Hello everyone, I have been playing bond puts for a couple weeks now and making good returns, I have stumbled upon an interesting view in the charts.

As you can see bnd an index funds that holds different treasury, mortgage, and cooperate bonds closed Friday at exactly the price before the bounce in 2018.

Some other charts

Lqd cooperate bonds

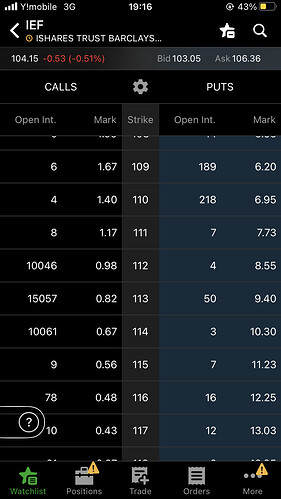

Ief 7-10 treasury etf

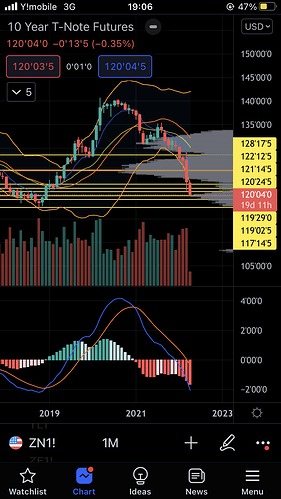

Zn1 10 year treasury futures

These charts show these close to the level they were at before the 2018 bounce.

A couple opinions online

https://seekingalpha.com/amp/article/4500112-bnd-the-bond-market-collapse-is-accelerating

Here’s one stating we break and come down further.

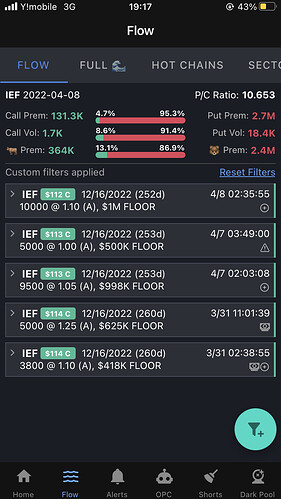

Something I found in unusualwhales is someone or someone’s with big money is buying the dip about 250 days out.

This could be just speculative or maybe possibly somebody sees a reversal in the cards.

As you can see the flow up top shows 99% puts buying recently and now large call buys coming in 250 days out.

Would love to hear some opinions on the possible future for bonds. I found all this stuff to be really interesting, where we go from here is interesting on one hand I agree with the prospect of bonds looking unattractive considering inflation, but on the other hand interest rate hikes and asset tapering have been pricing in for months now it could be the bottom.

I’m going to do some more digging but I just thought this chart closing at 2018 support, the large call buys, and the seeking alpha article to all be interesting.