of course it is. Had an order for the bid (june 12.5) and as the notifications came in for this thread today the 10’s and 12’s for both months started going up lmfaooooo. This is why we can’t have nice things.

oh, DD came out on reddit

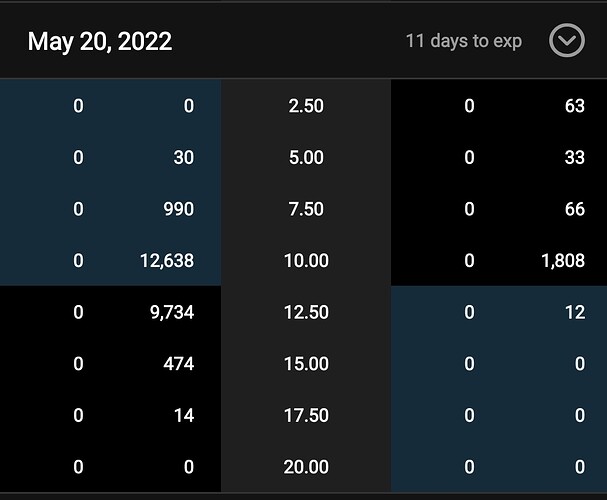

Looks like most of the volume from Thursday resulted in more OI.

10c is now up to 12,500. Volume is 3,500 so far today.

12.5c is now up to 7,800. Volume is 4,300 so far today.

I’m assuming most of this is not us.

This has now fallen back to $10.60 (from around $10.80 most of the day).

A couple ways to look at this:

10c are now a way more reasonably priced 0.65-0.75. This is why you don’t slap the ask when it’s at 0.80-0.85.

It’s possible that an arb who didn’t redeem is selling into the float right now. Could be a bad sign. Spreads have actually been pretty tight all day, which also indicates that arbs could be selling.

Be careful here. There might be a floor around 0.45 on the 10c, but if you’re buying at 0.65 or more that’s still a substantial loss. This will definitely dump back to NAV if redemptions are weak.

New filing today.

It’s a 13G filed by Meteora Capital, LLC, which seems to say that they’ve acquired up to 2,421,494 shares?

I am not sure if this affects the play. Are they free to dump onto the market?

There are several filing deadlines for Schedule 13G. For institutional investors, they are required to file within 45 days of the end of the year in which they finish above 5%, or within 10 days of first finishing a month above 10% if the initial filing has not yet been completed. Passive investors are required to file within 10 days of acquiring 5% or more of a security.5 Finally, exempt investors (as defined by Section 13(d)(6)(A) or (B) of the Securities Exchange Act of 1934) must file within 45 days of the end of the year in which they become obligated to file.

They’re at 16.4% of shares outstanding which means the latest they would’ve been acquiring the shares would be just after April 10. From April 11 onwards the shares were basically just stuck at NAV at $10.35, so they’re not acquiring shares for an arb trade.

Maybe they bought more shares to help push for approval of the extension vote?

Not sure what to make of this. Asgard intensifies

Another 13G filing today. This one is from Harraden Fund.

As of April 26, 2022, each of the Reporting Persons may have been deemed to be the beneficial owner of 852,693 Shares. This amount consisted of (i) 468,093 Shares held directly by Harraden Fund and (ii) 384,600 Shares obtainable upon exercise of call options held directly by Harraden Fund.

As of May 5, 2022, each of the Reporting Persons may be deemed the beneficial owner of 534,698 Shares. This amount consists of (i) 146,098 Shares held directly by Harraden Fund and (ii) 388,600 Shares obtainable upon exercise of call options held directly by Harraden Fund.

Harraden Fund reduced their total long position, mostly their shares position. However, I find it very interesting that most of their “Shares” count is actually from owning call options. 388,600 shares would be 3,886 calls. However, there is no way to tell which expiry or strike… but I’d assume the calls would be ITM and most likely 10c? But also, why would they even long so many calls?

Redemption numbers are in. Looks like remaining public float is 4.7 million. Not ideal, but not much, if any, worse than THCA was considering the amount of call OI.

https://www.sec.gov/ix?doc=/Archives/edgar/data/0001817640/000121390022024681/ea159576-8k_breeze.htm

Assuming the 12.5 goes ITM, that means that OI would only be 49% of the float, correct?

Depends on how much volume from Friday, which was massive, translated to OI. I don’t have those numbers handy.

Float seems too large to get pumped, I closed all my positions.

The only thing that’s missing from this play are the Backstop Investors (or a Forward Share Purchase Agreement).

BIs shrunk ESSC’s “Redemption Float” by 90% - and I haven’t seen a single thing about it across their SEC filings. That is not to say it won’t appear in future 8-Ks. We may still be early to the play.

BIs would have to lock up 2M shares of the redemption float for OI to equal 100% of that new float (~2M).

Will keep an eye out.

I believe FSPAs would have already been disclosed, but you never know. In any event, I am opposed to selling my 10c while this is well below NAV so I am officially bagholding.

I was just able to pick up 100 shares for 10.22. So I guess I’ll sell some calls, was this free money? What am I missing?

I am currently bagholding as well! Will be waiting to see market sentiment after wednesday

Throwing this back on the radar. Refirgerate dropped into TF and mentioned an extension meeting that was just completed.

Recent 10k

https://www.sec.gov/ix?doc=/Archives/edgar/data/0001817640/000156459023004918/brez-10k_20221231.htm

Looks like a lock up period of 8 months following the closing. With some conditions if the stock price moves.

Also saw this on the pumper feed.

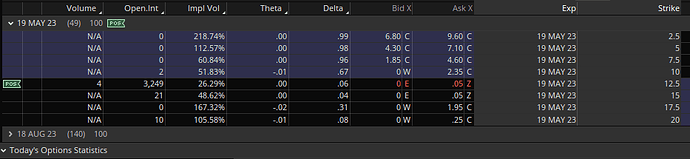

Has an option chain 5/19 and 8/18. Nothing crazy for OI, 3,249 currently, but i wanted to keep an eye on it if sediment changes.

Got a little bit of time to see where this ends up. I added a couple just so i would pay attention and not forget.

I kinda thought spacs were dead but there has been some movement recently that i was unaware of or just wasnt paying attention.

AMBI went from $10 to $50 on 3/1. No option chain

JMAC went from $10 to $19 on 3/14-3/23. No option chain

Looking through reddit and twitter the sediment is fairly poor and especially on spacs with options but things can change quickly.

Ill update if i see any changes.