TLDR; $BMTX is a digital banking service that Zoomers use, and it now has bank charter capabilities similar to $SOFI and others. Crypto offerings may also come soon, fueling their growth further. It has an extremely small float of 1.6M currently with an SI of 58%. ANALysts gave this stock PTs of $20-$25, indicating 100% upside. They massively beat earnings and have forward guidance that would make you want to yolo your entire port into it.

Sup everyone, it’s Ropirito. After making over 50% off of $MKTY / $SLNH shares and holding several hundred $MCMJ calls (both DDs in my profile), I am back with a play that many other smarter people have posted DD about in the past week.

Anyways, I believe there are several reasons why $BMTX or, BM Technologies, or as I like to call them, Big Money Tech, is severely undervalued AND has stats very similar to $IRNT that provide a strong short-term and long-term thesis. There have been a few DDs in r/BigBrainCapital on $BMTX but several different float calculations have been thrown out. Furthermore, there is not much info on the actual SPAC structure, so I will go through all of this. Huge credit to u/joeskunk for finding this play and u/CBarkleysGolfSwing for additional float data.

The main thesis is as follows (in order):

![]() Strong Fundamentals

Strong Fundamentals

![]() Low Risk - Cheap Warrants, Undervalued Shares

Low Risk - Cheap Warrants, Undervalued Shares

![]() Tiny Float

Tiny Float

![]() Higher SI Stats

Higher SI Stats

![]() Higher Darkpool Ratio

Higher Darkpool Ratio

![]() Higher Sentiment

Higher Sentiment

$BMTX is like if $IRNT and $SOFI had a baby, but better.

[size=6]I. Fundamentals[/size]

I just want to quickly highlight how strong the fundamentals are in this company. $BMTX serves as a digital banking service. They serve as a bank for nearly ~2M students that receive student aid funds, as well as savings accounts, with a partnership with T-Mobile. It was actually a spin-off of CUBI in an innovative growth unit where they didn’t want to restrict its innovation/agility by keeping it a part of the larger CUBI entity. Average serviced deposits in their accounts have grown by 335% YoY and nearly 553% in the past year.

This company is high quality with great fundamentals and a strong outlook. They have $20m in cash (up 93% vs prior year), revenues are up 52% vs prior year and operating cash flows up 120%. Why do I mention this? Well one of the biggest fears of small “start ups” is that they need to dilute in order to raise cash to grow, whether organically or via acquisitions. BMTX doesn’t need to dilute anytime soon and in fact, they just acquired First Sound Bank in an all cash offer (no shares, straight cash so no dilution). I’ll come back to this acquisition in a minute.

~ u/CBarkleysGolfSwing

The key here is their new bank charter capability, which may become a requirement for actually pursuing crypto offerings. “By making this deal BMTX is now neck and neck with a number of big boys - and seemingly ahead of the curve for many. Consider that CND / Circle basically just announced their intent to file their application in August. Note - this is a ~5.5 billion ev company. BMTX is 100m ev company.” ~ u/joeskunk .

Based on new updates, the addition of crypto offerings is getting more and more likely for $BMTX, and may be only 3 months away from implementation after this merger. Given the young demographic they have, this would popularize the platform greatly. This basically looks like another $SOFI to me.

$CND aims for banking powers yet is still stuck in the process of receiving them, while $BMTX;s merger brings them at par if not ahead:

-

BMTX has a charter while they don’t

-

CND is projected to have 1m accounts by Q1 of next year. BMTX already has 2M currently(2x)

-

CND revenue is expected to be 40m in Q1. BMTX is over 1/2 of that today, yet sitting at 2/100 of the valuation or 2% value.

Other peers also justify a potential 3x increase in value for $BMTX. We may see this re-rate up to 3x, for a market cap of $360M even though it would still have a revenue 3x more than its peers.

For more specifics, refer DDs on r/BigBrainCapital & r/Squeezeplays, as I don’t think it’s necessary to rehash information.

