Daily updates on my account to look back and reflect where i go wrong and sometimes where im right. My goal is slow consistent growth with the exception to server wide plays. This is my revenge tour. The comeback will always be greater than the setback.

Alright day 1. Started with $1,066 yesterday. Held some things overnight. I got blown out on SENS. Not awfully since it was only profit money from

taking positions on the way up. Held spy calls, got out of them decently red but hedged for them on this dip by buying some puts and ended green on spy for the day which was nice. AMD i took a stupid gamble on as i saw a double bottom and took a position and then it followed spy the rest of the day. Never touching amd again. Its too volatile. Draftkings i came out green on today with that nice pop to 24.70. Currently holding 1 GGPI $12.5 call for march….Overall ended up -10% on the day…. I was down nearly -30% but was able to recoup a decent amount of losses. Next week seems to be volatile with the emergency meeting monday. Probably going to get some bad news so im preparing for puts. Ended the day at $966

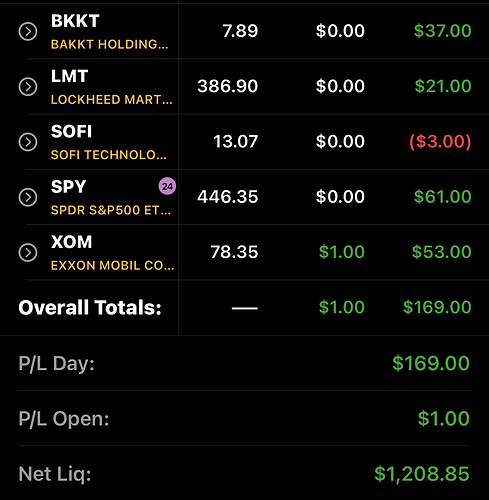

Havent done an update lately… oops but here is where my account is today. Been scaling up and now in the green! From $966 to $1,208 in a couple days! Getting consistent and making gains. Next stop is $1,500💪🏽

Layed fairly low today as i was busy at work but still managed to make some money and 11% of my portfolio. Happy with these consistent gains.

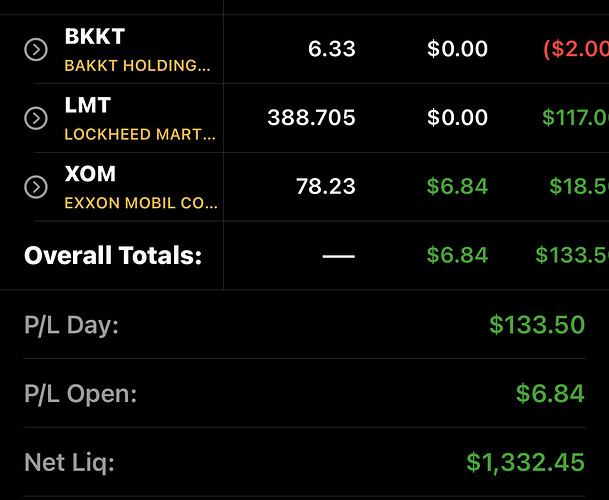

$1,208 to $1,332. Holding 1 $79 feb 25 XOM call overnight. Lets see if russia makes a move tonight that will shoot oil up.

seems like a lot of us squeezed out 10-11% today, good shit.

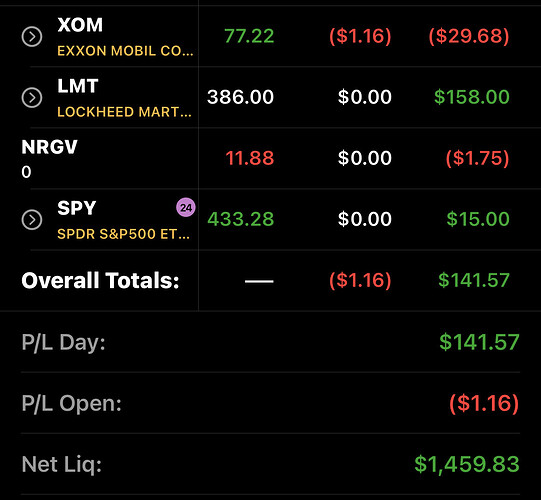

Another successful 11% day. bought 1 LMT call early on in the day and watched it turn to profits and then watch it all go away and turn into a $70 unrealized loss. On that dip around 10:45 i decided to double down and buy 2 more calls. Now holding 3. With the conviction that LMT couldnt go tits up with all the Russia and ukraine news dropping it was bound to recover. This was the most aggressive i have been in a while. Around 11:00 i opened TOS and saw LMT was up over $390 again. I saw a 30ish% gain and i took it. This has helped me build more confidence in the trades i decide to take. But still consistent gains are worth it in the long run instead of yoloing your entire portfolio into 1 stock and pray it goes up. Trading without emotions definitely helped today as well. Took a spy put and scalped 15 bucks off of it. Took a small L on XOM. Decided it wasnt worth the risk with the iran deal. Started the day at $1,318, ended at $1,459 with another 11% gain. Next stop $1,500!

