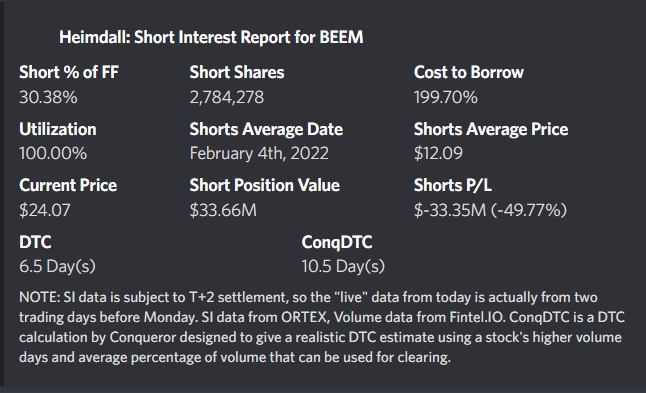

How on earth could their average price be so close to near the bottom?

I’m interested in learning more here, if it’s already at the -40% ish range, but the DTC is still 7-10 days out, does that mean we are still in wait and see? Or would we expect margin calls to happen forcing a potential squeeze?

Got in yesterday when you posted and got already for 50% gains. Thanks for posting this

Personally, I got in yesterday as the movement after good earnings is giving bullish and IV already dropped enough for a decent entry.

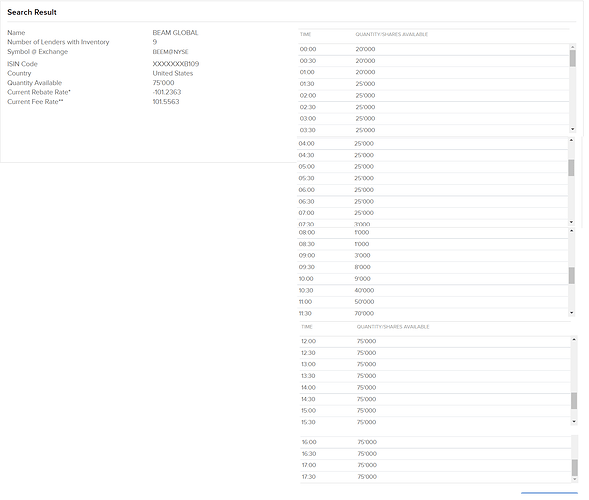

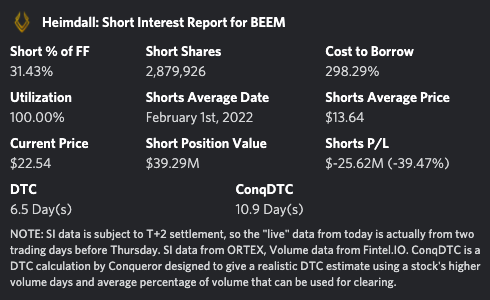

Shorts are now 50% underwater CTB still high. Using IBD to try and get as much most recent data as possible. Not trying to squeeze every last cent out of this per se, but watching my positions from yesterday like a hawk and any bearish indicators.

This was a terrific call out. I missed it but I’m glad some folks got in!

