There seemed to be some interest in this - So I thought I would make a thread.

- I only copied and pasted it all - The_Ni is the OP. Sorry about any formatting errors - quick search for BGFV and click community callouts to see the originals.

By @The_Ni 3/28 3/29 ish

Got 10.5C Jan 2023 BGFV LEAPS for $9. Current price $18.84.

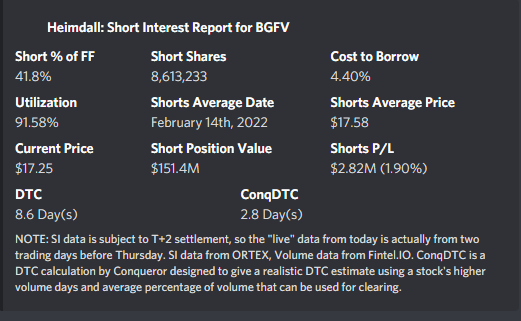

BGFV is inching up again. Crossed the 50day SMA. Decent company , heavily shorted - 41% of the 20M FF. With markets generally feeling good, this could drift up and then spike. Even if doesn’t spike, Jan 2023 gives a bit of runway to let the drift happen.

2d

That spike back in Nov was for earnings and I think a caddude or sirjackalot yolo on reddit.

2 Replies

1

Reply

![]()

thots_and_prayersLegend

Yep that was it

![]()

The_NiVerified

Fair point, to clarify, the conviction is mostly based on the underlying strength of the business, with the possibility of another squeeze as gravy, in case the meme world takes it on.

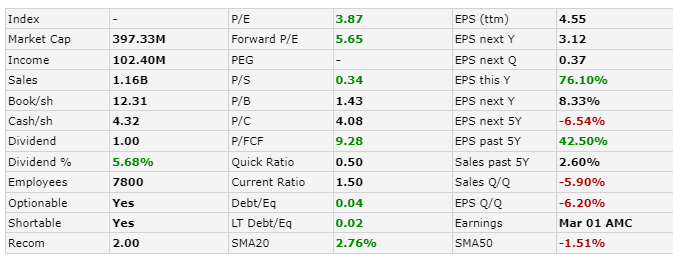

Annual revenue is > $1B and steady. Net income is > $100M, and FCF is ~$100M (Financials). Yet the market cap is, inexplicably, $370M. Now that prices have started to move up, hoping it inches closer to fairer value, despite price suppression from shorts.

This is the kind of valuation/marketcap that also makes similar companies a PE target - like Stamp and Cerner.

Realizing should probably write up a DD post on this since BGFV has history and has a few moving parts; will do so later today

The_NiVerified

![]() TheMadBeaker

TheMadBeaker

2d

Fair point, to clarify, the conviction is mostly based on the underlying strength of the business, with the possibility of another squeeze as gravy, in case the meme world takes it on.

Annual revenue is > $1B and steady. Net income is > $100M, and FCF is ~$100M (Financials). Yet the market cap is, inexplicably, $370M. Now that prices have started to move up, hoping it inches closer to fairer value, despite price suppression from shorts.

This is the kind of valuation/marketcap that also makes similar companies a PE target - like Stamp and Cerner.

Realizing should probably write up a DD post on this since BGFV has history and has a few moving parts; will do so later today

2 Replies

5

Reply

![]()

internetkingsVerified

Is there any expectation of a large dividend payment again from them?

![]()

The_NiVerified

Delayed BGFV callout - 7/15 20C limit buy filled; had set this earlier after seeing Conqueror’s buys for the Challenge portfolio. This is in addition to the LEAPS I got earlier.

Part of the driver for the rise today is good earnings from ASO, which is sort of a comparable.

And @internetkings, no idea about another large dividend payment, but wouldn’t put it past them. Earnings are 5/2, so we’ll know soon. Thanks for noting this, will keep an eye out for it.