Account is up 50ish % from my start point

Cheers for taking that 30% profit.

Thanks buddy. Hope you did well today yourself🤝

Not quite 11% but I took my money and ran haha

Today did not go as planned. I did NOT hold any XOM over the weekend. Decided it was too risky and my plan was to enter today at some point when i see a dip and confirmation of a reversal. Well i saw that many times. I kept buying the dip, starting around $77.5, followed conqs call and bought 1 mar 11 78 call, and then the dip just kept dipping so I bought another one, and then I bought another one. The dip never stopped. This is likely due to lack of news of war and invasion which is still imminent. I am holding these calls as i think today was mostly due to the lack of news. On the other hand i made some pretty solid trades on spy scalping puts a couple times. Scalped a LMT call on that 392 break. And took JBs IMPP callout this morning. i also took conqs USO callout and im currently down on that. Account is not looking pretty but i am still up from where i started. I am confident oil prices will sky rocket as soon as news of an official invasion or war has begun. $1460 → $1288

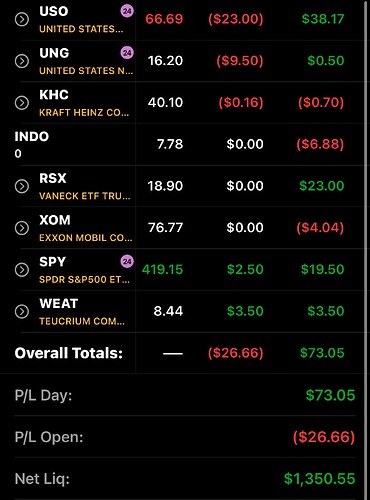

Howdy-ho. Today i followed most of conqs callouts except for my own spy scalp and JBs INDO scalp.

Pretty decent day i guess, nothing to crazy, took the day off of work to go fly fishing and exploring up in the mountains so on my way there i took some small positions and held then with confidence in that ukraine/russia isnt going away anytime soon. Was able to check in on the challenge once in a while, overall not terrible but still down from my recent high of $1460….

Start of day $1288, EOD $1350…

The road to $1500 continues.

Yesterday i took some of conqs positions to hold overnight in preperation of a russian invasion of ukraine. Looks like the plays worked out well. I also bought a lotto spy put before close ( feb 25 $408 put) i bought it for .50 and sold it this morning for 3.08… Heart and prayers to the innocent ukrainian citizens. Account is up 75% from yesterdays close of $1350. Closed the day out at $2300…. Was up to $2488 at one point but i did take more of conqs positions which i am currently down on.

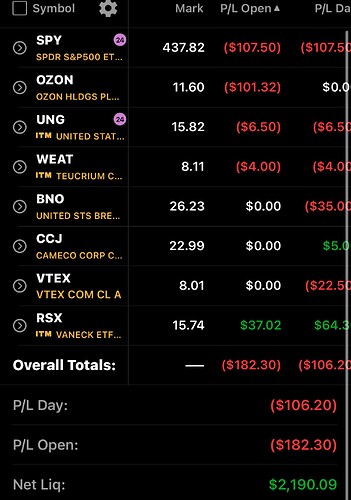

Account update: down 4% on the day. Holding spy, rsx, ozon (puts) and ung and weat calls over the weekend, lets see if we can get some bad news from russia and ukraine, possible escalation on an invasion to a full scale along with much harsher sanctions should make some great profits all around. But nothing is guaranteed. Account is up a lot from where i began at $996. Ended the day just under $2200. Have a great weekend everyone, see you on the battlefront monday.

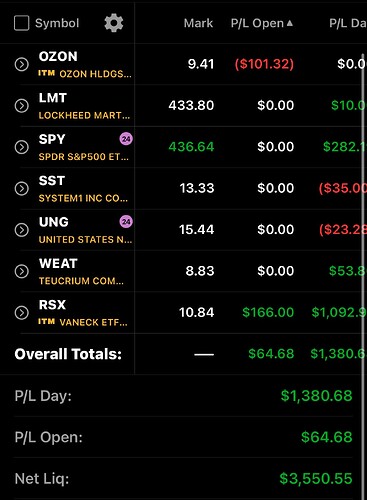

ACCOUNT UPDATE: up 62% today!

