Primarily this DD will be based off of sentiment and I plan on continuing to add to it as more relevant information becomes available. The company Canopy Growth Corporation, $CGC, I am focused on is one of many popular marijuana tickers like $CURLF, $TLRY, $CRON, $ACB and unfortunately $SNDL ( I would not touch $SNDL with a 10 foot pole). Many of these companies generally share market sentiment and will pop and drop together as witnessed in the past when most of these companies had hit their peaks in 2018 for ATHs and subsequently in Feb. 2021 when they hit near highs for what they were trading at. The other tickers share similar charts with pops and drops at the same time as CGC did and I plan on addressing them in the future with another post.

CGC MONTHLY

CGC WEEKLY

This is my TA on the current state of CGC. It looks like CGC has been on the downtrend since early 2021 when it hit $50s range and it appears to have found it news bottom. The recent pop that CGC had in October was due to the news that they had acquired Wana Canopy Growth Announces Plan to Acquire Wana Brands, the #1 Cannabis Edibles Brand in North America .

TLDR for strategic benefits from article:

-

Strengthens Canopy Growth’s U.S. Ecosystem : Wana’s leadership position and ongoing expansion across the U.S. bolsters Canopy Growth’s product, brand, and geographic exposure to the U.S. cannabis market upon federal permissibility.

-

Dominant Edibles Category : The gummies category is one of the fastest growing segments in both the U.S. and Canadian cannabis markets accounting for more than 71% of all edibles purchased1. Based on Canopy Growth’s consumer research, edibles are expected to continue to serve as the primary point of entry for new consumers into the THC category and as such having a leadership position in the gummy category is critical.

-

Market Leadership in the Edibles Product Category : Wana is the leading cannabis edibles brand in North America based on market share, with the largest multi-market presence of any independent edibles brand across the U.S. gummy market, and #1 share of the Canadian gummy market2, respectively.

-

Increases Exposure to U.S. Cannabis Market Upon Federal Permissibility: Upon exercising its right to acquire Wana, Canopy Growth will own and operate Wana’s vertically integrated facility in Colorado as well as its rapidly growing licensing division, which currently covers 11 states and is expected to cover more than 20 states by the end of calendar year 2022. This expands upon the coverage provided by the Company’s existing right to acquire Acreage Holdings, Inc., a U.S. multi-state operator, and the Company’s conditional ownership interest in TerrAscend Corp., another U.S. multi-state operator.

-

Further Strengthens Canopy Growth’s Leading House of Brands: Wana is the #1 cannabis edibles brand in North America and will complement Canopy Growth’s diversified product portfolio across the recreational cannabis industry.

Back to the current. It looks like there is strong level of support around $11.35 ( 11/8 jump to $13 which started its run to almost $16 on 11/15) and has been trending downward since. When looking at the daily as of 11/19 it appears to have found its new bottom as of now. There appears to be strong levels of support and consolidation around the $12 point and was able to close at $12.18 on the day ( still -1.38% for the day). This is still trading within the wedge and it appears to be potentially bouncing off the bottom of it as well. I do not think CGC will go below $12 and if it does, I believe its $11.35 will be enough to carry CGC to more safer levels. CGC has alot more room to grow as a company and has alot of room to gap up to previous highs. This is where the sentiment comes in more than anything for me. Some of the big world players that have currently legalized recreational marijuana are Canada, Mexico, and just recently Germany and I believe that The United States are going to be the next major country to do this. This would be a full green North American trans national marijuana trade. Just sit back and really think about the potential that the marijuana industry has in the very near future. In my mind, this is like getting in on the ground floor of the alcohol or tobacco industry and we are still currently early. Many more companies will pop up and there will be much more potential to invest but I believe with a fully green north America, these popular marijuana stocks that already have established roots and infrastructure set for large international scaling operations will be the front runners and leaders in the market, especially CGC. CGC will be able to capitalize on the segment of people who are opposed to the idea of smoking it in one way or another and instead would feel more comfortable trying it in an edible form. With their recent acquisition of Wana, they are in a great spot to be the leaders in the edible industry.

Looking at their financials briefly, Marketbeats.com overviews for us that Canopy Growth last released its earnings data on November 5th, 2021. The reported ($0.02) EPS for the quarter, beating the consensus estimate of ($0.16) by $0.14. The firm earned $145.70 million during the quarter, compared to the consensus estimate of $145.63 million. Its quarterly revenue was down 3.4% on a year-over-year basis. Canopy Growth has generated ($2.66) earnings per share over the last year (($2.66) diluted earnings per share). Earnings for Canopy Growth are expected to decrease in the coming year, from $0.03 to ($0.42) per share. Canopy Growth has not formally confirmed its next earnings publication date, but the company’s estimated earnings date is Tuesday, February 8th, 2022 based off prior year’s report dates.

