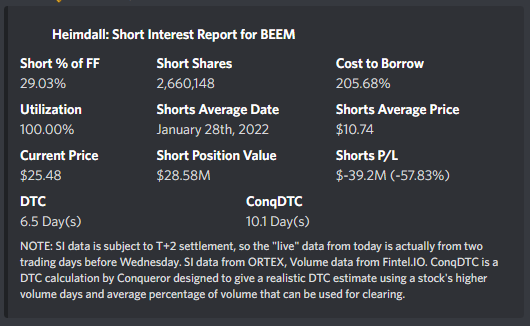

Updating this, we’ve seen somewhat of a drop in short interest from 2.9M shorted to 2.6M, everything still looks really good however and I’m still bullish on this play in the short term. One thing I did want to comment on is regarding “Shorts Average Price”, I commented on how it was pointed out that this calculation likely isn’t optimal in the following thread: Fix "Shorts Average Price" Calculation

Given this, I’m manually estimating the true average to be congregated around the halfway point between the “Avg Age” and “Avg Age” x2 (since it’s an average the “Shorts Average Date” should be the mid point between today and the outstanding shorts) until we find a better method.

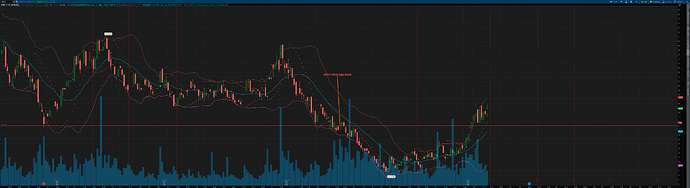

So with that factored in, Avg Age is sitting at 75 days (which gives us our first point of January 28th. Now if we double that and we get November 14th. The midway point is then around December 22nd and a more realistic short average of $21.00:

Does this mean that it’s not a squeeze candidate? No, not really. You have to keep in mind that this is an average which means that while reasonably half the outstanding shorts are potentially still ITM… the other half really aren’t. So theoretically if it were to go, you’ve got a decent “ramp” of shorts set up.

If we get the bear market rally being predicted this is still a top watch as I think the buying pressure might force an exaggerated movement. I’ve begun rolling out into May’s since I think this will continue being profitable to swing at least for the next little bit.