DAPP integrated directly into the desktop wallet, BEAM can be staked to earn the initial rollout of the BeamX token which has not yet been listed on any exchanges. BeamX token is/will be the token for BeamX DAO.

Development track/ team

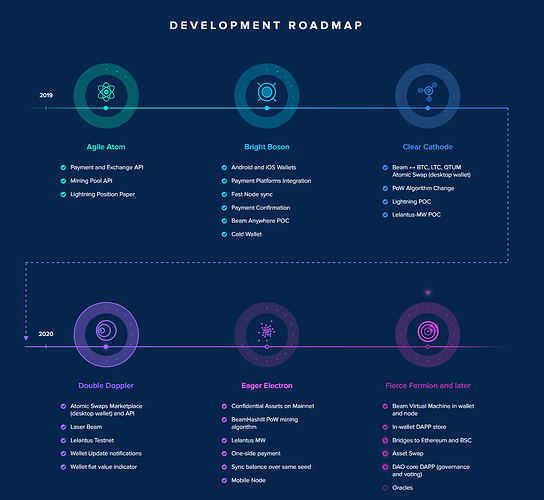

So far the BEAM team has reached and completed many milestones in their development, and they continue to add new targets. Their report for Q3 2021 adresses new developments such as the ability to swap BEAM assets for one another. While cross chain swaps were already available, this would be a faster way to trade assets already on the same chain.

CTO/TechLead: Alex Romanov

Alex is not a crypto OG but rather picked up all of the concepts while developing Beam as its CoFounder. He did not even get into BTC before BEAM. Although he was not trained in Blockchain he is trained in Computer Science and has had a career in programming/development prior to getting into BEAM. He is the most visible figure when it comes to BEAM and seems to be more publicly involved.

Formerly CEO, now “Business Lead” : Alexander Zaidelson

He has a MA in Applied Linguistics and an MBA related to Finance and Entrepreneurship.

And others…

Exchanges

The majority of BEAM trading, according to CoinMarketCap takes place on Binance with most of it being on their BEAM/USDT pair and the rest on the BEAM/BTC pair. There are also many other exchanges but Binance has the most liquidity by a large margin.

Tokenomics/Price action

Max Supply: 262,800,000

Current Circulating Supply: 103,904,960 (40% of total supply)

Circulating Supply Inflation: ~34% in the past year

BEAM started trading some time in 2019 and its price reaches almost $3 in the first month, and dropped to an all time low of $0.13 in March 2020 during the crash caused by the Coronavirus pandemic, since which it has been trading at the $0.30-$0.60 range until the crypto bull market started where it reached up to $2.1 in April 2021. It has since completely crashed from that falling back into the $0.30 range but has been steadily making higher lows from there and reaching $1 in October following twitter announcement that BeamXDao was launching and the ability to stake BEAM. Then in November it trended down and eventually went back down to sub $0.60 levels. Then in december 2nd the price jumped top $1.3 probably due to the launch of https://beamnft.art/. Then since then it has again dropped down to around $0.60 levels where it currently sits at.

Its previous movement since the crash from $2 was consistently rising but was a widening ascending wedge which tends to be a reversal pattern, and this seems to have come true when it broke the bottom line of that wedge briefly going sub $0.60.

So, where will it go from here?

Marketing

The only marketing related content for BEAM seems to be their twitter and YouTube channel, and their articles on medium which are all not actually marketing but updates on development.