Came across this tweet: https://twitter.com/GoldmanSpacs_/status/1487136001155903492

It describes a share unlock for $CCCS that ends tomorrow. However, I think the share unlock may have already occurred and the downtrend has begun.

[size=4]SEC Filings Dig[/size]

Here is a link to the S-1/A: Link

Starting on page 36 of the filing, it notes:

The shares become unlocked 180 days following the Closing Date.

What is the Closing Date? As defined in the filing, the Closing Date is July 30, 2021:

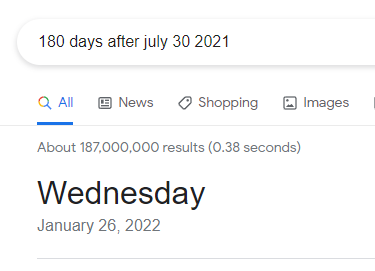

180 days after July 30, 2021 is January 26, 2022:

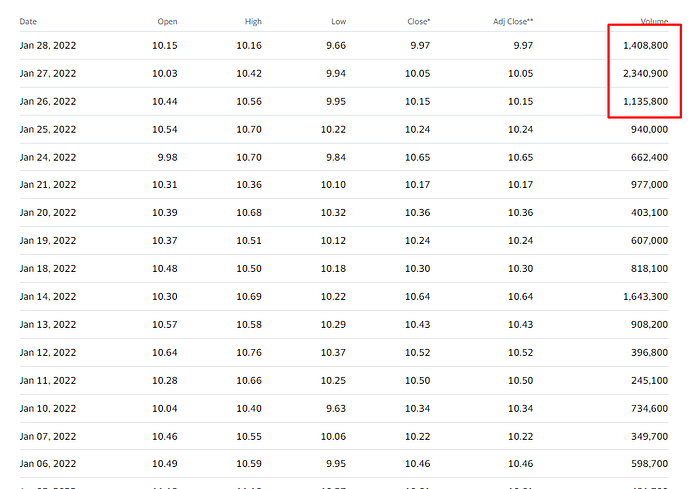

We can see that after January 26, daily volume has notably increased. I think this is due to extra liquidity from the share unlock:

The stock has been on a general decline as it was, but seems to have broken the $10 floor since the unlock.

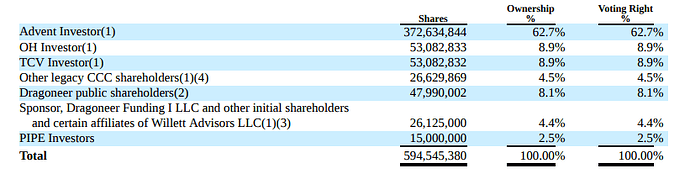

Unlocked shares, as quoted from the screenshot earlier from the “Advent Investor, the Sponsor, and each other shareholder party to the Shareholder Rights Agreement”:

[size=4]Lofty Valuation?[/size]

According to Bloomberg, CCC Information Services, Inc. provides software products and services . The Company offers software solutions, analytical tools, and comprehensive data that focuses on integrated claims management, collision repair, and insurance estimating services.

