Hey guys I’ve been following this ticker for 2 weeks now in another thread, but since everyone’s here now I figured I’d move over. BKKT - Potential run-up to earnings for anyone interested

So earnings is 2/13 before market open. So the question now becomes can this pop on earnings? Well in my opinion it would take one of two things:

A) Significant earnings expectation beat/surprise

B) Partnership announcement with a large, well-known company (looking at you Apple)

In regards to A:

So far the only thing out on their earnings report is that it will include a $92 million loss in relation to the merger. Nothing out on actual analyst expectations that I could find, except in this one article.

https://www.nasdaq.com/articles/bakkt-is-surging.-is-the-stock-ready-to-explode-after-earnings

This article says “Like most companies going public through a SPAC, Bakkt’s projections are aggressive. The company is projecting $55 million of revenue this year, which it looks like it will miss based on the current run rate through the first nine months of 2021. Then net revenue is expected to jump to $224 million this year and surpass $500 million in 2025. Bakkt is also projecting to surpass 30 million users in 2025.”

In regards to B:

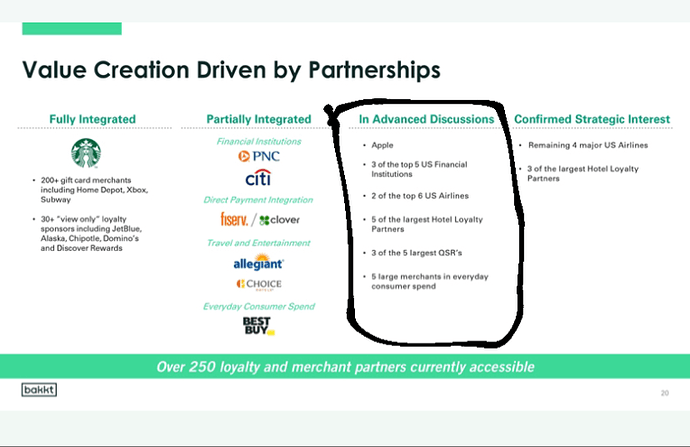

I doubt an announcement of a new partnership with anyone on earnings, let alone Apple, just cause in the past Bakkt announces partnerships right when they happen they don’t really hold them until earnings as far as I’m aware. The rumors of an Apple partnership specifically stem from a slide on their earnings 6 months ago where they mentioned they were in advanced discussions with Apple on a partnership deal.

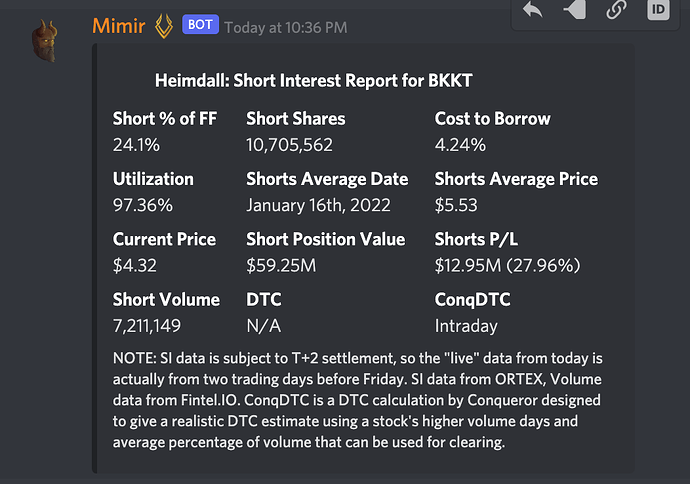

SI 9 days ago:

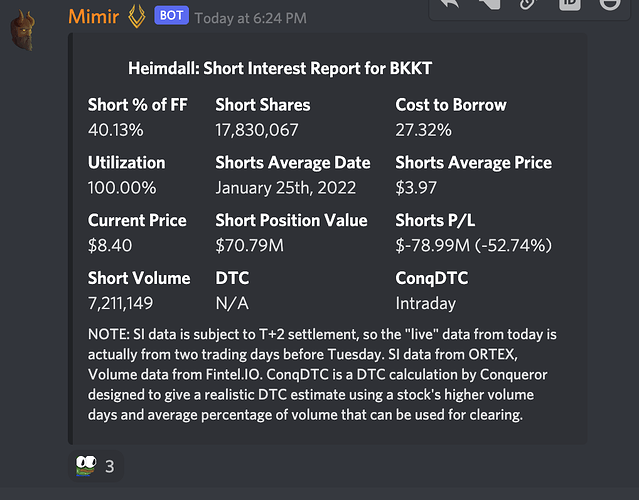

SI today:

SI keeps increasing and I can’t figure out why. I figured the increased volume the past 2 weeks was shorts exiting, but why does the SI keep increasing then? Perhaps the volume is institutional buying? I’m not well-versed in SI so if anyone has any theories I would love to hear them.

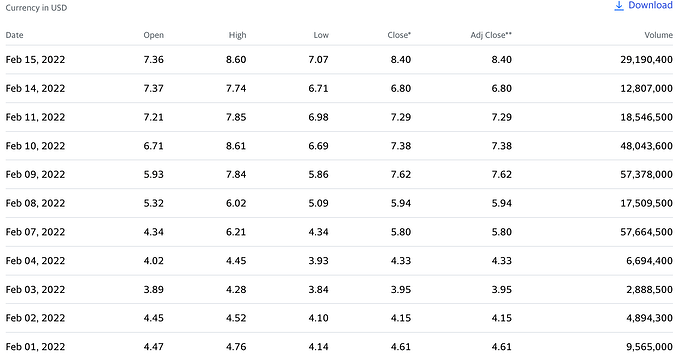

Volume over time: