Main site: Bitcoin - Open source P2P money

Max Supply: 21M coins.

Total Circulating Supply: 18,884,175.00 BTC

Guide for Individuals: Bitcoin for Individuals - Bitcoin

Vocabulary: Vocabulary - Bitcoin

Guide for Developers: https://developer.bitcoin.org/

Whitepaper: Bitcoin: A Peer-to-Peer Electronic Cash System

CoinMarketCap page: Bitcoin price today, BTC to USD live price, marketcap and chart | CoinMarketCap

News Link: Bitcoin price today, BTC to USD live price, marketcap and chart | CoinMarketCap

Update: 2023-01-17

Happy New Year, everyone!

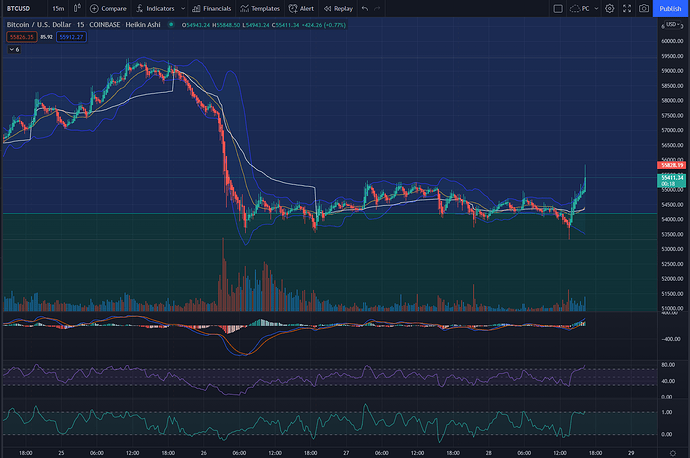

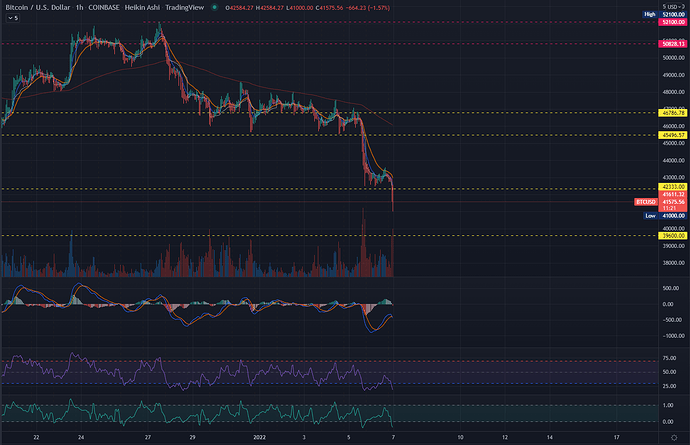

This past weekend along with the week before that given a nice green pump on BTC…

Not sure how long this will last, and I’m honestly not touching anything yet.

If you’re trading this, good on you.

