Ticker:

Description of why you are requesting DD:

Applicable links to news articles or Reddit analysis:

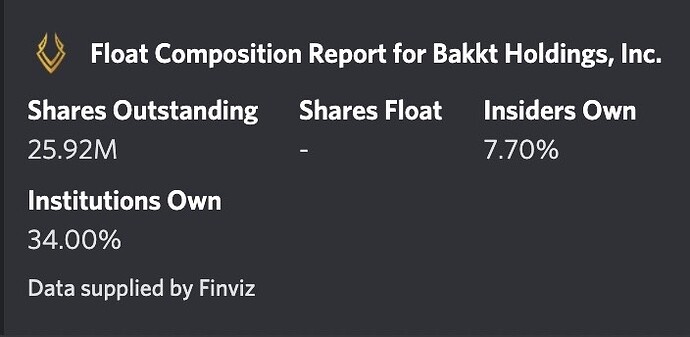

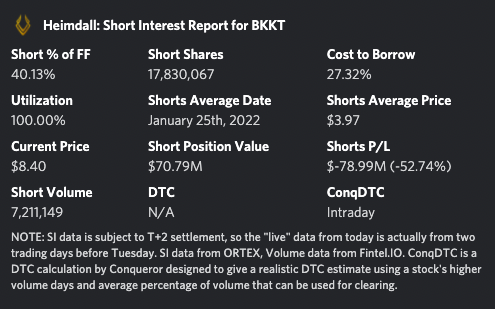

What’s the current short interest, shares outstanding, and float?

Short Interest 11.08M

Short Interest % Float 24.94%

Shares Outstanding 57.16M

source: https://fintel.io/ss/us/bkkt

With this company, I believe it’s tied to the going price of cryptos like Bitcoin and such. If the price of Bitcoin isn’t at a high price, I don’t believe there is a chance for a squeeze. The initial short squeeze on this resulted from the company releasing surprise news that it was partnering with Mastercard to provide access to crypto. There would need to be a good catalyst like surprise news or surprisingly good earnings to cause a squeeze imo.

Do we know if they’re due to report earnings soon?

I was finishing a similar reply. Only thing to add is BKKT had a high SI last time. The Mastercard announcement likely multiplied what was looking like a pop in price around Halloween 2021.

So this is definitely a short squeeze, however, the buying pressure would be pretty severely limited by the liquidity of the stock itself. For instance, recently, between 48-57 million shares of BKKT traded for several days. This would allow shorts to hypothetically exit within a single day.

However, not all shorts will exit at the same time, so theoretically the pressure could be prolonged when coupled with FOMO.

So to be clear, yes, it’s a short squeeze in all likelihood but as far as like a GME or AMC style one, probably not. Going to be watching this tomorrow though.

Feb 17 I believe. Be aware a lot of the shares are still in lockup, though that won’t have any effect on an earning’s play since they are due to unlock April I think

How can we confirm float, is it 25.92M or 57.16M? I did great on this one last fall and told myself never double dip but the set-up is worth watching. Thanks for posting!

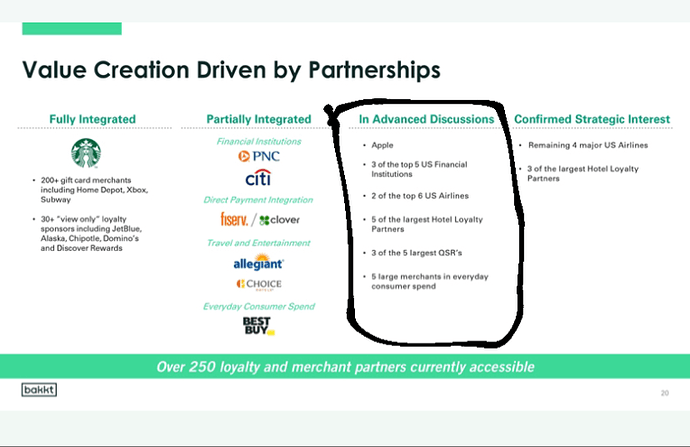

Heard rumors about an apple partnership that might appear in PR tomorrow, on top of that, earnings are out on Thursday but we pretty much already knew it lost a shit ton of money. It seems like FOMO and a major catalyst tomorrow might trigger a squeeze once volume comes in? But conq mentioned the buying pressure would be limited so I’m not too sure on that assumption. Thanks for all the replies!