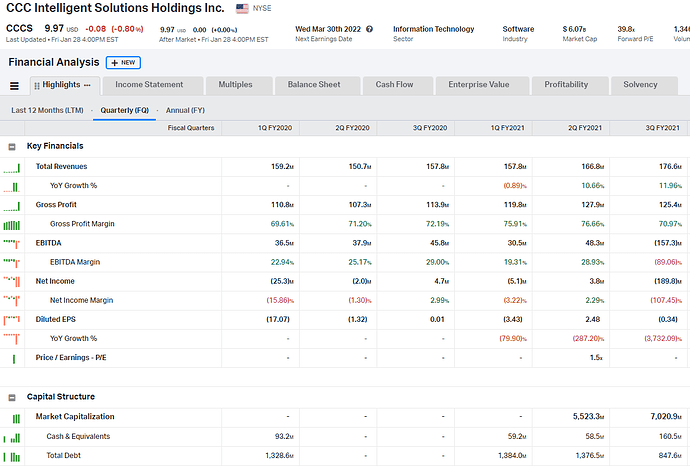

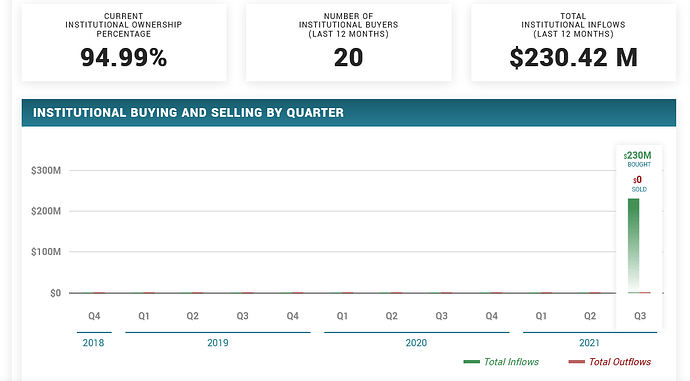

Marketcap: 6B

Revenue from the last 4 quarters: 659M

Cash: 160.5M

Debt: 847.6M

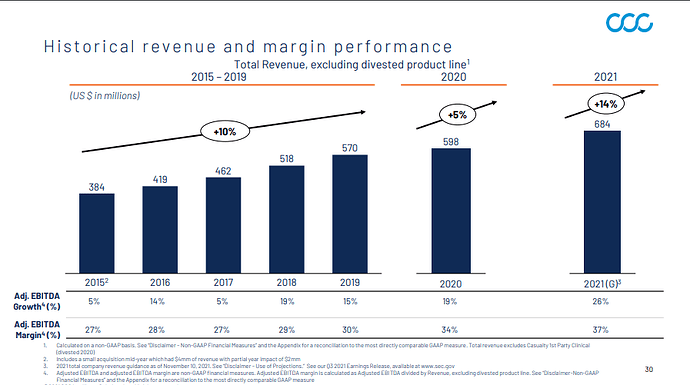

Latest Quarterly Investor Presentation

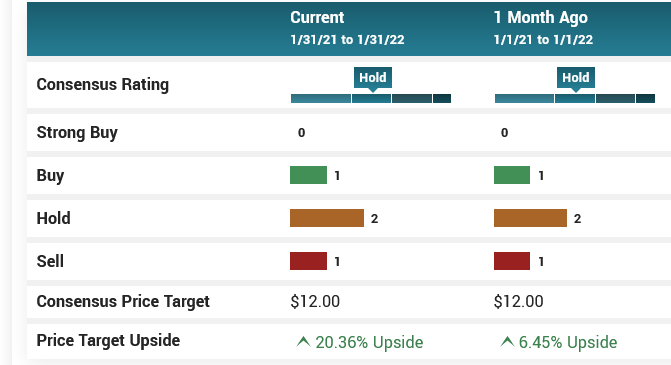

Here they note that historically they saw growth of 10% in revenue and are hoping to achieve 14% growth from here on.

At a 6B valuation they have a P/S of ~9.10, and P/E of ~37 if I exclude the latest quarter where they lost money due to the public offering.

I’m not really sure but the current 6B valuation seems a little high. But they are a SaaS company so maybe the higher valuation is more justified, but their anticipated growth seems to be on the low low end of a SaaS company.

[size=4]So what’s the play?[/size]

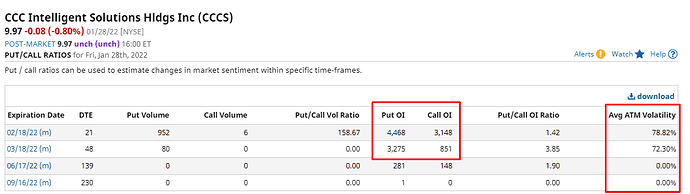

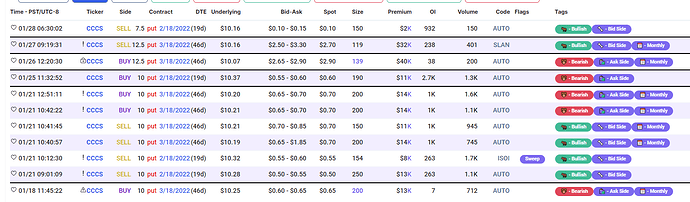

I think I want to go in with Feb or March 10p.

Looks like others have loaded their puts, and the ATM IV is still relatively low.

Note the relatively large put position opened on January 26 that seems to coincide with the DD.