Starting a discussion here on potential plays regarding volatility caused by news insinuating an easing of Covid restrictions in China.

China has adopted a “Covid Zero” policy, vowing to move quickly to crush potential outbreaks regardless of potential repercussions, resulting in Chinese stocks taking a giant Winnie the Poopoo. However as we can see here:

the market is ready to rally on any perceived notion of an easing of policy. In this instance the notion of easing policy any time soon was crushed, and a lot of these stocks fell to what they were trading at before this catalyst.

From this, we can take that:

- For any company that hasn’t returned to pre-catalyst baseline we are presented with a potential put-play (for example BABA):

We can see the jump from the catalyst on 11/1 followed by a respected downtrend line. In this situation, we got confirmation that there is still a restrictive stance regarding policy which I would take to mean we are headed back to 64 with minimal chance of another catalyst before then. If puts are cheap, I may take one, but I’ve incinerated a lot of money lately on options so what I really want to focus on is:

- The Reopening Play

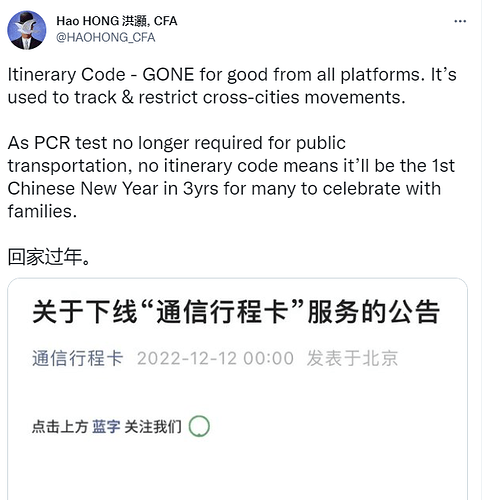

Restrictions will ease in time (March 2023 got thrown around in the catalyst on 11/1). They must for the sake of the economy. A lot of these stocks are near or at ATL. I am also of the mind to believe even if this current policy impacts the economy/stocks negatively, we could see soothing words from Chinese policy makers leading investors to believe its “not that bad”, resulting in a pump.

Please contribute any Chinese stocks you think have growth potential (decent fundamentals, a good product, etc) so that we can keep our eyes on this situation. I myself will probably start accumulating some BABA shares after we see what happens at 64 + the catalysts in the American market such as CPI.

What we need to be cautious of:

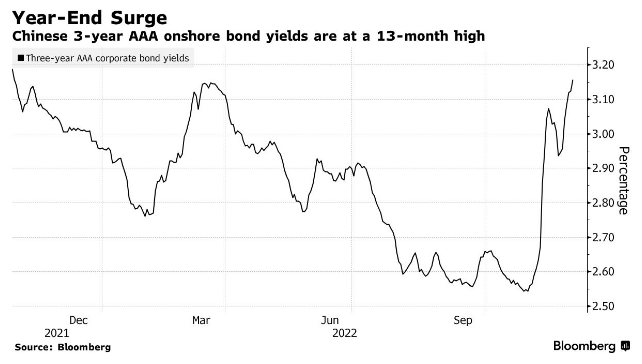

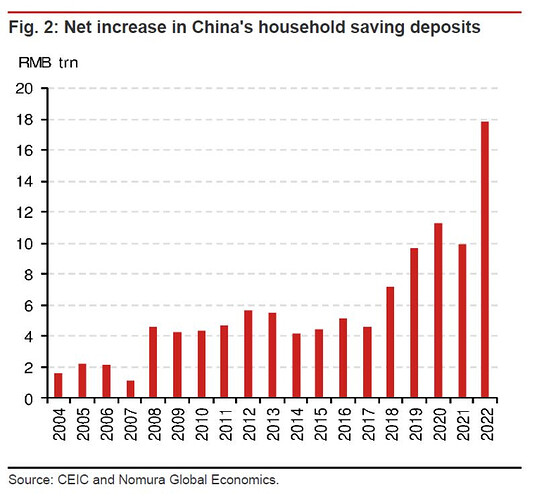

What does the overall state of the Chinese economy look like? Are there recession fears for their economy as well? What would a recession in the US do to Chinese stocks? Will they ease covid policy before a potential recession in either country?

These are things I don’t know, and would love to see discussed by others who have a good idea of the current state of either economy and their relation to each other. Let’s make some Yuan.