Full disclosure this will be my first DD. CND is a SPAC (special purpose acquisition company), they are also commonly referred to as “blank check companies”. I will not get too far into what a SPAC is and how they function, I am still learning myself and those questions would be best directed to Gods.

Also, I am an idiot and probably just embarrassing myself right now.

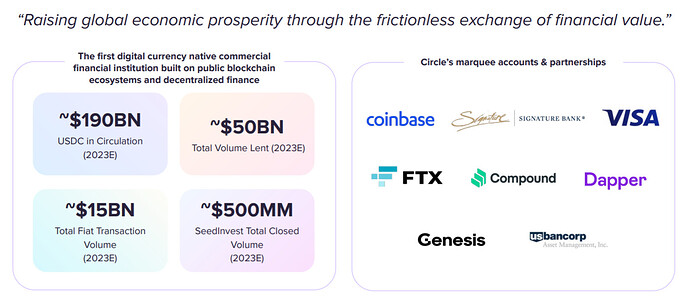

CND will be merging with a company called “Circle” - A peer-to-peer payments technology company. It was founded by Jeremy Allaire and Sean Neville in October 2013. Circle’s mobile payment platform, Circle Pay, allows users to hold, send, and receive traditional fiat currencies.

Market Cap: $426.2M

Public Float: 27.79M

Short Interest: 1.3M - My interest in this stock does not come from the short interest, figured I would put it here to keep everyone on the same page.

Institutional Investors: Marshall Wace LLP, Fidelity Management & Research Company LLC, Adage Capital Management LP, accounts advised by ARK Investment Management LLC and Third Point.

Merger Date: The transaction is anticipated to close in Q4 2021.

Other Info: Circle operates SeedInvest, one of the largest equity crowdfunding platforms in the U.S., which is a registered broker dealer.

JULY 8 2021:(Remember this date) Stablecoin issuer Circle says its going public is $4.5 billion dollar deal

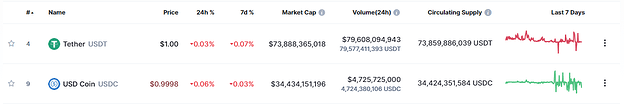

USDC is the tether coin Circle provides to the market, its current circulation is greater than $27 billion and has supported over $900 billion in on-chain transactions. Making it the 2nd most used and circulating stable coin. You don’t have cryptocurrency exchanges without stable coins.

What does Circle really do? Instead of trying to explain that here, best to just watch this quick YouTube video. https://www.youtube.com/watch?v=GUIr5gH5eIk

For those non-crypto goers reading this, the one coin above USDC, called Tether, has currently been under heavy fire by the crypto community and the SEC. You can read more on those details here - The Tether controversy, explained - The Verge. Essentially Tether is slowly falling out of favor and is leading closer to the Treasury Secretary and SEC stepping in and cracking down with regulations. Speculation on how this will occur and what forms this regulation will take are up in the air.

JUNE 9 2021 :(One month after merger deal)

Senator Elizabeth Warren decided to grace us with her infinite wisdom on cryptocurrencies and after ripping DOGE coin apart and saying BTC miners are bad for the environment, she said the following:

“Crypto has significant problems, but our current payment system also has significant problems. Both the government and banks have dragged their heels for years, resisting innovation and evidently taking the same hide-and-wait approach to facing the worldwide movement into cryptocurrencies.

“Central bank digital currency, which is often called CBDC because the world needs another acronym, digital currency from central banks, has great promise. Legitimate digital public money could help drive out bogus digital private money. It could help improve financial inclusion, efficiency, and the safety of our financial system - if that digital public money is well-designed and efficiently executed, which are two very big “if’s.”

“So I’m looking forward to hearing from our witnesses today about how a central bank digital currency would work, why it might be necessary, how it intersects with cryptocurrency, and - most importantly - how it should be set up so that all Americans can enjoy its benefits.”

Subcommittee hearing- :hearing | Hearings | United States Committee on Banking, Housing, and Urban Affairs

TIME- 34:37 : Senator speaking here- “While I am not certain that we need a central bank currency, I think we should consider the development of private digital currency.” “Including stable coins, which by the way, can be perfectly stable with respect to the dollar. Private digital currencies have the potential to increase access to financial services for all Americans….”