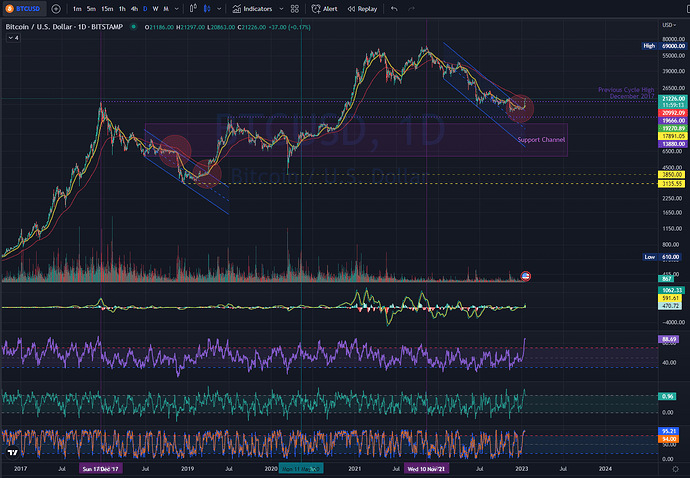

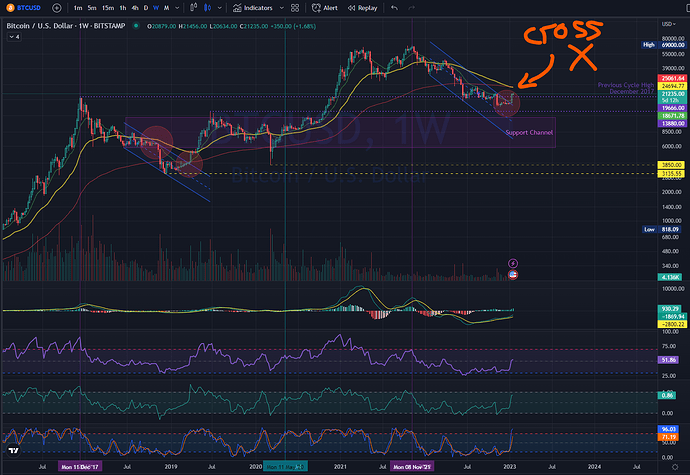

Here’s a look at the weekly candles…

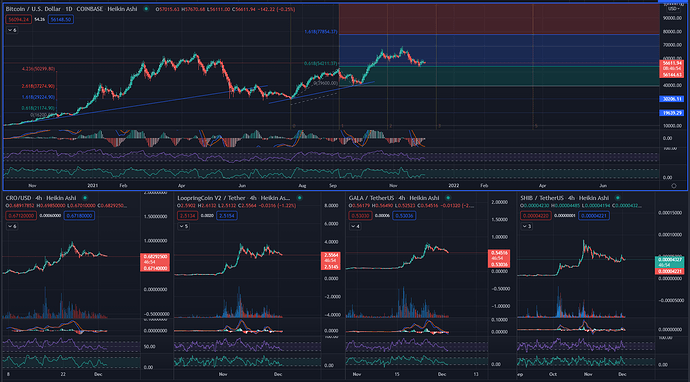

And there’s a clear cross on the 45ema and 200ema lines, sign of possible further weakness.

Be fast taking profits, be patient taking new entries.

Update: 2022-06-18

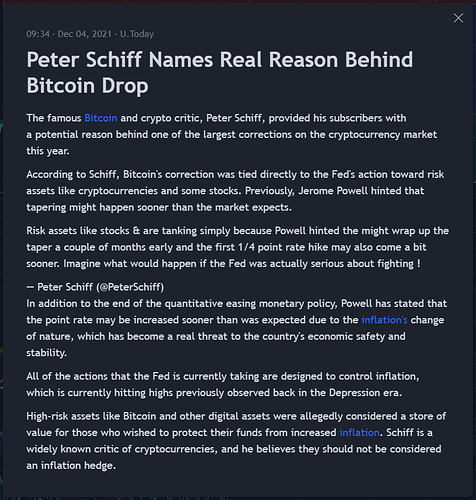

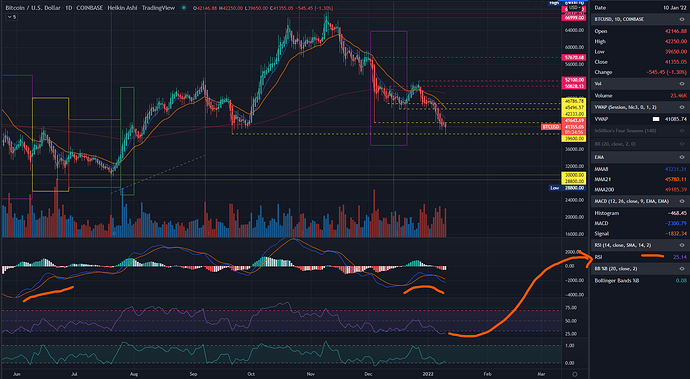

As we’re witnessing Bitcoin continue to flush down in value, it’s best to be reminded of Risk Mitigation…

Do Not Try To Catch A Falling Knife!

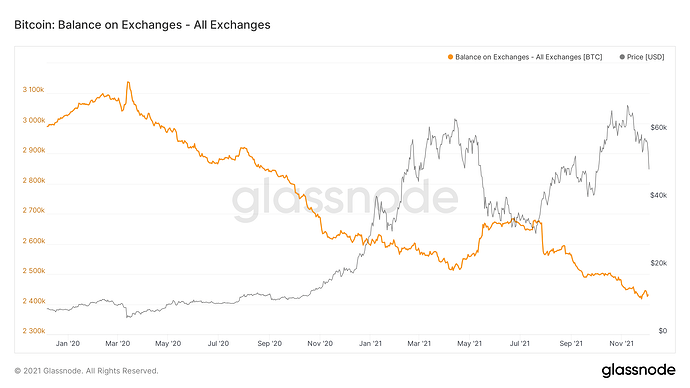

As you can see on that Weekly candles chart above, Bitcoin will give you a lot of days to accumulate at whatever low price it settles on.

