Curious on what your thoughts are now? I understand you look at BTC over a long period of time but this jump up may have effected some things? or still waiting for that 80%?

I can only assume it’s RU retail (and the concerns around all that) trying to secure assets whichever way they can.

I don’t trade much on assumptions, though (I prefer data I can actually read), so yes I’m still looking for that lower BTC entry–whether or not that will come soon or never, is another matter.

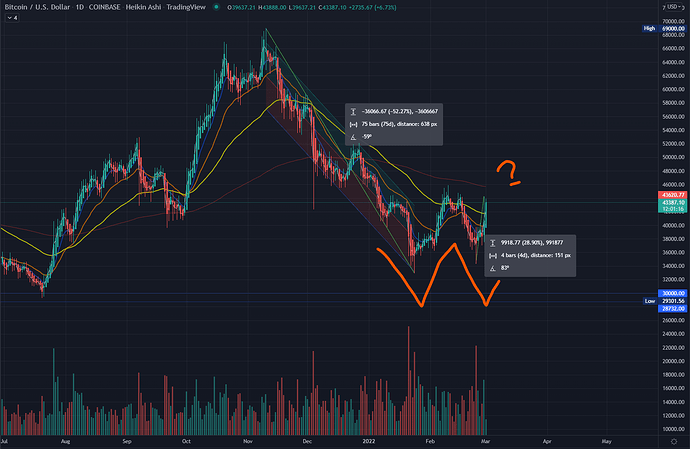

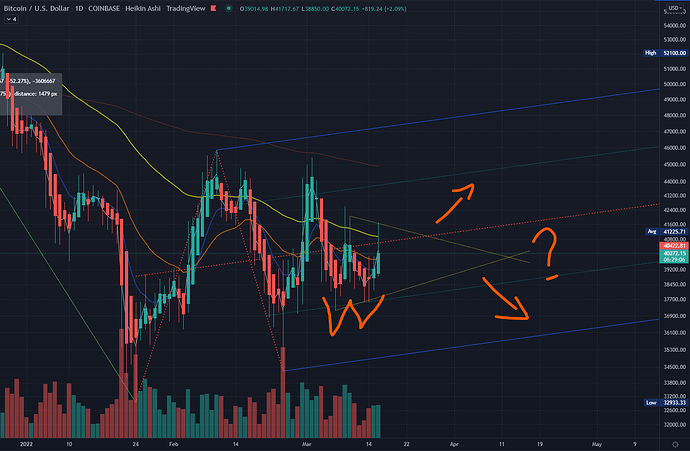

This is a great Double Bottom pattern…

Not a bad place to look for entries on a break, maybe around 40k.

Scalping is the way, until the floor is found and confirmed.

I choose to be cash (mostly) at the end of the day.

I haven’t bought any significant BTC yet. Just grabbed some OTM miner lotto tix just incase this thing really rockets here due to a short squeeze. I got GREE $10 ARBK $12.5 and $15 all march 18 expiry.

Going to dig a little deeper today on where and who is buying coin rn.

