[size=5]Overview[/size]

With RH behaving like a stupid overvalued piece of crap, missed opportunities on earnings plays, and earnings being an inscrutable mishmash of binary facts and emotional nonsense, I started digging into behaviors of tickers prior to after-hours earnings calls to try to identify measurable trends within tickers that may lend some insight into how a stock may move with earnings.

Namely I wanted to find out how we can avoid losses after astounding DD. How can so many people pour their minds into earnings theories but get trumped by either something stupid said in earnings call, misses on guidance, misses on goals, etc.?

I found interesting correlations, and cannot stress the following enough:

- This is gambling, and arguably a stupid way to gamble.

- This is the byproduct of frustration with earnings and nothing else.

- Doing DD and looking for opportunities outside of earnings seems to still be more profitable than trying to guess earnings.

- This is not financial advice, strategy advice, or anything similar. These are the musings of an idiot who likes shapes and patterns.

Theory

Insider information is unavoidable and will be used to inform trading practices regardless of its legality. We can gain enough insight by watching volumes prior to earnings to predict the outcome of the earnings call, however it requires quick decision making in the final 5 minutes of trading. An important warning is that while this seems predictable directionally, it does not seem to be an accurate gauge of velocity. I cannot estimate how much a stock will move with this method.

Findings

There is a very short period, oftentimes less than 15 minutes, prior to market close in which we may be able to discern which direction the stock will move after earnings. I have reviewed historical earnings data and found that this method is roughly 80% accurate. Generally, stocks that have higher volume have better showings in the final minutes of closing, so while the low volume stocks are more volatile, higher volumes may be a better target for this kind of strategy.

[size=5]Strategy[/size]

Timing

The timing is the trickiest part of this entire strategy. Last night I started watching 2 minute candles on Webull at 3:48PM EST. Between 3:48 and 3:56 a stock’s movement may reflect the movement it will make in the aftermarket, and could be a reflection of insider information informing stock movements right before market close.

Examples

Docusign:

Lovesac:

And finally, the painful one.

RH:

The Blind Gamble

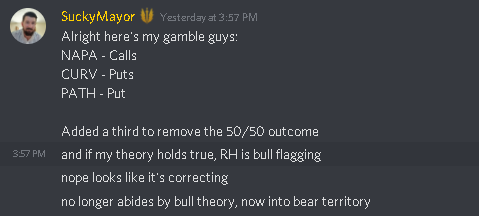

I was observing and mock calling which direction the stocks would move, and found that I was right at least 80% of the time. The problem with fake callouts when you have nothing on the line is confirmation bias. You will always find data to support your thesis until you put it into motion. So I picked three tickers with AH earnings last night and opened some positions at 3:57PM based on what I saw:

- CURV

- NAPA

- PATH

I did no TA, no DD on these stocks prior to choosing them.

The Outcome, and the Bastard

Last night at 3:57PM EST in the Upper Crust Discord I declared my three plays, and the bastard of it all is that I also called that RH appeared to be bull flagging. I immediately recanted, but I have since further observed that the final 2-4 minutes may not be reflective of the movement that the stock will make.

Last night when I called this out, I was not confident of the methodology so I did not want to cause mass panic and potentially ruin what should have been a great play. It turns out there was something to it. I am very sorry I didn’t call out what I was seeing.

So what of my three plays? They all moved exactly as I expected, however the financial benefit was net neutral for me. My options were on the “lotto” side, and certain tickers like NAPA people just didn’t care about.

All options had a 12/17 expiry

CURV - Opened $12.50 Put. This was the big winner. The stock tanked 20% after earnings, and I made a cool $45.

PATH - Opened a $30 Put Lotto. This was sold for a $20 loss despite the stock losing 5% after earnings.

NAPA - Opened a $25 Call. This is a stupid stock and went up 4%, and I sold my option at cost.

All in all I made $25 off of blind earnings without DD.

[size=5]Conclusion[/size]

There may be something to this. It does not seem foolproof, it does not guarantee how much a stock will move, but I have seen more instances in which this is confirmed than instances in which it isn’t. I cannot stress enough that I do not recommend making this type of trade without doing some type of DD, however I wanted to float this strategy out there.

Today I will be playing the following stocks using the same methodology and will report my results:

- ORCL (How did we miss writing a DD on this one guys?)

- LULU

- CHWY

Shoutouts

@Kevin has been a champion with posting unusual options volumes on the trading floor. Its the same philosophy that volume is king, and I’ve asked him to contribute if he has any other volume-based strategies he’d like to share.