You don’t have to rush.

If you spend even a few minutes on this thread, you will be reminded that this crash below 20k has been expected since it broke under 55k.

Cryptocurrencies are speculative plays, full of Pumps and Dumps.

You best believe the biggest winners keep their cash until a collective group of fools decide to pool money back in–just enough to keep things afloat.

Bitcoin has no practical use case–it is only being kept alive (and pumped) by SENTIMENT.

Gold has practical uses.

I am not discouraging you from trading Bitcoin and other cryptocurrencies.

I am encouraging you to pull your heads out of that shit-pile you’ve been feeding on.

There will be a great window of opportunity–if Bitcoin stays alive again this time.

Stay cash until then, you want the price to hold at least 3weeks before jumping back in.

DCA if you prefer, but be sure to limit your exposure.

Don’t put all your eggs in one hand.

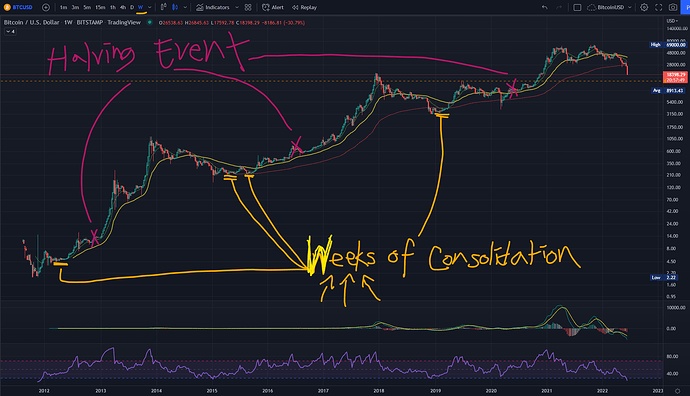

*The next Halving Event is not expected until 2024–and only IF Bitcoin survives.

Update:

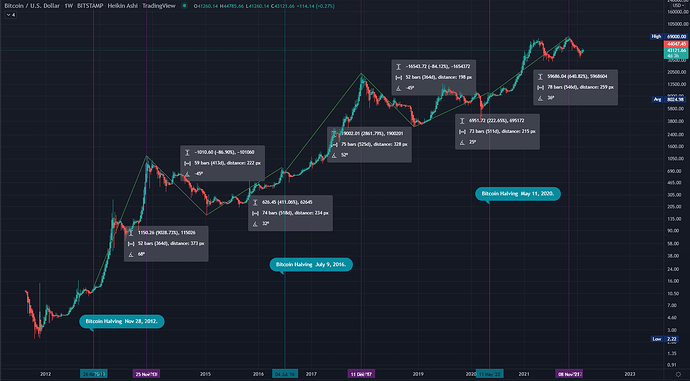

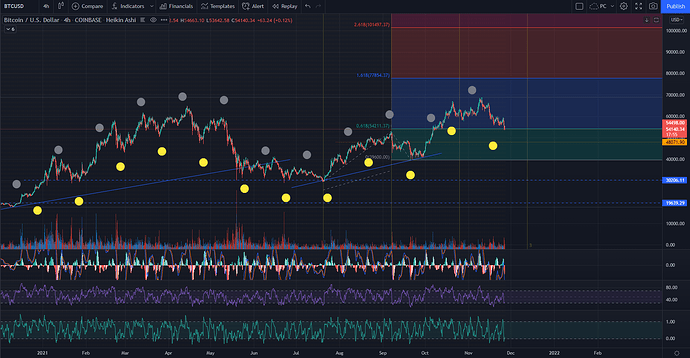

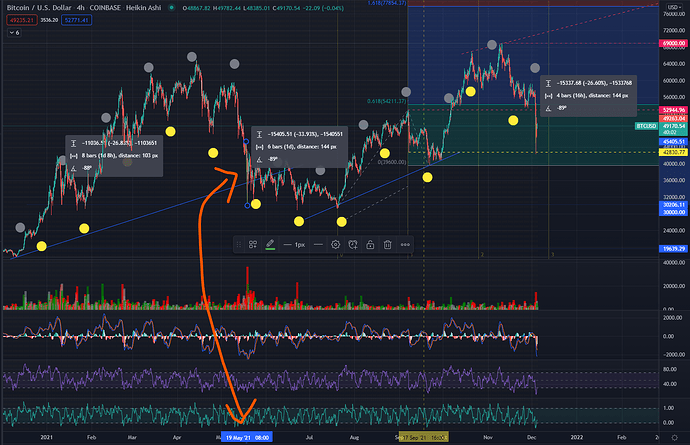

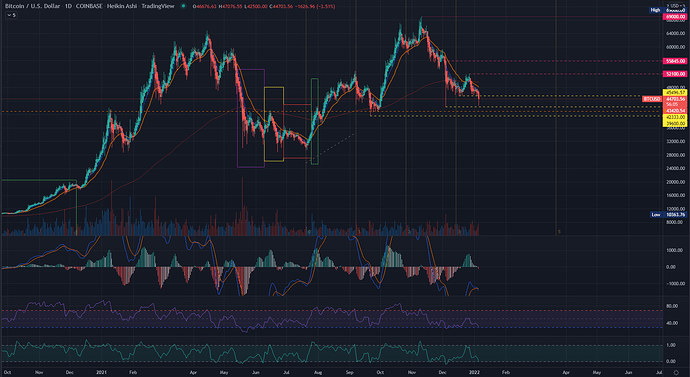

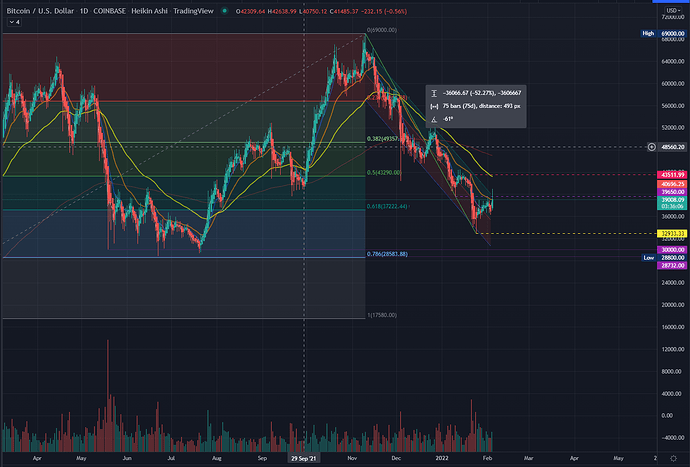

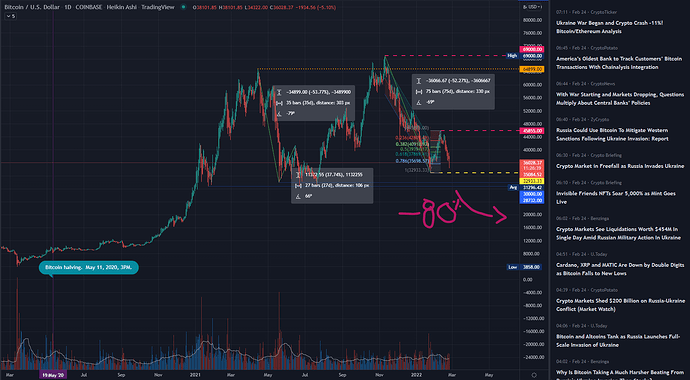

This is BTC Weekly…

As you can see, its short history demonstrates a move down to around -85% after reaching new ATHs post Halving events.

It takes around 1year to drop that much.

There still is a possibility of a further move up, sure.

But I’m more eager to catch it at the bottom-end.

