Hey guys - first time posting, long time lurker, so I really welcome any feedback on making this clearer or if anything is missing.

ABOUT: Cellebrite DI Ltd.(CLBT) provides digital intelligence solutions for the public and private sectors worldwide. For more information on the product line-up for those interested: https://www.cellebrite.com/en/about/

I work in the SaaS space and I rub shoulders with smarter people than me that work in valuations and M&A. As you may be aware, Tel Aviv is a hot bed for tech start ups in the region and the name CLBT came up as an up and comer from former employees that have worked there that have joined my company. The unverified anecdotes and personal experience of those I spoke to in Tel Aviv was that CLBT has a solid management team, and most importantly an incredibly solid product but I’d rather let the metrics speak for themselves.

As a result of my research, I stumbled on a gem of DD (yes it was posted on WSB). This was posted by someone that appears to have worked/ or currently works in the PE space for SaaS companies based on his excellent analysis of the common metrics used in the industry. I am attaching the thread for your information as its definitely worth a read and captures exactly what makes this company attractive. All credit goes to u/ASpicySpicyMeatball as I shamelessly share his work here.

Key points mentioned in the DD attached and research:

The Good:

-

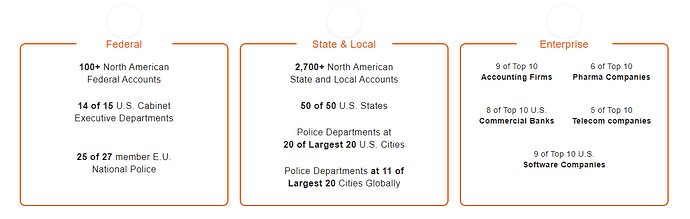

90% of public safety agencies in the US are customers with a near 100% win rate when going up against peers for contracts. They have complete dominance over the sector and analysts estimate the company will generate 2021 revenue of $235 million, which is more than three times larger than the second-biggest industry vendor.(3)

-

Cellebrite has 140% net retention. This means that all customers are spending 40% more each year on Cellebrite than they were the prior year, while retaining their initial commitment. I have worked in previous SaaS companies and this metric alone is INSANE. This means very sticky customers that increase their commitment every year - my previous company was very proud of a 110% Net Retention when discussing metrics with potential VCs.

-

I don’t put much value on this, but worth mentioning the team spearheading this is True Wind. They have signaled their confidence at this low valuation by choosing to defer 100% of their sponsor shares until they reach specific price targets. As you’ll read in the DD, they are set to receive 40% of their shares once the stock sustains a trading level at $12.50, 40% of their shares once the stock sustains a trading level at $15.00, and 20% of their shares once the stock sustains a trading level at $30.00. In short, the sponsor team believes that this business will be trading at $30.00 within the year. This is relevant as insiders are assumed to have the best information of the direction of the company, and confidence from the management in the value is a great sign.

The Bad:

- There’s potential reputational and financial risk if someone uses the product for bad purposes. This has impacted their bottom line as they have ended their relationship with the HK police due to US restrictions. Furthermore, they have stopped work with Belarus/ Russian police in the aftermath of their software being used for stamping out democratic protests in those countries.

- 140% net retention is likely to come down. They will need to either grow organically or through acquisition.

- http://cyberlaw.stanford.edu/blog/2021/05/i-have-lot-say-about-signal’s-cellebrite-hack

4a. Counter point to 4. from the original poster of the DD: (https://www.reddit.com/r/wallstreetbets/comments/pq4grw/comment/hddxhz3/?utm_source=share&utm_medium=web2x&context=3)

The DD:

Again - the DD above is not done by me and all credit should go to him. I wanted to share this ticker here as I believe in the research u/ASpicySpicyMeatball provided and experienced the confirmation bias from former employees who are kicking themselves for not having stayed in.

I am up slightly on my warrants & shares, but holding this until the market wakes up to this ticker. Obviously this is not financial advice as I am just a random on the internet, nor is it ever intended to be financial advice. DO YOUR OWN DD. I do hope this helps your personal research in CLBT and whether you decide its a good place to park your money.

Personal positions (I am adding slowly on low volume dips).

3,000 Warrants (CLBTW)

500 shares (CLBT)

20 * 10C/ Apr 22 (CLBT)

PT is when you’re happy with profit.

If you’re not familiar with warrants, some extra info from the 10k:

"Redemption of warrants when the price per share of Class A common stock equals or exceeds $18.00. Once the warrants become exercisable, we may call the warrants for redemption:

In whole and not in part; At a price of $0.01 per warrant; on a minimum of 30 days’ prior written notice of redemption, or the 30-day redemption period, to each warrant holder; and

If, and only if, the closing price of our Class A common stock equals or exceeds $18.00 per share (as adjusted for stock splits, stock dividends, reorganizations, recapitalizations and the like) for any 20 trading days within a 30-trading day period ending on the third trading day prior to the date on which we send the notice of redemption to the warrant holders."

Possible Bonus: CLBT is touted as a potential de-SPAC play, but that’s not my area of expertise so I can’t comment on the timing or mechanics behind it without further research. The main play for me here is to hold long term, and any squeeze mechanic will be the cherry on top.

Other news:

(1) November 10, 2021 Q3 Results - https://investors.cellebrite.com/news-releases/news-release-details/cellebrite-release-third-quarter-2021-financial-results-november

(2) Closed acquisition to round out product suite - Cellebrite to Acquire Digital Clues, Strengthening Its Market Leading Position as the End-To-End Investigative Digital Intelligence Platform Provider

(3) Analyst coverage - William Blair

(4) Analyst coverage - UPDATE: Cowen Starts Cellebrite (CLBT) at Outperform

(5) Institutional Holdings (TW for apes - dirty Citadel hedgies) - https://www.nasdaq.com/market-activity/stocks/clbt/institutional-holdings

I will keep editing this if I find new information.

Cheers!