I can speak from experience that BKKT loves to PR during market hours, that last run with the halt I’ll never forget.

I think this runs with BTC if it continues to rise could contribute to pressure. And it is a Reddit favorite ticker so could see some FOMO with the major run today. I will watch this tomorrow for March calls entry.

Thanks for good info everyone.

This could be an interesting turnout if you decide to play it on the challenge account.

This rumor you mentioned piqued my curiosity and I went looking through all the different social medias to see if I could find the source. I did find that BKKT did a promotion with Apple Pay in December but I am unsure what more of a partnership they could have if they’ve already done a promotion and are using Apple Pay terminals.

https://www.bakkt.com/blog/consumer/tap-into-crypto-with-bakkt-and-apple-pay

The news I did find that caught my attention is the NYSE filing a trademark for selling NFT’s. NYSE is owned by ICE who also is majority stakeholder in BKKT after spinning them off so a partnership makes sense in my mind. That I think is a more likely news catalyst but who knows how quickly that could come if ever or if it even matters for this potential play

Hey guys I’ve been following this ticker for 2 weeks now in another thread, but since everyone’s here now I figured I’d move over. BKKT - Potential run-up to earnings for anyone interested

So earnings is 2/13 before market open. So the question now becomes can this pop on earnings? Well in my opinion it would take one of two things:

A) Significant earnings expectation beat/surprise

B) Partnership announcement with a large, well-known company (looking at you Apple)

In regards to A:

So far the only thing out on their earnings report is that it will include a $92 million loss in relation to the merger. Nothing out on actual analyst expectations that I could find, except in this one article.

https://www.nasdaq.com/articles/bakkt-is-surging.-is-the-stock-ready-to-explode-after-earnings

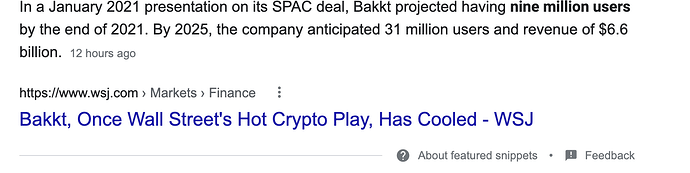

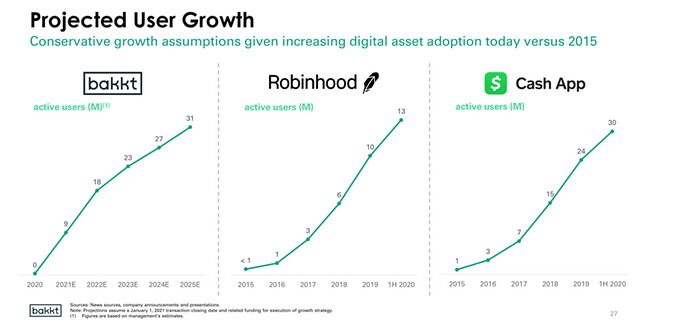

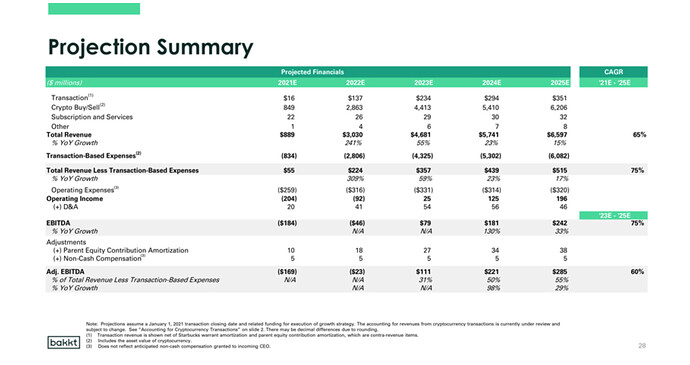

This article says “Like most companies going public through a SPAC, Bakkt’s projections are aggressive. The company is projecting $55 million of revenue this year, which it looks like it will miss based on the current run rate through the first nine months of 2021. Then net revenue is expected to jump to $224 million this year and surpass $500 million in 2025. Bakkt is also projecting to surpass 30 million users in 2025.”

