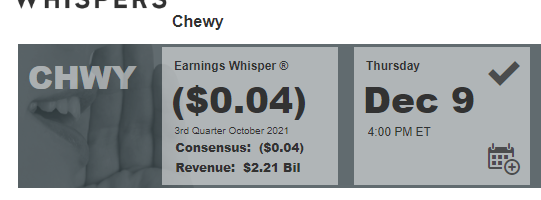

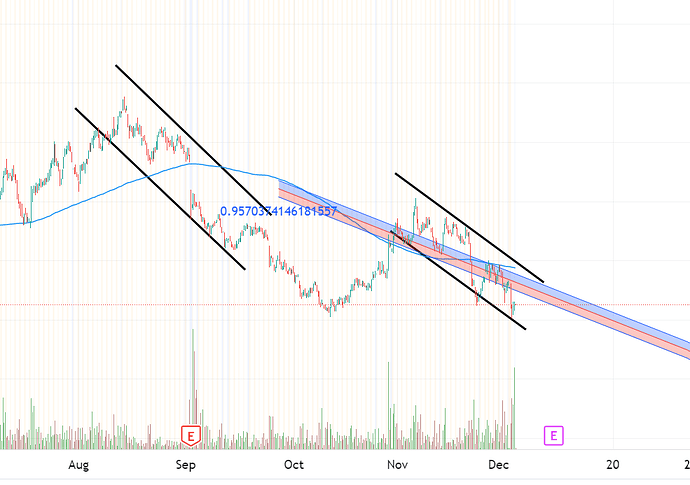

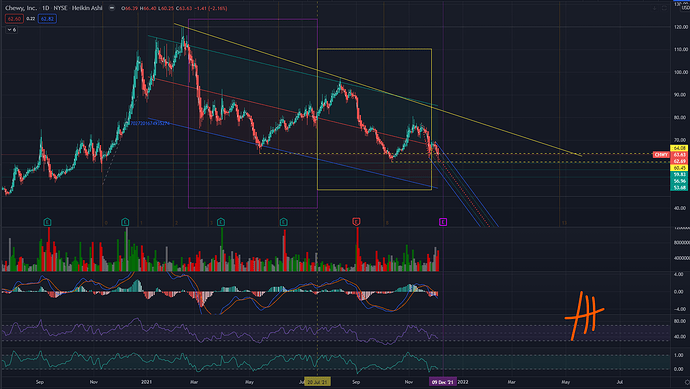

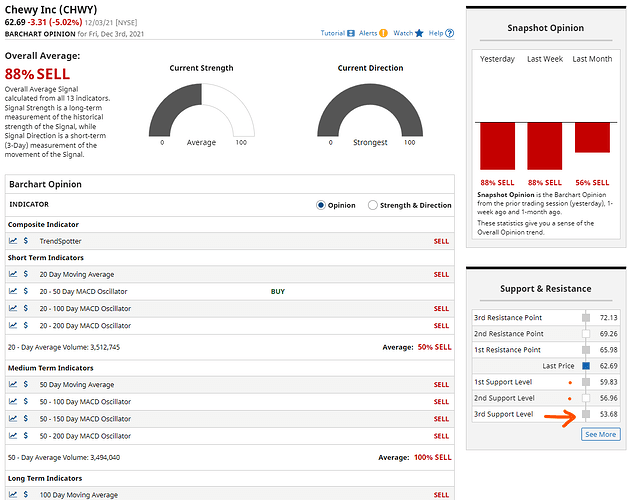

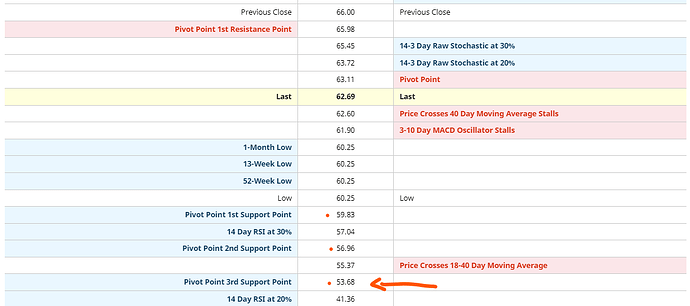

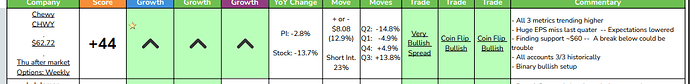

I lean bear on CHWY, as it is a covid-19 inflated stock. Here’s some important things to consider before taking on this play:

- CHWY’s last ER was the initial exposure of how the company benefited from the covid-19 pandemic. This is likely already known and ‘priced-in’. That being said, it still is trading above it’s pre-pandemic levels.

- Their differentiator right now is expanding into pharmacy for animals. This not only adds a revenue stream, but also increases the stickiness of their users.

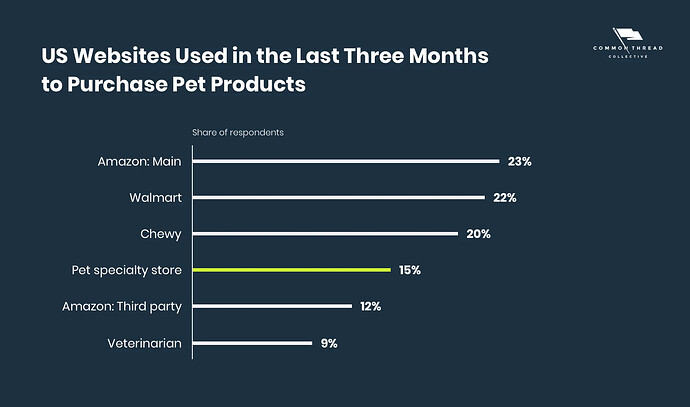

- For point 2, Amazon and Walmart are the two biggest competitors when it comes to purchasing online pet products:

Amazon and Walmart are also expanding their online pharmacy push for humans, and you can bet your bottom dollar they’ll look to expand that into the pet space as well. I do not expect Chewy to hold onto this advantage for long. I also don’t think the revenue driven from their pharmacy sector in their business will be significant to make up for their main money makers (food).

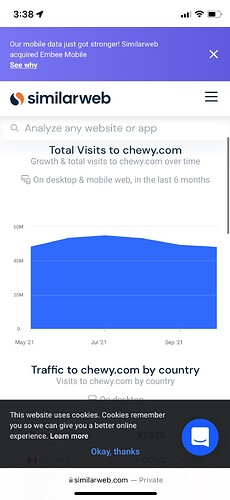

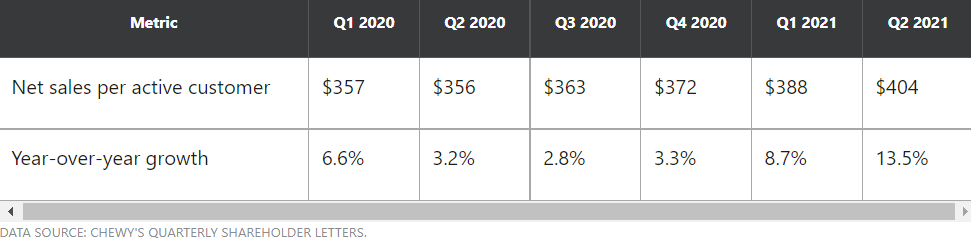

- During their last ER, it was reported their user base continues to grow and more importantly, $ per user was also increasing.

“Customer spending on our platform is at an all-time high,” Singh said. In the second quarter, Chewy’s net sales per active customer was $404, up 13.5% compared with the same period last year. Active customers of 20.1 million in the second quarter was 21.1% higher than in the second quarter in 2020.

“So what does that tell you? More customers. They’re spending more. They’re staying with us longer, and we continue to deliver very strong comps,” Singh said.

- They mentioned supply chain headwinds as a reason for their rising out-of-stock levels,

Out-of-stock levels remained elevated in the second quarter, but they improved modestly versus the first

quarter, resulting in a smaller drag on net sales in the second quarter. This is the result of supply chain

conditions improving in some areas as certain vendors reduce backlogs. However, other areas like wet

dog food are still being affected by industry-wide production capacity limitations.

A big reason on their revenue miss was on supply chain, which they noted as “moderately improved”. There aren’t many companies that are handling supply chain well. It is unlikely CHWY is too.

- Petco reported last quarter their online revenue is booming.

Digital revenue grew 32% YoY and 159% on a two-year basis2

; driven by repeat delivery, BOPUS and Same Day Delivery differentiation

The difference between CHWY and WOOF (Petco) is Petco also has the benefit of foot traffic. When you make a delivery purchase from CHWY, you receive your product and that’s the end of that transaction. While Petco also offers delivery, you can also opt to go pick up your product at Petco. The foot traffic advantage of going into Petco works in their favor as customers are more likely to purchase additional products to the ones they purchased online to pick up.

In general my thesis is CHWY had first mover advantage but their lunch is getting eaten by traditional retailers expanding into the pet ecommerce space. What made CHWY great in the first place (online ordering and convenience) is also what’s stopping them from expanding as much as they could. This ER play should be interesting to see how they plan on growing their # of customers. In a year or so, I wouldn’t be surprised to see them get acquired by a major retailer.