Brief Overview :

I know what you’re thinking, “another pharma play, these are a literal coin toss,” but there’s more to this than you might think. Citius Pharmaceuticals is a late-stage biopharmaceutical company focused on the development and commercialization of first-in-class critical care products. They are currently in phase three for their flagship product; Mino-Lok. Mino-Lok is an antibiotic lock solution used to treat patients with catheter-related bloodstream infections (CRBSIs) and central line associated bloodstream infections (CLABSIs). These conditions are life-threatening and there is yet to be a product made specifically for it - Mino-Lok would be the first and only. This is one of the very first companies I looked into when I first started investing and is my highest conviction play. Now let’s get into the good stuff!

Pipeline :

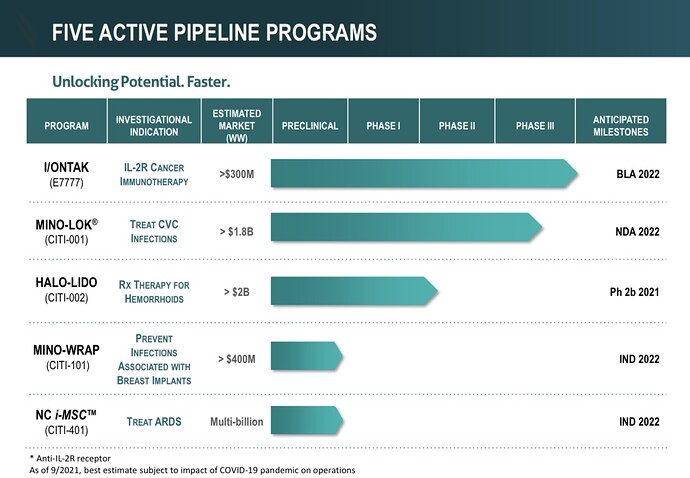

Citius currently has a pipeline of 5 products (shown in the image below) that are focused on anti-infectives in cancer care, oncology, and stem cell therapy. 3 out of 5 of these products will be the first and only of their kind.

Now let’s take a closer look at the star of the show : Mino-Lok.

Mino-Lok is the first and only antibiotic lock therapy created to sterilize and salvage infected Central Venous Catheters or CVCs. As of right now, the treatment that is used to correct these infected catheters is an invasive technique in which they have to physically remove and replace the infected catheters. This process is risky, puts the patient through another strenuous procedure and is not a 100% guaranteed fix. 57%-67% of patients that go through this procedure experience adverse affects. Furthermore, the cost of this is procedure is upwards of about $10,000. Mino-Lok addresses the complications and costs of this standard method.

Below I’ll list some statistics shared in their last investor presentation

Phase 2B Trial Results

- 100% effective in salvaging CVCs in all patients treated with Mino-Lok

- 100% of patients treated with Mino-Lok all had complete microbiologic eradication with no relapse

- Complication rate for Mino-Lok® patients was 0% vs. 18% for control arm patients

Phase 3 is currently underway and has since been reviewed by the DMC (data monitoring committee) with recommendation of continuing the trial with no modifications.

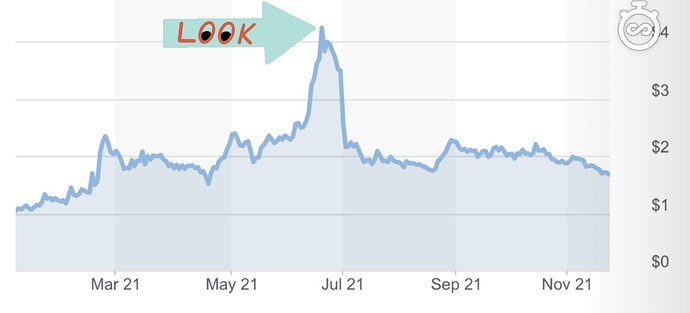

With that being said, let’s take a look at the chart during the time of the DMC review.

Investors were looking forward to the DMC review in the hopes that they would grant a halt for superiority. For those that don’t know, a halt is basically when they conclude that all of the data collected so far is enough to stop the trial and grant emergency use of the product. This is very rare and the fact that it did not take place is not something to be concerned with. In fact, the DMC recommended continuing without modification which is bullish in itself. CTXR ran up reaching its 52-week high of $4.56, upwards of about ~300%. Now there’s a couple things we can take from this run up.

- This is an indication of what potential impact FDA approval will have on the stock price if it is successful in its trials

- Provides an indication for the stocks sensitivity to news

- Since a halt is a rare occurrence, the sell-off could be seen as a market overreaction

Finances

CTXR currently has a market capitalization of $285m and around ~$100m cash on its balance sheet. Something important to note is that this is a pre-revenue company - I’ll touch more upon this in the risks section below.

Institutional/Insider Ownership

CTXR is 17.2% institutionally owned (up 4% in 2021) and 14.8% is owned by the company itself. These are both bullish indicators as they believe the price will rise substantially from what it is now.

Risks

As I mentioned before this is a pre-revenue company. What does that mean? It means that they are not producing income by selling products because they have no products to sell yet, meaning they have to make money other ways. One way to do this is dilution of stocks. However, i read their fiscal report for 2021 and saw this:

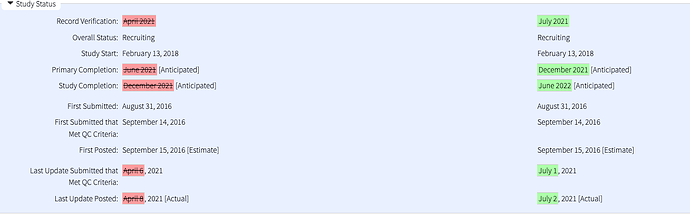

It looks as though as of September 30th, the stock has already been diluted, which I assume is the cause for the drop in the price from 1.80 to 1.60 along with an overall bearish market sentiment the last couple weeks of 2021. They also state that with this dilution they “estimate that we will have sufficient funds for our operations through March 2023.” Hopefully by 2023, if all goes as planned they will have products on the line by then which is where they will then have a steady revenue from. Of course, this is not a guarantee that there will not be a dilution, however it’s strong indication that it will not happen again in 2022.

I’ll end this DD with a forward looking statement from President and CEO of CTXR, Myron Holubiak:

“As we move into 2022, we anticipate multiple positive milestones. These include: accelerated enrollment and completion of the Mino-Lok® trial during the year, topline results in the first half of 2022 for the recently completed I/ONTAK Pivotal Phase 3 trial followed by a BLA submission in the second half of the year, initiation of the Halo-Lido study in early 2022 and completion of the study by the end of the year, and continued progress on Mino-Wrap and our iPSC-derived mesenchymal stem cells for the treatment of acute respiratory distress syndrome (ARDS). With the addition of key personnel to our clinical, manufacturing and commercial teams, we are aligning our resources to ensure continued progress across each of our development programs, and the successful launch of potentially two commercial products in 2023.”

Looks like 2022 will be an eventful year for Citius!

Disclaimer : This is not financial advice, please do you’re own DD before taking any positions.