Canopy Growth (CGC) Earnings Date and Reports 2024

CGC CURRENT STATUS & RECENT NEWS

Cgc currently has a market cap of 4.8 billion, now being the second most valuable Canadian stock on the US market with $TLRY being the leader with around 5 billion. on 11/19, CFO Mike Lee and Chief Product Officer Rade Kovacevic will leave CGC with Judy Hong serving as the new interim chief product officer. This change was “designed to drive execution towards its priorities” . The biggest insider that holds a stake in CGC is Constellation Brands (STZ), the distributor for Corona and other alcoholic drinks. They have invested roughly 4 billion into CGC.

https://www.investors.com/research/canopy-growth-stock-marijuana-stock-is-it-a-buy-now/

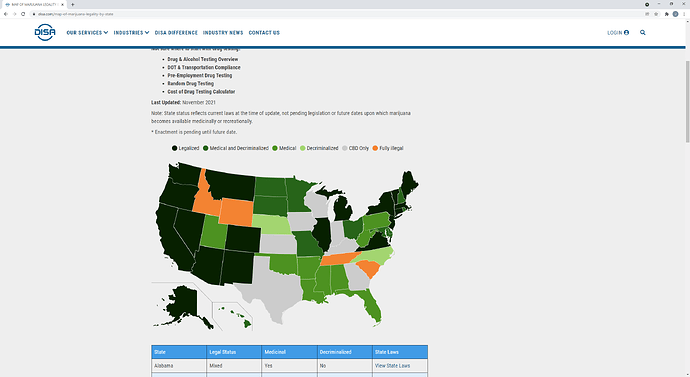

The marijuana industry is still a new one and we have not even began to see what heights many of these companies will be able to reach as well as new potential marijuana tickers that arise as the boom inevitably happens. As of right now, our country has primarily legalized weed in some form or another through the state level and it is only a matter of time until it is done on the federal level with either full decriminalization or legalization.

The Secure and Fair Enforcement Banking Act (Safe Banking Act) and the Marijuana Opportunity Reinvestment and Expungement Act (More Act) have been passed as part of a defense spending bill as well as the Cannabis Administration and Opportunity Act ( CAOA) and Clarifying Law Around Insurance of Marijuana Act ( CLAIM Act) being introduced in the senate. Currently another pro marijuana reform act was brought up for consideration. This one would be the biggest catalyst for the explosion of the marijuana industry in our markets and world wide. The States Reform Act was brought up by house republicans and this is in tangent with the already existing proposal by Chuck Shumer’s CAOA. The States Reform act was proposed on 11/15 and if passed, would

- Decriminalize cannabis at the federal level

- Expunge federal convictions for people with non-violent cannabis convictions

- Impose a 3% federal excise tax on cannabis ( rather than the 25% proposed in CAOA)

- Empower the US Department of Agriculture to regulate cannabis cultivation, the Alcohol and Tobacco Tax and Trade Bureau (to be renamed the Alcohol, Tobacco, and Cannabis Tax and Trade Bureau) to regulate interstate and international cannabis trade, the Bureau of Alcohol, Tobacco, Firearms and Explosives would regulate cannabis products, and the FDA to regulate medical cannabis only;

- The creation of federal permits necessary to operate within the market, grandfathering in those who have already been licensed by states that allow for cannabis

- Permits the VA to recommend cannabis to veterans and prevents discrimination against veterans in federal hiring or for healthcare benefits. The States Reform Act does not protect non-veterans from discrimination based on cannabis use in federal hiring;

The States Reform Act is better than the CAOA or MORE act by a landslide in so many different ways and has republican support. This is what everyone has really been waiting for is the republican support on the national level and with this support, there is a very real chance that cannabis becomes legalized federally soon. I believe in the next 2 years there will be full legalization, if not sooner because I truly believe this current administration is going to have to do something drastic to win midterm elections and not lose their majority. This is the exact hail mary I could see them trying especially with republican support behind them. ( Trying not to be political here sorry).

I currently see this as a medium-long term hold with Swing trade potential as well. This industry appears to be heavily news driven and as more positive news comes out towards the steps of legalization, I believe that these stocks will continue to rise and that we are all still very early to this industry if you had not played it in the past during its last two pops. I am looking at near ITM leaps. I currently hold a small position that I picked up Friday. I would not recommend taking a position until there is confirmed support. We bounced off the $12 support once but I would like to see a double bottom before I think it is wise going in for a position/heavier position. I Plan on trimming my contracts I have or any I add when it appears to be on its way to $14 and will gauge the situation then. I currently hold two 4/22 $12.5C.

I plan to go more into this and add to it as more relevant information becomes available and as I give it a more deep dive than I have right now. This is more cursory to get the conversation going and please feel free to add to this and give a bullish/bearish case or anything that you think should or could be added so we can all potentially benefit having the information consolidated here. My first DD and if you made it this far I appreciate you reading it and look forward to any comments/suggestions/and discourse we may have on CGC and the potential of the marijuana market.