Sentiment towards stable coins are currently being looked on in a favorable light, AND to top it all off Circle has officially disclosed plans to become a full-reserve national digital currency bank in the United States. Circle has made sure to follow all commercial banking requirements. Stating that;

“In the commercial banking sector, the global standards for liquidity are based on Basel III, with standards to ensure that banks can provide 1:1 dollar liquidity to depositors even during extremely-rare high-stress periods, with sustained large outflows for a full 30 days. Basel III mandates that banks must maintain sufficient High Quality Liquid Assets (HQLAs) to ensure they can meet the liquidity demands of such a stress situation. Basel III defines the Liquidity Coverage Ratio (LCR) as the amount of HQLAs on a bank’s balance sheet divided by the expected net outflows in a 30 day stress case, and mandates that banks maintain their LCR above 100%. You can read more about Basel III standards and the details of these definitions with the Bank for International Settlements (BIS).

Circle has always held ourselves to the highest of regulatory standards, to ensure that a dollar exchanged into USDC is safe. As such, we have always exceeded, and will continue to exceed, the bank-grade LCR and HQLA requirements under Basel III. As we move towards national bank-level regulatory supervision we will begin to publish information about the fundamental liquidity of USDC and our liquidity coverage under Basel III. Similarly, as specific national supervisory standards for dollar digital currencies emerge from the President’s Working Group, we will proactively work with our national regulatory counterparts on the ultimate commercial adoption of new dollar digital currency standards.”

Announcing the news on Monday, Circle co-founder and CEO Jeremy Allaire noted that Circle is willing to operate under the supervision and risk management requirements of the Federal Reserve, the U.S. Treasury, the Office of the Comptroller of the Currency and the Federal Deposit Insurance Corporation.

Circle intends to work with major corporations to integrate a reliable digital cryptocurrency into their payment networks. We may see this play out with companies such as AMC who just announced that they are going to be accepting crypto like BTC and ETH as payments. While that is good for publicity it is unrealistic to think that other businesses will adopt this on scale due to the volatility of these cryptos. BTC and ETH are volatile and while they CAN be accepted as a method of payment, it is probable that the company would want to convert that BTC or ETH into something stable… enter Circle.

Risks: See bottom of investor slides : https://f.hubspotusercontent00.net/hubfs/6778953/investors/Circle-Investor-Presentation-Sep2021.pdf

Circle and Coinbase is currently wrapped up in a SEC investigation - https://www.marketwatch.com/story/stablecoin-backer-circle-is-under-investigation-by-the-sec-11633442545

Circle and Coinbase are complying with the investigation. The result of this investigation could have very positive… or very negative results.

Cryptocurrencies SPACs mergers have not always done well in the past. However, we all remember what happened to BKKT two weeks ago when it partnered with Mastercard, hit national news and reddit.

Partnerships:

SPAC Equity Holders

Management Team

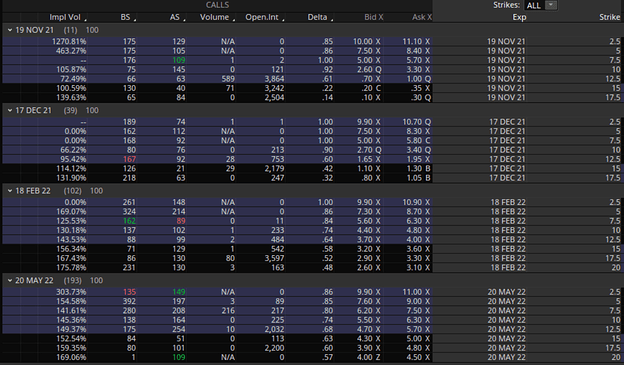

Options Data 11/8/2021

Options Data 11/12/2021

Conclusion:

- Circle is about to become the first publicly traded company that controls a stable coin. They are well established in the crypto market and USDC are used by many exchanges including Coinbase.

- They are more legitimate than their counterpart - Tether.

- They have multiple high profile partnerships including Coinbase and Visa.

- Their management team, shown above, seems extremely strong and knowledgeable in banking, political and technical space.

- It is a low float stock with increasing OI, see screenshots above.

- Existing equity holders have lock up periods that would discourage them dumping them on the market soon after they go Public.