[size=4]Why am I discussing fundamentals? Because I actually see this stock growing naturally to several price targets set currently.[/size]

During the earnings call 2 days ago, one question from an analyst was asking what was most important in the acquisition of First Sound. Sidhu alludes that once merged, their ability to “add new products, services and attract new customers for better cross sell” and she drops $SQ and $SOFI in there as examples of what fintech can do with an actual bank charter. This shows jme that they have aggressive growth plans and offerings in the works, but just can’t announce yet. She also explicitly states their convos with regulators are already well underway and that H2 of 22 for merger is conservative, H1 sounds in play.

Q3 2021 core EBIDTA increased 91% to $7M from $3.7M. Guidance for EBIDTA also increased to $26M or almost 400% more.

Q3 2021 core earnings were $2.8M or about $0.23 per share, almost 300% more than the previous year of $0.09.

$BTMX has a cash balance of $20.4M and ZERO balance on it’s $10M Line of Credit.

The CEO also has confidence that they can 10x the market cap in 3-5 years.

There were 3 analysts on the call asking questions. 2 already covered and issued PTs for $BMTX, (Mike Grondahl @ Northland Securities PT $20 and Michael Diana @ Maxim Group PT $25). That’s anywhere from 75% to 100% upside from here.

Those analyst targets were BEFORE they acquired a bank for its charter. By being on par with bigger companies like $SOFI, the upside is even greater now and I expect PTs to rise further.

In a new Seeking Asshole article today, sorry my bad, Seeking Alpha, a valuation comparison was setup showing how with the same capabilities as $SOFI, which $BMTX has it should be worth atleast 3x more and it would still be undervalued relative to some peers.

I won’t make any claims on why or why not it should be worth the same as those other companies since I don’t know their financials as in-depth, BUT, regardless of an $IRNT type move, $BMTX is severely undervalued. Going long with shares, warrants, and far dated calls would serve just as well to capture large price increases.

[size=6]II. The Float[/size]

The investors presentation from the past day post earnings highlights a free float of 8.9M shares:

Free Float: 8.9M

Institutional Shares: 6.7M

This is after accounting for the 1.9M pipe and 1.3M insider shares. Now, institutional reports updated yesterday showing on Fintel’s site approx. 5.9M shares. However, if you actually export the 13f filing data and sum it from Fintel’s own site, the total is 6.5M shares.

13d Activist Shares: Potentially 4.1M. This is up in the air due to the last filings being from February this year. Also, this would result in a negative float which means retail would not be able to buy in (clearly not the case). I suspect that these numbers have changed much more since then or adjusted to a part of the free float.

Short Shares: 808K Shares

Final Float Calculation: 8.9 - 6.5 - 4.1 - 0.8 = -2.5M shares. However, I don’t think 13d numbers are correct, so let’s say none of those shares are owned.

[size=4]We still end up with a final float of ~1.6M shares.[/size]

[size=6]II. Short Stats & Liquidity[/size]

Overall, the short stats on this play are actually ridiculous given the size of the float.

Our first stat is Short Shares Availability. This has been creeping downwards everyday for the past week, with nearly 250K less shares available in the last 5 days.

Strangely enough, the actual short interest has remained the same at 808K shares, which given our float, indicates Short Interest % of nearly 58% of the free float.

The Dark Pool Short Volume Ratio has also remained at 42%. As seen with past “squeeze” stocks or volatile plays, as this percentage approaches the mid 50%-60% range, it is a sign of larger covering behind the scenes. In this case, because the SI is creeping up, we may have more shorts entering at the moment. Over the past week, Dark Pool Short Volume has actually reached nearly 85%, a number I have not seen in the past even with low float deSpacs. Even across all combined exchanges, this value topped at 82%.

The current CTB is relatively low at 14%, however, $IRNT had around a 4% CTB prior to its initial pop. CTB has also been creeping up over the past week.

One thing to note is that although gamma is increasing on the chain, it is not nearly as high as $IRNT’s. However, looking back at the old post, the OI on $IRNT was relatively low but due to the small float, any amount of shares hedged would end up contributing to a large move on the underlying. If $BMTX receives even some attention as it has in the past couple days, this stock may be primed for a similar move in the upcoming days/weeks.

Based on Fintel short squeeze leaderboard, $BMTX continues to climb the ranks. The short squeeze score is 85 and it is ranked 56 out of all stocks. A few days ago it was around #120.

We can also see how small the float may be based on this liquidity. About 50K shares this morning moved the stock 7% briefly due to a larger purchase near a $12.5 limit.