Closed on friday $2190

Closed today $3550

Took my profits from RSX, WEAT, SPY, and cut small loss in UNG

Holding OZON as i have no choice lol.

Repositioned into 6 RSX puts holding overnight

What a fucking day! Cheers everyone!

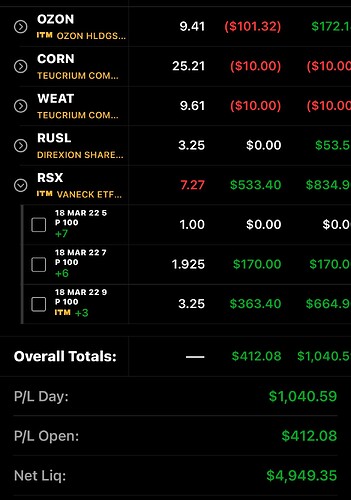

Current positions ![]()

One of my flaws is confidence. I gotta be more confident in the challenge… ive been holding back on taking positions, only buying 1-3 contracts in the begging held me back a good chunk. Now got more comfortable to take larger positions but still setback a bit from where i could have been. I tend to not let (could have) profits get to me but just something to note on my mind. I have overcome that confidence holdback and started realizing when to take good entries! Been getting pretty spot on with identifying peaks and bottoms. Not complaining about the profits ive been making like shit 20-60% is insane. But i think im going to trade with a little more confidence here in out. Taking larger positions on plays that have lots of conviction on working out. Huge thank you to conq and the entire community for all you do to help educate everyone. Hope everyone is making some amazing gains and potentially life changing in the future. Cheers wieners

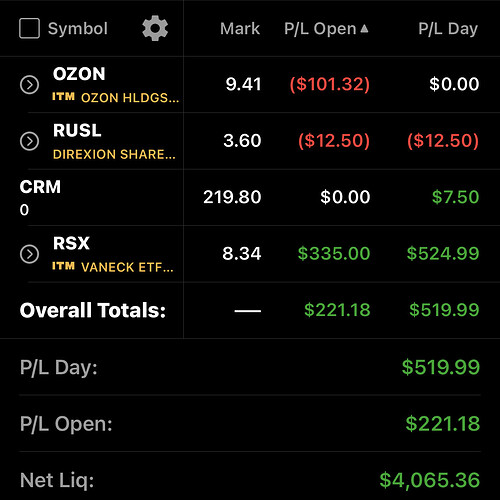

Account update: +10% $520 on the day

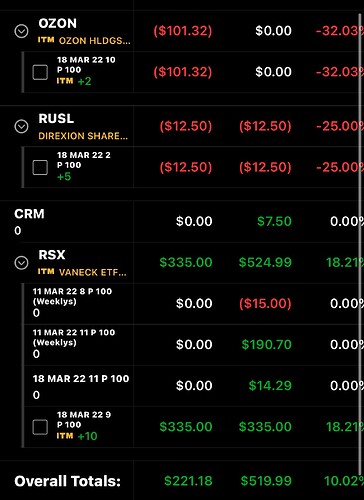

Took PROFITS on RSX at open and repositioned into mar 18 $9 puts throughout the day at the peaks. Currently holding 10 puts RSK, 5 $2 RUSL puts(gamble) and im locked into these 2 OZON puts riding them into the Abyss…

Acc value yesterday $3550. Closed out at $4,065 today

Account up 320% from $966 —> $4065

Bless up to conq and everyone for the amazing plays.

Proof of positions

Took 100% profit on RUSL $2 puts. Bought 5x for .10 sold for .20….

Sold 7x of my 10x 9$ Rsx Puts at open…. Going to load back up on the peaks throught the day. Currently looking at the $7 strikes for march 18th. Following the challenge

Account update: +23% on the day, +$1040

Account value $4,950. Up from $966

Holding RSX, WEAT, OZON, CORN overnight

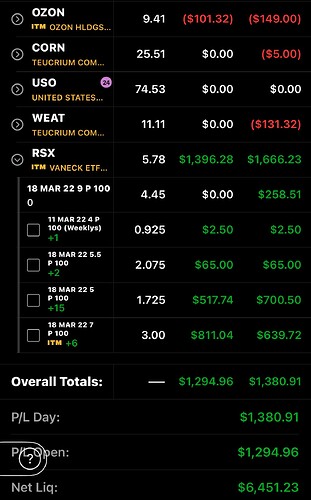

Positions

RSX- Picked up a couple more 5puts at the double top. Holding 9 $5 puts and 6 $7 puts both for march 18th