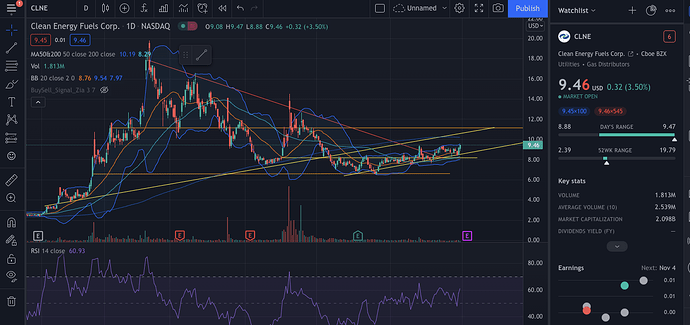

Ticker: CLNE

Description of why you are requesting DD: I feel CLNE could gap up to $11, which could drive retail meme stock sentiment, wondering if it could go beyond $11 on a high volume spot-type event. After $11, it has jumped before to $13, $17, $19 on WSB sentiment.

Earnings are next week - Nov 4, momentum seems bullish, need help with actual decent analysis.

CLNE is on my meme stocks watch list. It’s hit a bottom around $6.50 in August and has been on a bullish trend since then. For the past 4 weeks, it’s been trying to re-establish $9 support and it seems to finally hold.

In the background, I believe the Infrastructure bill and climate change politics are driving good momentum for this stock. That’s the extent of my understanding.

With earnings coming next week and the bullish momentum, I was wondering if this could drive a spike in volume and momentum and spill over that $11 target.

Thanks!

Edit: Analyst PT around the $11-13 mark:

About CLNE:

Clean Energy Fuels Corp. engages in the provision of natural gas as an alternative fuel for vehicle fleets in the United States and Canada. It also builds and operates compressed natural gas (CNG) and liquefied natural gas (LNG) vehicle fueling stations; manufacture CNG and LNG equipment and technologies; and deliver more CNG and LNG vehicle fuel. The company was founded by T. Boone Pickens and Andrew J. Littlefair in 1996 and is headquartered in Newport Beach, CA.

There is a whole subreddit about it, but it’s only one side of the story:

https://www.reddit.com/r/CLNE/

1 Like

I’m playing CLNE. It’s been on an upward trend for a while so I was hoping the infrastructure bill would come and give it a bump but that never came so I’m playing the earnings. We’ll see how she goes!

3 Likes

Update: Looking at CLNE building support at $9.50, then go test $10.50.

Earnings tomorrow after the bell. Will be watching AH closely.

Unfortunately, meme stop frenzy hasn’t spilled over and there is much news on the CLNE topic, even the subreddit is pretty calm besides the usual hopium.

However, analysts remain neutral, and the stock is currently pricing an optimistic outlook. If earnings beat expectations and guidance is strong, it could drive analysts to update their price targets and trigger some volume.

Flip side: it works both ways. Tight stop loss is your friend, dont baghold.

If anyone has any insight or info to add, please do so, I would welcome some additional opinions!

1 Like

CLNE ran on low volume all day and no volume AH.

Earnings call anti-climatic so far.

Results more or less as expected.

Outlook remains optimistic so barring any last minute surprise it’ll remain as boring as it gets.

I’ll now go back to my room and sleep on my disappointment.

Clean Energy Fuels EPS in-line, beats on revenue

Nov. 04, 2021 4:07 PM ETClean Energy Fuels Corp. (CLNE)By: Shweta Agarwal, SA News Editor

- Clean Energy Fuels (NASDAQ:CLNE): Q3 Non-GAAP EPS of $0.01 in-line; GAAP EPS of -$0.02 misses by $0.02.

- Revenue of $86.1M (+21.5% Y/Y) beats by $0.61M.

2 Likes

Someone said they always play clean when it dips down to $7.70, and sells around $8.60…

At its current price it would have to really smash earnings to push up further but I think they actually missed by a penny.

Entry should’ve been in August.