[size=4]Final Short Stats Recap:[/size]

| Short Interest % | 58% |

|---|---|

| Short Shares Avail. | 250K |

| Shares Shorted | 808K |

| Dark Pool Ratio | 42%- 85% |

| CTB | 14% |

[size=6]III. Warrants[/size]

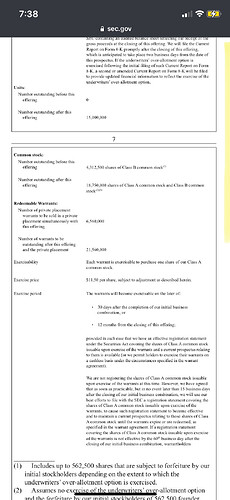

According to filings from earlier this month warrants are exercisable,

“if, and only if, the last sale price of our Class A common stock equals or exceeds $24.00 per share (as adjusted for stock splits, stock dividends, reorganizations, recapitalizations and the like) for any 20 trading days within a 30-trading day period ending on the third trading day prior to the date on which we send the notice of redemption to the warrant holders.”.

Aka, no warrants are being introduced until the stock itself goes up 100% from today’s price and stays above that for about 20 days. Now here’s the thing, even when this does happen (which I hope since that means big profits), the warrants simply bring cash flow and increase the market cap of $BMTX by about $275M.

24M warrants executed at $11.50 would lead to an additional $7.6 of value per share max.

When an individual decides to redeem a stock warrant, he takes it to the company that issues the stock. At that point, the company creates additional shares of stock to give to the investor. Instead of going out into the secondary market and buying shares from other investors, the company simply makes more shares.

When a warrant is exercised, the company issues new shares, increasing the total number of shares outstanding, which has a dilutive effect. Warrants can be bought and sold on the secondary market up until expiry.

This is a big distinction I would like to make that many people including myself miss. Initial redemption allows for creation of more shares but the actual exercising is what dilutes a float.

In page 8 and 9, we see the following:

Since the business combination occurred in January, warrants CAN be exercised but given the first condition of above $24 for 20 days within a 30 day period, there isn’t any reason to worry about this.

[size=6]IV. Lock-Up Periods[/size]

Going off the 8-K filing:

Founder Shares:

“(In the case of the founder shares, until the earlier of (A) one year after the completion of our initial business combination or (B) subsequent to our initial business combination, (x) if the last sale price of our Class A common stock equals or exceeds $12.00 per share (as adjusted for stock splits, stock dividends, reorganizations, recapitalizations and the like) for any 20 trading days within any 30-trading day period commencing at least 150 days after our initial business combination”.

Currently there are 4,312,500 founder shares.

Common Stock:

In the case of the private placement warrants and the Class A common stock underlying such warrants, until 30 days after the completion of our initial business combination.

Chardan, the institution that issued the business combination, is subject to much longer lockup times of 5-7 years.

[size=6]V. PIPE[/size]

The PIPE continues to hold almost all of their 1.9M shares. What we see recently is pipe registration resulting in massive dumps and screwing over retail holders. BMTX pipe owners have continued to hold through several run ups and I do not see that changing. They also bought in at $10.38 as per this filing, which gives me confidence that they are in this company for the long run.

[size=6]VI. Summary[/size]

So what do we have here? $BMTX has a float of 1.7M while $IRNT had a float of about 2.7M. Short interest stats are continuously increasing for $BMTX with an SI % of nearly 58%. Warrant dilution and lock-up periods are currently a nothing burger and pose minimal risk to shareholders or the float. Finally the final float is around ~1.6M (variable depending on SI). I believe this stock will move at similar proportions if not more.

But most importantly, this company is actually undervalued and has very strong financials to back it up. What we’ve seen with many SPACS this year is trash fundamentals and pure hype that results in many bagholders. There is no bagholding with $BMTX. Even if this never reaches the momentum that other stocks have had in the past, the fundamentals, PTs, and data support high growth over the next couple months.

[size=6]VI. Positions[/size]

I am long on a shitload of shares, warrants, and Feb calls. $BMTX is too sweet from both fronts to not dive into. None of what is written in this post is financial advice, please do your own DD in addition.