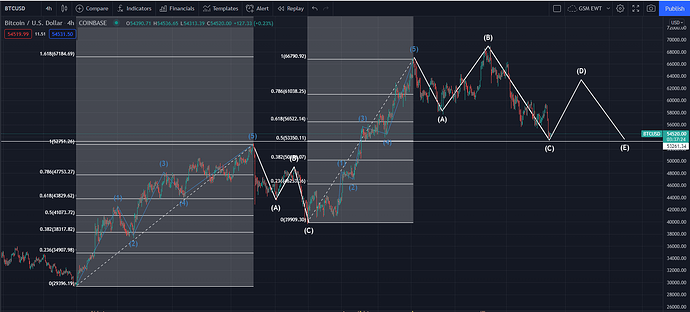

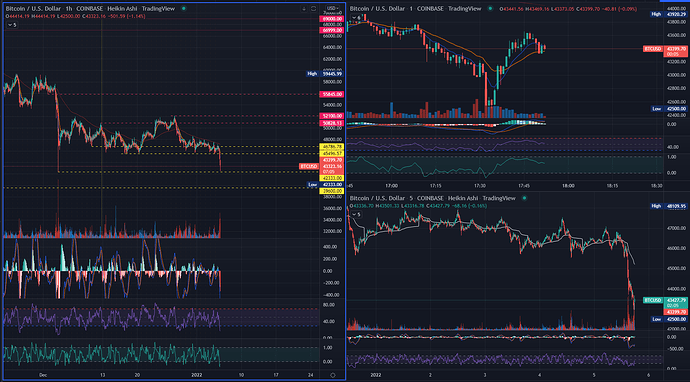

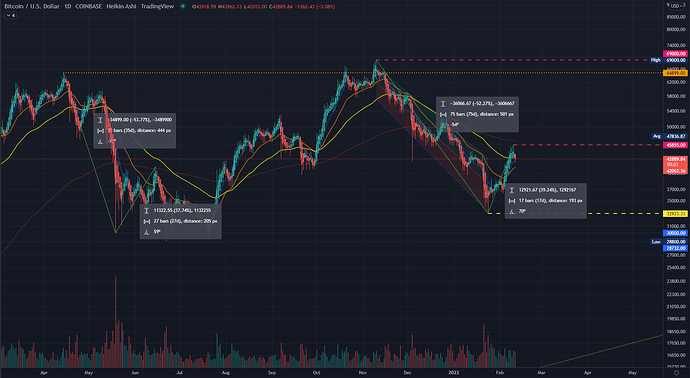

Chart:

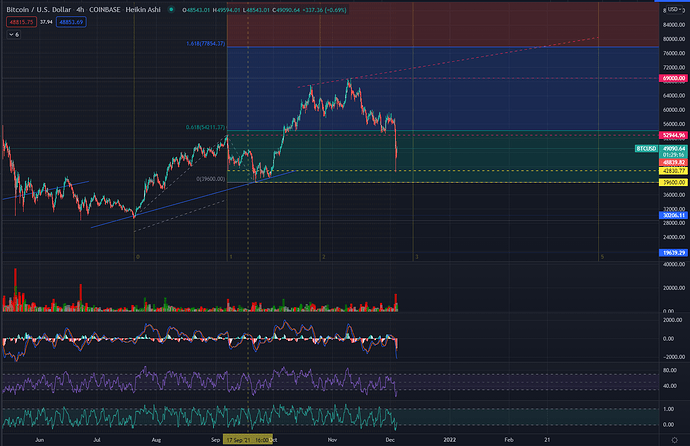

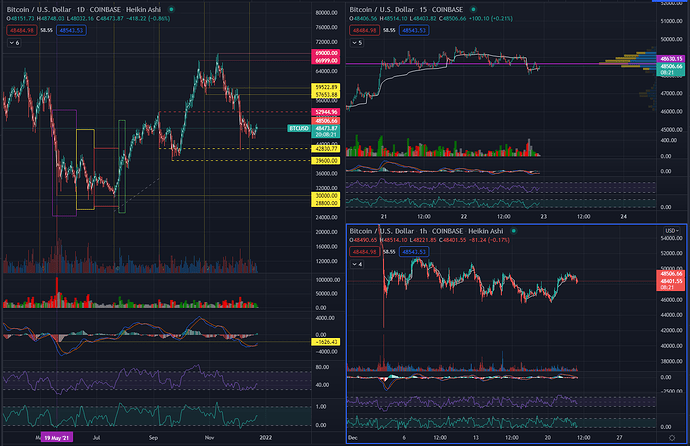

Bitcoin is currently sitting at the critical support channel of $54k to $55k.

Should this break again to 53 (already dipped 2x there today), we might be looking at $48k as the next strong support line…