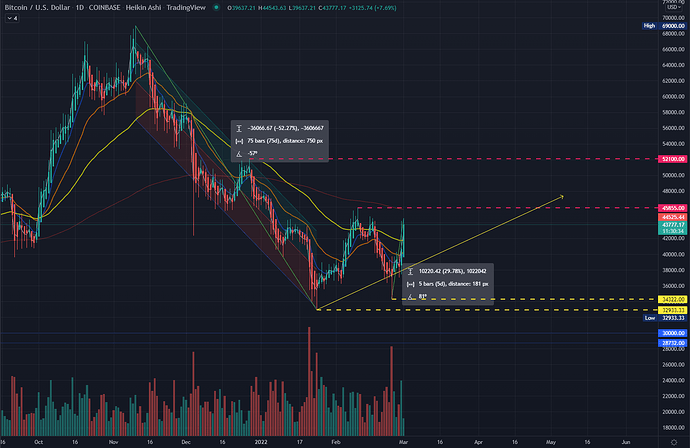

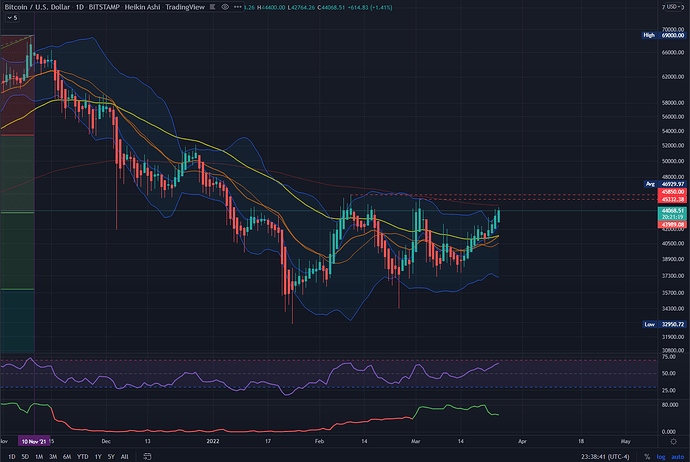

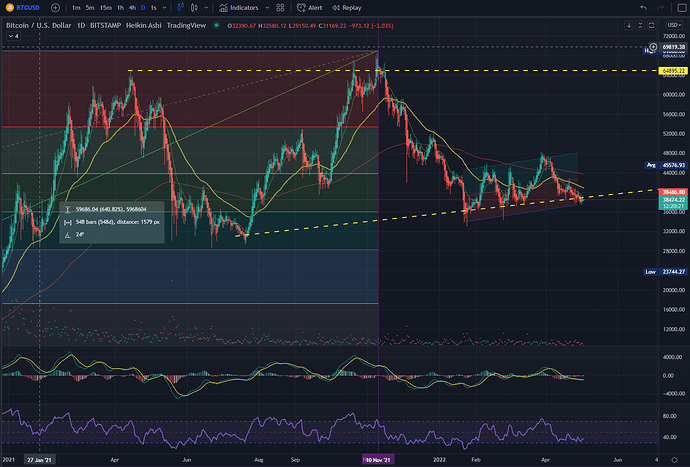

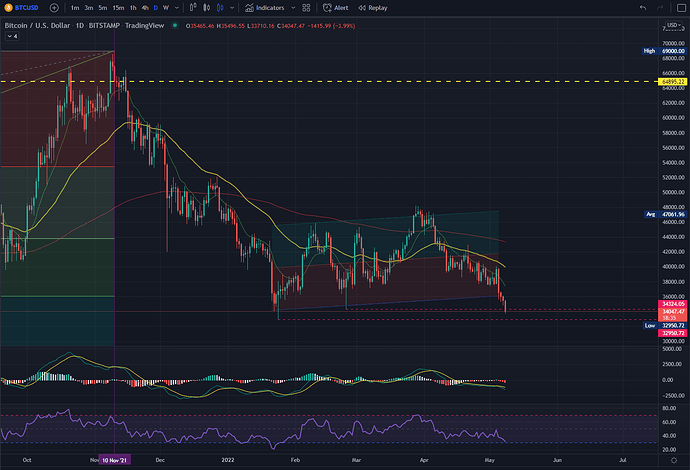

Here’s Bitcoin’s current trading range on the Daily…

Wedged at 45,855 atm, the high price to beat is 52,100.

Lower supports are dashed in yellow.

Back-test supports are lined in blue.