In regards to B:

I doubt an announcement of a new partnership with anyone on earnings, let alone Apple, just cause in the past Bakkt announces partnerships right when they happen they don’t really hold them until earnings as far as I’m aware. The rumors of an Apple partnership specifically stem from a slide on their earnings 6 months ago where they mentioned they were in advanced discussions with Apple on a partnership deal.

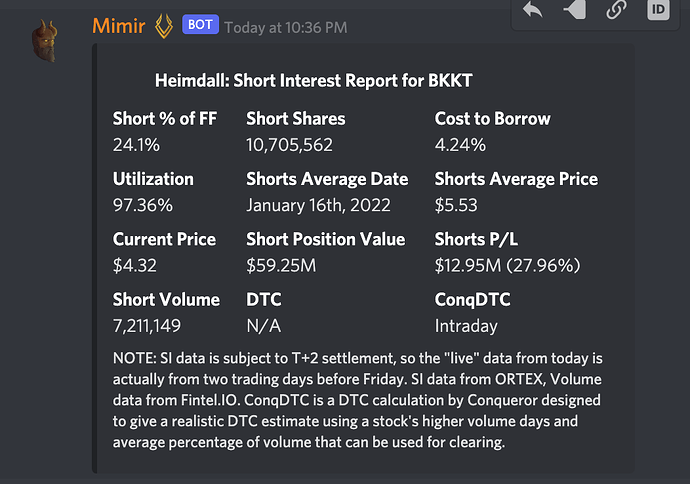

SI 9 days ago:

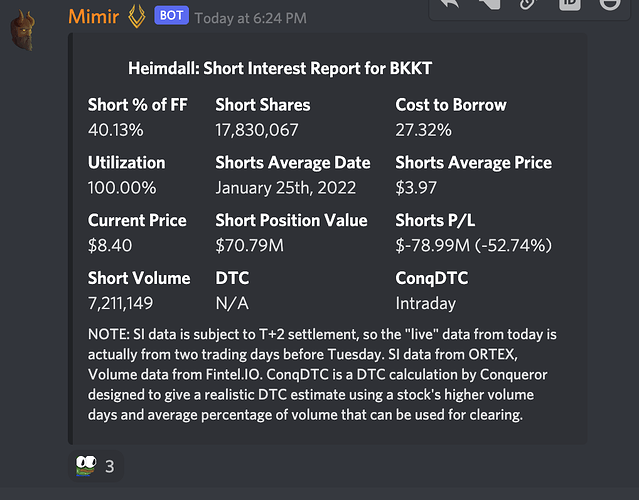

SI today:

SI keeps increasing and I can’t figure out why. I figured the increased volume the past 2 weeks was shorts exiting, but why does the SI keep increasing then? Perhaps the volume is institutional buying? I’m not well-versed in SI so if anyone has any theories I would love to hear them.

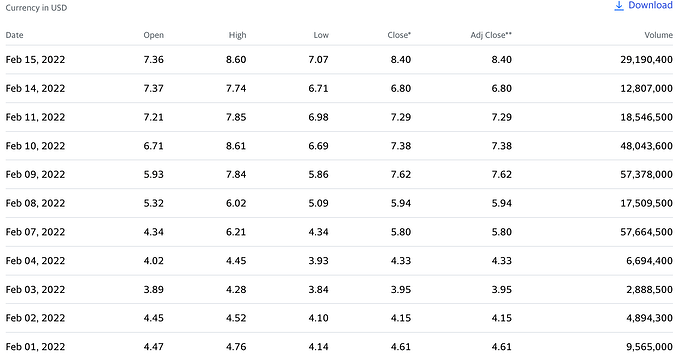

Volume over time:

Thanks to @Speckled_Mongoose for the original DD, I didn’t think to credit anything cause I didn’t expect it to have so much attention. The reason why I wrote it here is because I felt like it has short squeeze potential and wanted some eyes from that perspective.

