Thank you so much for creating this thread, @internetkings!

To summarize, the case for BGFV is:

- It is a decent company that seems undervalued

- It has been showing favorable price action recently

- It has high SI and squeezed before, adding the potential for some gravy

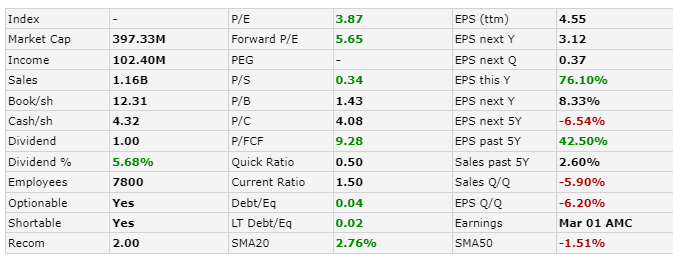

The Company is Undervalued

- BGFV is a ~$400M company that has had ~$1B income every year for the last 4 years, and last year, had $100M in profit.

- Dividend yield is 5.68%

- Gross profit is 37%, EBITDA is 12%, FCF margin is 8%

- Price to book is 1.46, and PE is 3.8

If people spent money outdoor recreation through the worst of the pandemic, chances are they’ll keep doing so through whatever slowdown is happening.

The price is currently $17 . I haven’t run DCF calcs or done comps with peers, and doing PTs is always risky business anyway, but my mental marker based on the ratios and historical moves is around a $25 level. @conqueror you’d mentioned a discussion on fair value in the past but I could not locate it in the forums. If you could please link it, that would be great!

(From FinViz)

Price Action is Favorable

After all the squeezy stuff in Nov 2021, BGFV stepped back into the shadows and continued to be shorted, resulting the price getting stuck in the $17-$20 channel.

This changed with its earnings report on Mar 1, which seemed tepid at first (met on revenue, slightly missed on EPS, guided lower for Q1 2022 but issued a $25M buyback), but market took to it positively and prices started moving up on that orange trendline.

ASO’s earnings from May 29 gave it additional tailwind, although it has given up those gains and fallen back to the trendline.

Note that price is right on the 50SMA today also.

It is possible that BGFV falls below both the trendline and the 50SMA, in which case might release the July calls or a loss. But will hold on to the Leaps anyway as I do believe in the long term potential of this company.

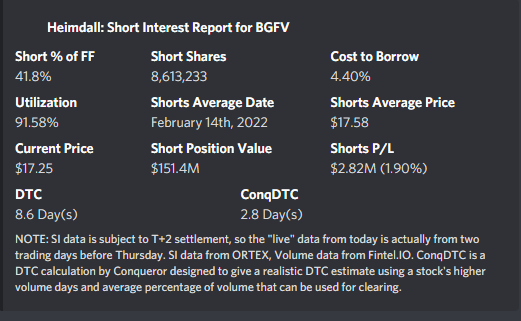

Short Squeeze Potential

This is not a requirement of this play, and frankly if a squeeze happens, it would make sense to take profits and re-enter later when prices mean revert. But what has happened before may happen again as SI is 42% of FF and float itself is 21M only, so worth sparing a prayer for this. Not like the shorts are in kind of pressure though, but if price keeps drifting up and/or some pumper notices it, a squeeze could be triggered.