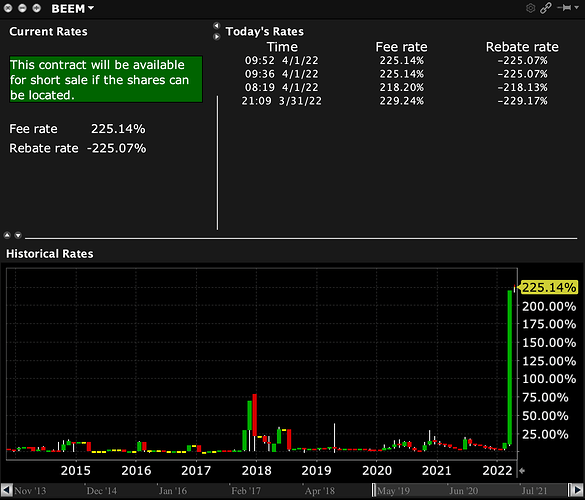

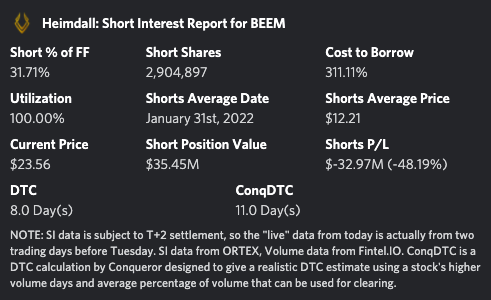

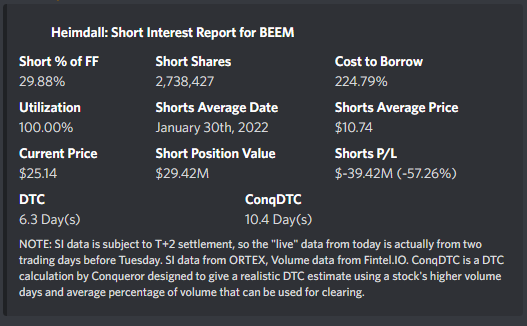

Took a position in this based on the short data, this is probably one of the better squeeze setups that I’ve seen in recent memory:

DTC is at 11 days, which is truly wild, liquidity is floored out and shorts are down approaching 50% on average.

Putting in some Bids - based on Conq’s challenge account @ 1.18 average and the current price of 1.65 for 25’s hoping (could be praying) for fills @ 1.40 - FOMO’ed in @ 1.70

Based on Conq’s play put in some bids for 5/20 50’s @ .80 if they fill they fill - if not will watch for new entries if they arrive Edit - never got filled canceling order always a new play and a new day

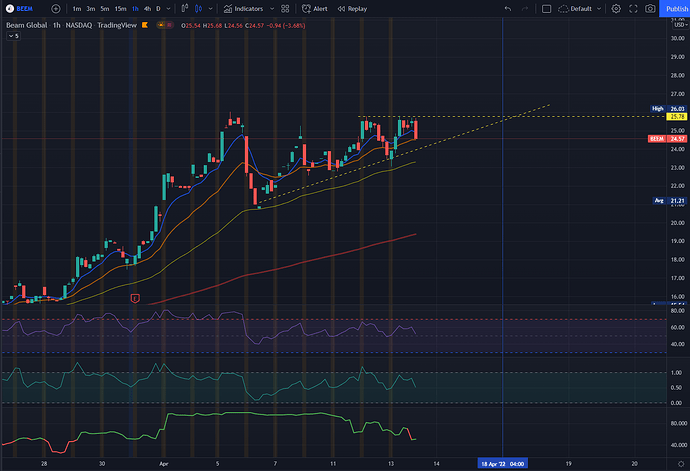

When I started playing this stock last week I was shook by by BEEM’s -2-5% drops AH, but honestly slept on it when I realized the volume is always under 1k.

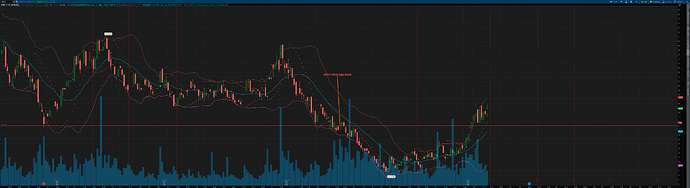

Shorts are still holding steady at roughly 40% down. The stock itself is resisting downward SPY movement but absorbing bullish momentum.

Only concern right now is that volume has basically evaporated. But I think this is worth the hold should it continue to just chill here. Might look into swapping to May strikes tomorrow though.

With the almost minuscule volume does this prolong it and make it more drawn out squeeze or do you foresee it being even more violent upward movement as a couple thousand share candle seems to bounce it a few percent. ? If volume remains at current levels we should also be able to more noticeably see covering I’d think.

CTB on BEEM dropped significantly to 32%

Think it could be worth tracking the numbers on this just to see if we can gain any info on what causes/how fast shorts will cover IF they do end up covering in significant numbers.

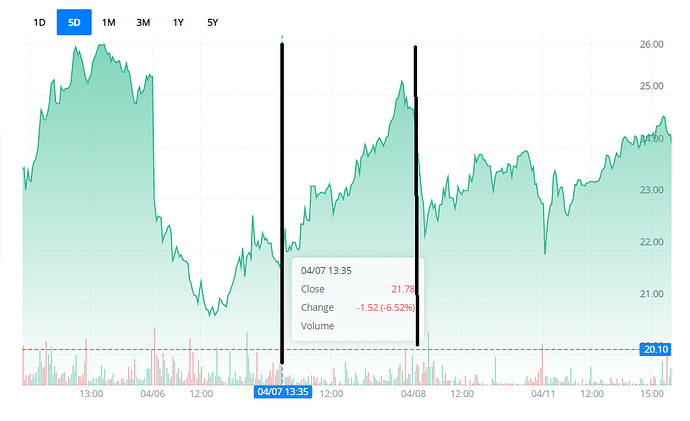

SI was 2.9m at open. If Ortex shows T+2 then ~120k shares were covered thursday 7th, around 1/3 of total volume the day, wild.

It ran from 21.78 to over 25 on this day too.

Another thing that might be worth mentioning is that it was under SSR restriction that day. Not sure how much of a difference that makes but when SI is a significant part of the daily volume it must have some effect, could be something to watch for to take a position.

11/04/22

Still watching this one:

Something interesting is that the “Shorts Average Price” continues to get lower and lower which indicates that you have newer positions that are exiting recently. If It continues to hold in this price point you should probably look to see the older positions start to move so we’ll be watching for that same “Shorts Average Price” statistic to start moving upward again. Going to collect a May position on this without a doubt.

According to IBKR around 55k shares returned, theres a disclaimer here but can’t figure out if it’s saying its T+2 like Ortex for the numbers or just for the borrow fee.

“Instrument loan (SLB) data contained herein, and in downloadable format, reflects our estimation of the current availability and rate information. This information is offered on a best efforts basis, without warranty as to its accuracy or validity. Share availability includes information from third parties which is not updated in real time. Rate information is indicative only. Trades executed in the current trading session typically settle in 3 business days and the actual availability and borrow costs are determined on settlement day. Traders should be aware that rates and availability can change significantlyin the time between trade and settle dates, particularly in thinly traded stocks, small cap stocks, as well as classes of stock that have an upcoming corporate action (including dividends).”

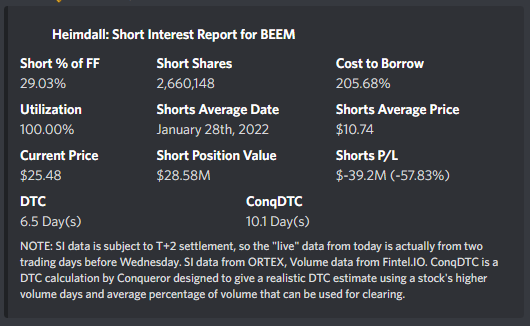

Updating this, we’ve seen somewhat of a drop in short interest from 2.9M shorted to 2.6M, everything still looks really good however and I’m still bullish on this play in the short term. One thing I did want to comment on is regarding “Shorts Average Price”, I commented on how it was pointed out that this calculation likely isn’t optimal in the following thread: Fix "Shorts Average Price" Calculation

Given this, I’m manually estimating the true average to be congregated around the halfway point between the “Avg Age” and “Avg Age” x2 (since it’s an average the “Shorts Average Date” should be the mid point between today and the outstanding shorts) until we find a better method.

So with that factored in, Avg Age is sitting at 75 days (which gives us our first point of January 28th. Now if we double that and we get November 14th. The midway point is then around December 22nd and a more realistic short average of $21.00:

Does this mean that it’s not a squeeze candidate? No, not really. You have to keep in mind that this is an average which means that while reasonably half the outstanding shorts are potentially still ITM… the other half really aren’t. So theoretically if it were to go, you’ve got a decent “ramp” of shorts set up.

If we get the bear market rally being predicted this is still a top watch as I think the buying pressure might force an exaggerated movement. I’ve begun rolling out into May’s since I think this will continue being profitable to swing at least for the next little bit.