Thanks but I couldn’t care less about credit I just want money lol. I was originally playing the run-up to earnings anyways, not a short squeeze like is being discussed here.

Good thing you made a new thread def got more eyes on it now

Based on your earnings analysis there might be a post earnings play in the cards for this. I’ve taken a gamble put to possibly hold through earnings (chose an ITM put to negate IV crush), stock is incredibly inflated and earnings don’t seem likely to be good.

I agree that a drop/reversal after earnings is the more likely scenario after earnings. I’m personally holding some lotto calls just because I feel like if there is some sort of surprise or extremely positive projections this could pump quite a bit more, especially with the way the SI is stacked. But yes to reiterate I feel a moot earnings and dump is the more likely scenario.

Thanks for that callout, loaded up on the puts and it’s printing. Any thoughts on loading up some calls after the put play?

Here are a list of projections Bakkt put out in Jan 2021. It will be very important to see if they are on track to hit these, or they cut any of these projections.

Official Projections: https://www.sec.gov/Archives/edgar/data/1820302/000119312521005833/d913171dex992.htm

Tweet: x.com

They also projected 9 million users by the end of 2021 so we’ll see if they hit that or not.

https://www.wsj.com/articles/bakkt-once-wall-streets-hot-crypto-play-has-cooled-11645016580#:~:text=In%20a%20January%202021%20presentation,and%20revenue%20of%20%246.6%20billion.

(I don’t have WSJ so I can’t access this article lol)

The projections on the SEC form is where the Apple advanced discussions slide is from. So that was first floated a YEAR ago, not 6 months ago like I thought.

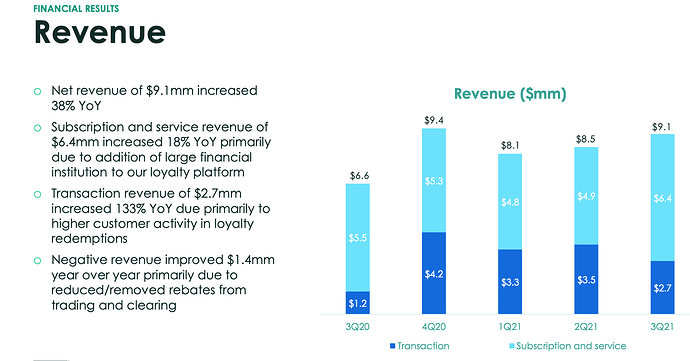

I mean some of these projections are kinda insane. $6.6 BILLION revenue by 2025? For reference, they had only $9 million revenue Q3 2021.

Below are their net revenues for the first 3 Q’s of 2021… roughly $25 million so far. They call the $9M in Q3 their “net” revenue but they later subtract their $39M operating expenses from this to get a $28M total loss in the 3Q. Wouldn’t that make the $9M their total revenue, rather than net? Not sure how that labeling works. Their $889 million total revenue projection for 2021 tho… idk man someone smokin the piss on that one… unless I’m misunderstanding how their net vs total revenue numbers are reported…

Roughly $10M in transaction revenue so far this year they need $6M more to hit the $16M transaction revenue projected for 2021. Not sure how much Mastercard, Fiserv, other new deals will boost their transaction revenue so unsure if they will hit this, but I would say it’s definitely possible.

(Slide below is from Q3 ER this is official reported data).

If they cut any of these projections the stock is toast short-term imo, especially if all the new partnership rumors amount to nothing as well. However, if they are hitting these lofty projections it’s quite impressive and bullish to me even if there is no ER hype surprise.