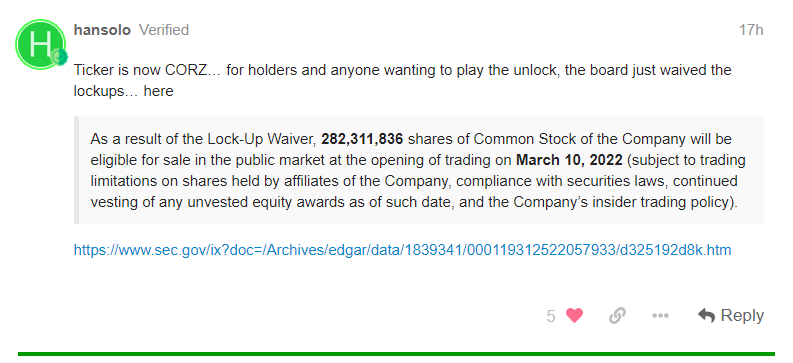

Are you long CORZ? What’s the DD on it?

Isn’t there a massive share unlock coming for CORZ on the 10th? I’m sure that’s starting to get priced in at the moment but why wouldn’t you wait a bit longer before buying in?

I don’t know where the original post for this was, but here is the info for the CORZ share unlock that is supposed to happen at open on March 10th.

Crypto noob here - what are people’s views on the US looking into a potential digital dollar?

The dollar is already digital. You mean a US cryptocurrency? Hate the idea. Governments and banks cannot be in control of currency if we are going to fix the broken money system. The only solution is mass-adoption of currency which has no single entity manipulating its value. A US coin being created would just be proof that governments are scared to lose control of their respective currencies.

Agreed - Now I think that’s the entire point of this US idea. If BTC is gonna work, they want a piece of it.

I’m wondering how that would affect the world of crypto, namely: would it give further credibility to BTC? would they be able to leverage BTC in some way? Or would it be a direct threat to BTC, starting a trend amongst world governments? This is all very blurry to me.

try it out for us peasants

Not sure what’s going to be announced in the coming days, but BTC is looking bullish on this nose…

Whichever direction it decides to move eventually, near April 11 is a good mark for some more volatility.

Bitcoin might just try to push past 45k soon…

If it gets rejected, I’ll expect a bounce around the 40k line.

After March madness, the market usually turns very bullish.

With the Biden admin pushing for the Digital Dollar, I’m waiting for further news of regulation.

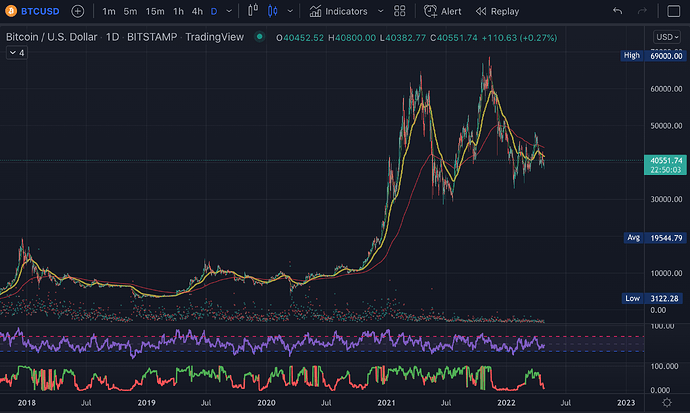

Am I still holding out for that dive to 13k BTC? Yes I am.

These days, my head is swimming with multiple projects. It’s ok if I miss some runs.

It’s been a while since my last update here.

BTC Volume has steadily gone down since the fall from its ATH…

Look at the dots under the price candles.

If I’m not mistaken, a knife down below 30K is coming real soon.

While it is still tracking the line I drew a month or two ago, Bitcoin price movement is steadily losing strength…

Kindly take my opinions here with a ton of salt, since I really rely heavily on TA for entries.

Crypto currencies are still mostly riding on sentiment in this early stage, so only math gives the clearest view.

Bitcoin, it’s tracking at the lower channel of this consolidation area…

Latest News…

Bitcoin Mining Difficulty Hits Record High

1 hour agoCryptoPotato

The mining difficulty of the world’s largest cryptocurrency, Bitcoin has reached a lifetime high of 29.79 trillion.

