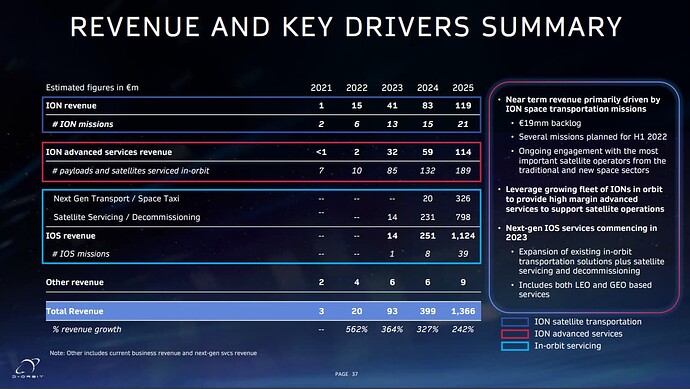

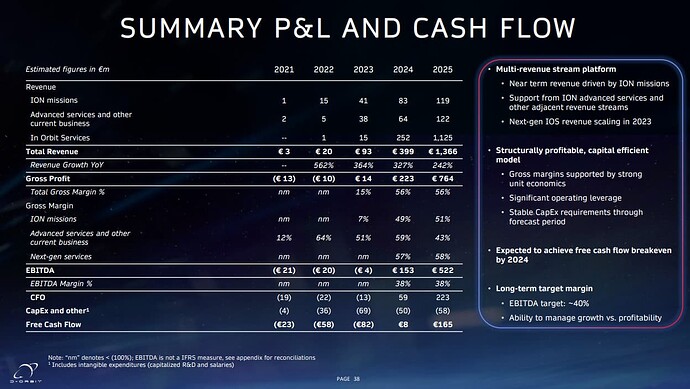

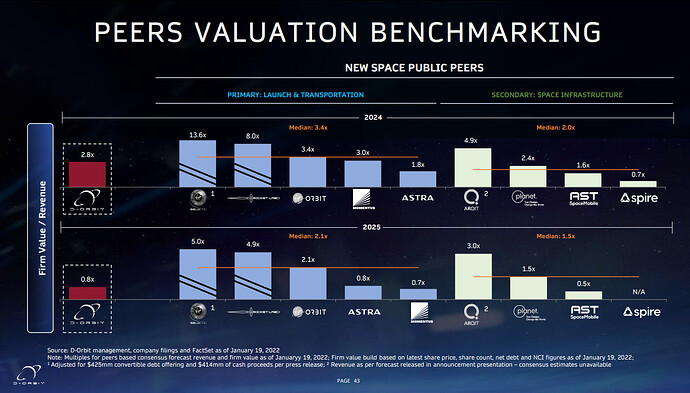

$BREZ is a spac that will be merging with D-Orbit. An Italian space transportation company that seems to be a sort of “ride share” company for launching numerous satellites at once, deploying multiple satellites in multiple orbits. A couple articles I read described it as “satellites-as-a-service”. They have actually had successful launches and are working on some pretty cool stuff. Nevertheless, they had revenue last year of $3.4 million and are valued at $1.28 billion based on the transaction…which brings me to the purpose of this DD request. Is this another merger puts candidate? I saw everyones been pretty successful with them, mainly IVAN most recently I believe.

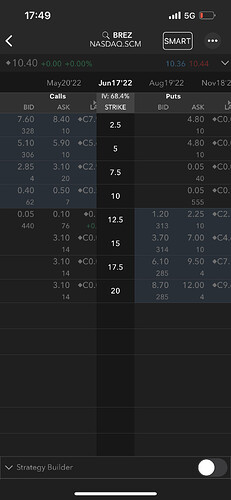

I am not educated on how these deals go down as it relates to the business combination meeting, NAV, redemptions etc. I couldn’t find any SEC stuff to link but I found a reddit thread where everyone was shitting on it so I assume that means my initial thoughts of puts were correct. They have until Feb 25th to combine or they have to add $.10 per share in a trust to extend 3 more months, which they did last november. Also, I noticed when I looked at the chain early today there was 0 anything on the puts. I thought that was odd and figured forget it but I remembered they just announced the news today so maybe that is why. Just randomly came across this on twitter (algorithm infiltrated my mind apparently) and wanted to get this out there early in case there is a play here due to the feb 25th meeting.

I’m just adding this article and the reddit thread as everything else i’ve read thus far says all the same things.

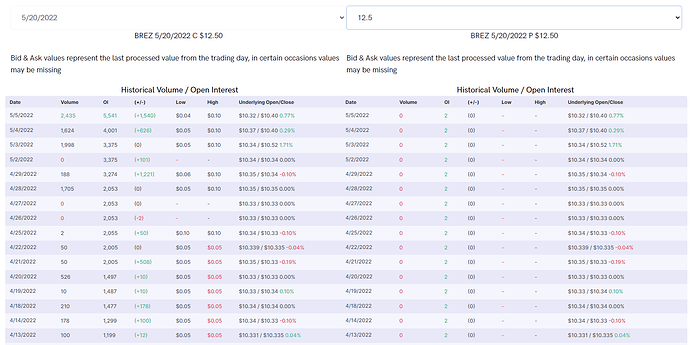

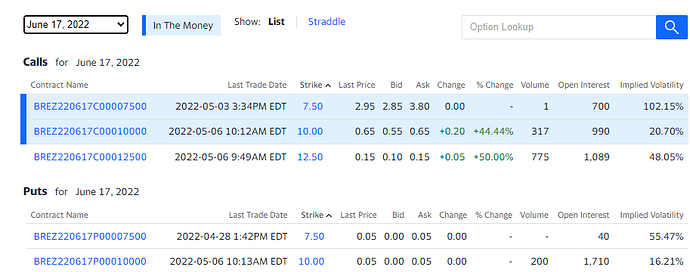

Yes there are options ![]()

https://www.reddit.com/r/SPACs/comments/sdwy4w/brez_deal_with_dorbit/