nano

March 14, 2022, 1:19pm

1

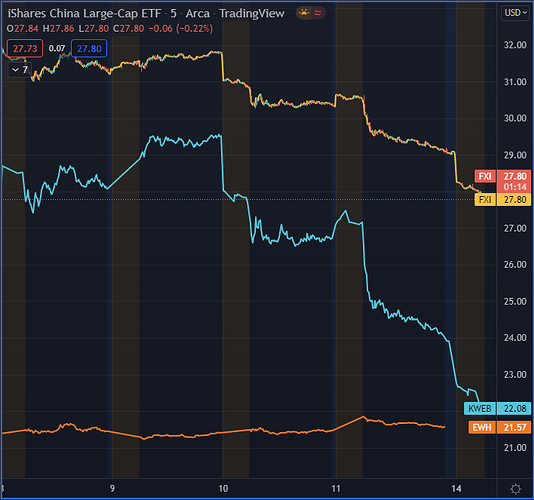

Might be a bit late here, but getting a thread started to discuss a potential put play on Chinese ETFs (I know, I know).

@The_Ni , @JellyPowered , and I were discussing it this morning, seems like there may be an opportunity here with new Covid lockdowns, etc.

7 Likes

Just got filled on a 4/18 26P for FXI after going back through and reading what @nano @The_Ni and @JellyPowered discussed in premarket, thanks guys.

4 Likes

MENoir

March 14, 2022, 3:33pm

3

Took a single FXI 4/14 26P for now. I’m ready to get hurt by another foreign ETF. Will monitor before deciding to add anything to this position.

1 Like

nano

March 14, 2022, 4:34pm

4

Not a ton of OI on the 26 strike (though a good amount of volume today). I’m still watching, but looking at the 28 strike.

1 Like

MENoir

March 14, 2022, 4:41pm

5

Yeah, hella volume today. My 26p was up 10% and is back down just above breakeven. Gonna watch for a few days maybe to see how it plays out.

nano

March 14, 2022, 4:55pm

6

I took one put around the $27.75 rejection.

1 Like

Have we considered looking at puts on $ASHR the Chinese ETF? It is down about 4% so far. Robinhood says it has a large concentration of companies in Shenzhen(the majority of the shutdowns are happening there I believe), so this could good for a quick scalp.

I also see that $BABA has made serious moves down, so maybe similar to $OZON, a way to indirectly short the Chinese market.

1 Like

This will be good, Elaine can just re-use the same article and switch the ticker names

4 Likes

MENoir

March 14, 2022, 5:38pm

10

Full disclosure: I took 20% on that FXI put. Will be keeping an eye for reentry.

1 Like

nano

March 14, 2022, 5:45pm

11

Got out of mine as well. Nice 15% gain.

Looks like FXI is somewhat SPY correlated and I think we could see a pop here, leading to another entry.

2 Likes

tizzle

March 14, 2022, 7:33pm

12

Jumped in FXI today with some 26p for 4/1. Picked them up for $1.01 avg.

just sold my FXI 28p for 27%. got in this morning when i saw you guys talking about it on TF. i don’t want to hold these overnight so will look to get back in tomorrow if it presents itself.

thanks guys, great call!

3 Likes

nano

March 14, 2022, 7:48pm

14

Congrats! We were late getting in on this, but glad some people made money on it today.

The_Ni

March 14, 2022, 7:54pm

15

Just got:

FXI 4/14 28P - exposure to China large cap

KWEB 4/14 20P - exposure to China internet-based companies

Was also debating between but didn’t get:

EWH - tracks Hong Kong and reacted much to the Shenzen closings, but isn’t showing much life here

MCHI - broad exposure to China markets, similar to FXI, but less liquidity

Counting on some more negative pressure from a combination of COVID lockdowns and concerns around delisting from US markets.

4 Likes

nano

March 14, 2022, 8:24pm

16

I joined you in holding some KWEB overnight.

1 Like

nano

March 15, 2022, 12:14am

17

More lockdowns announced.

1 Like

Great thread guys thanks for the call outs !

Made some money playing calls on $YANG today. Something to keep an eye on also

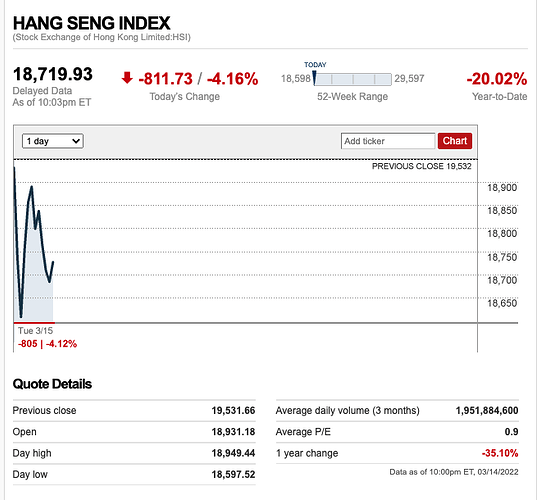

by the way @nano HSI (Hang Seng) opened up limit down. It’s bounced somewhat but is still down 4% on the day in the current Asia session.

2 Likes

Thanks for putting this thread together, going to start a position on a few of these tomorrow.

Also looks like Covid cases keep going up.

https://twitter.com/spectatorindex/status/1503542633238777859

Also adding this one

https://twitter.com/DavidInglesTV/status/1503572017554997249