Bitcoin has withstood an onslaught of sellers as it calmly rose to $39k despite a choppy broader market. Despite the volatility, its adoption continues and its mining difficulty has never been higher. Zooming out, mining difficulty has risen by approximately 30% since a year ago when the figures were around 23.58 trillion.

Mining Bitcoin Has Never Been More Difficult

According to the data compiled by BTC.com, the Bitcoin mining difficulty has hit a record high after rising by over 5% on April 27. Since the beginning of 2022, the metric has increased by nearly 23% as it underwent three positive readjustments and two negative ones. The next difficulty readjustment is slated for May 10.

Bitcoin’s network hash rate, on the other hand, fluctuated significantly closely following its price action. It even notched an all-time high of over 258 EH/s on the same day before settling near 222.68 EH/s.

Data from BTC.com further revealed that Foundry USA lead the chart contributing the most hash power – 17.05%. It was followed by AntPool with 14.28%, F2Pool with 13.86%, Poolin with 12.58%, ViaBTC with 11.73%, Binance with 11.30%, etc.

Embracing the Bitcoin Standard

Blockchain analysis platform, Glassnode, recently noted that bitcoins are being accumulated and both retail and professional investors are taking portions of the asset from exchanges and are willing to hold on to current prices on private and cold wallets.

This development comes even as the crypto market has continued to struggle in gaining any meaningful momentum in recent months. Besides, wallets with more than 1K BTC have also demonstrated an aggressive upwards move which could potentially signal big players beginning to re-accumulate again.

While some countries are still hung on to high taxation instead of bringing about regulatory clarity, a few others have taken a bold step towards addressing the latter. Over the past decade, several economically-challenged nations switched over to the US dollar. But excessive money printing is driving people away from these fiat currencies.

A prolonged period of high inflation, high unemployment rates, and stagnant aggregate demand has made the existing monetary tools futile. With investors now increasingly embracing Bitcoin, nations aren’t far behind. After El Salvador adopted Bitcoin as a legal tender, the Central African Republic followed suit and went on to become the first country in Africa to do so.

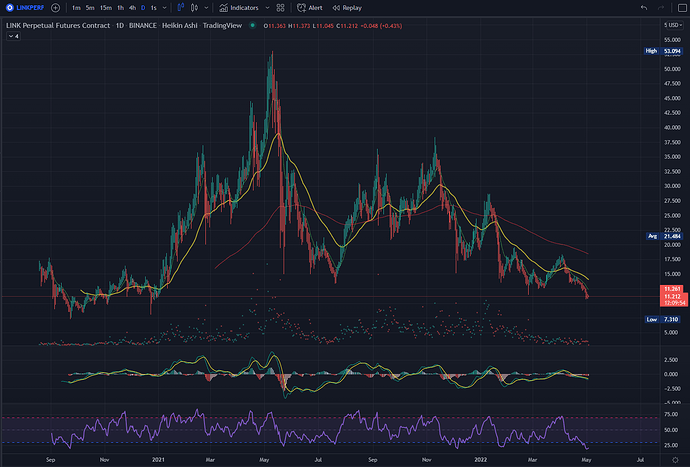

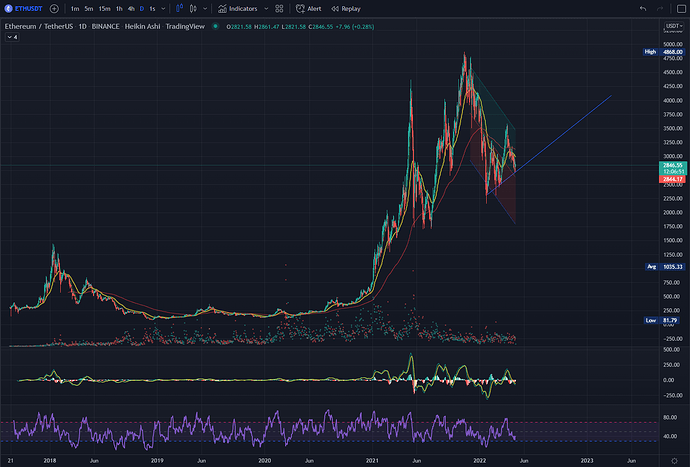

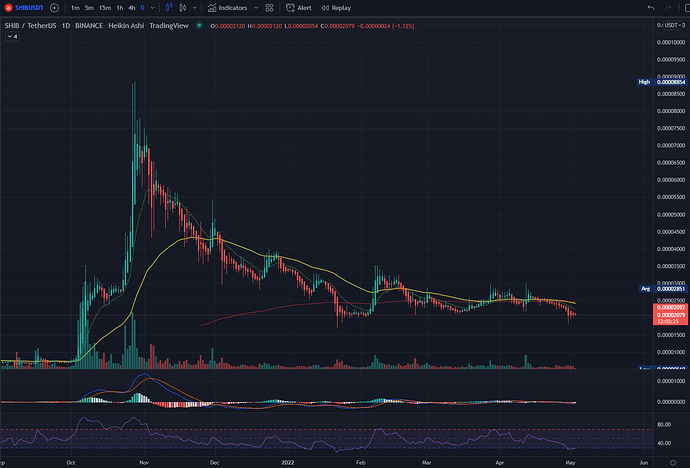

Bitcoin, ETH, LINK, SHIB, etc–weakness all around…

I’m yet to see any clear buy signal in any chart–far from it.

There are some buying activity going on, and that’s cool, but it’s no loud and hot signal yet anywhere.

Most charts are trailing the bottom of their RSI…

Meaning it’s ok to buy here for some hope of a pump in the short term, but don’t go in heavy.

I’m probably going to go with $50.00 today on BTC, just to try a single-leg strat that I’ve been practicing on blue chip stocks.

My hunch is that we’ll start to see movement after 3pm tomorrow…

A day or two late even, give or take.

Everyone’s on the edge. Big players are tired and just want to play it safe.

Flushing down is more likely than a huge rally going up.

So stay green and dry, and just be ready to ride the trends…

All dog-shit coins are shitty atm.

SHIB’s tip is like a shib’s pipi.

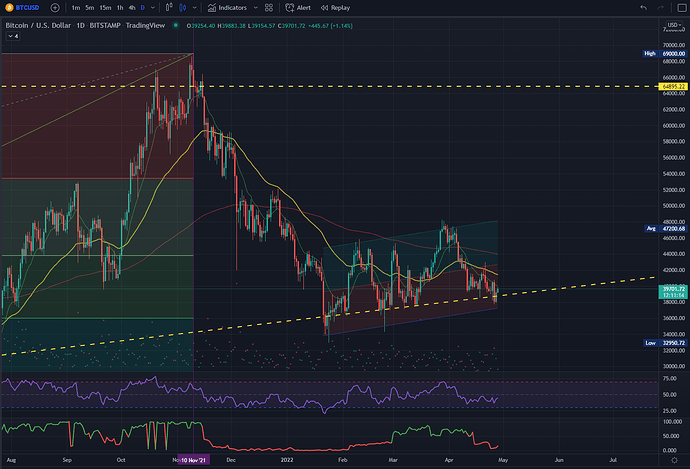

This is a great idea, shared on TradingView by user Theperfectionist…

Give it a quick glance.

It’s in line with my idea.

While Bitcoin is currently tracking down and will probably break that support line of 32,950…

I wouldn’t be surprised for one last push to 42k again.

What I want to see in the coming months is a series of rejection at the 48day (or 55) moving average line (yellow).

So for now, I am expecting a reversal and then we can watch it track down to 20k.

Hoping for that 13.5k price line–but that may be asking too much, with the level of hype BTC has these days.