Looking at SI as BTC creeps closer to the 21K margin call level for MSTR.

This was posted on TF by @juangomez053, I took these puts on MARA & SI (SI being a surrogate for MSTR since the premiums are nuts for that one) in case BTC reaches below the 21K threshold or in the event MTSR starts to liquidate it’s position.

https://twitter.com/cryptowhale/status/1536356226409410560?s=21&t=6n0oHLcZW6zGG9a1QCMqZQ

Which expirations you got?

One thing to consider about many of these crypto/mining plays and especially companies that mine cryptocurrency is their profits.

Most of the major cryptomining companies focus on BTC with their ASIC miners. While some do have ETH being mined, that is slowly being shifted away from as ETH gets closer and closer to its change from PoW to PoS.

I know that there is currently those trying to see if they can re-purpose those ETH ASICs to do other coins but once ETH does completely swap over a lot of those are basically DIW.

Now while BTC/ETH are crashing hard right now, for these mining companies they technically should still be profitable for their BTC mining but not nearly as high as before.

MARA iirc has tons of Antminer S19s. If their per kWh price is around the $0.05 avg, as long as BTC remains above $10k, they should still be making a profit.

Bear market is a great time for companies to mine more of their specific coin if less efficient miners de-activate and the network hashrate goes down.

The same thing goes for hobbyist miners/enthusiasts as it provides a great opportunity to mine alot more of a coin as folks who were only in it for immediate mine then dump folks exit the mining pools which helps with network hashrate and difficulty.

Now in relation to crypto exchanges, a good portion of their revenue comes from the transaction fees that occurs with the buying/selling of crypto. A majority of COINs revenue (around 90%) is from those transaction fees. With how bad the crypto market is bleeding you have money being pulled out whether thats from institutions or from retail.

With the bleed in ETH, all the other alt coins are suffering hard especially those on ERC-20. Liquidity is going to be drying up quick and less folks will be pumping money into the system.

One of the things you have to factor in for the mining companies is the failure rate of hardware. It is much higher than you think (almost 20% for some mining companies!). Also, if the mining company borrowed money to fund operations or expand operations, what happens now that BTC/ETH are 50% of what they were 60 days ago? There is a big difference between being gross profitable (revenue exceeds operating expenses) and net profitable (revenue exceeds operating expenses, debt payments, capital expenditures, etc.).

Tomorrow I’m going to keep my eye on MSTR, BITO, NVDA, SI and COIN. Also looking at taking a longer-term position on AMD.

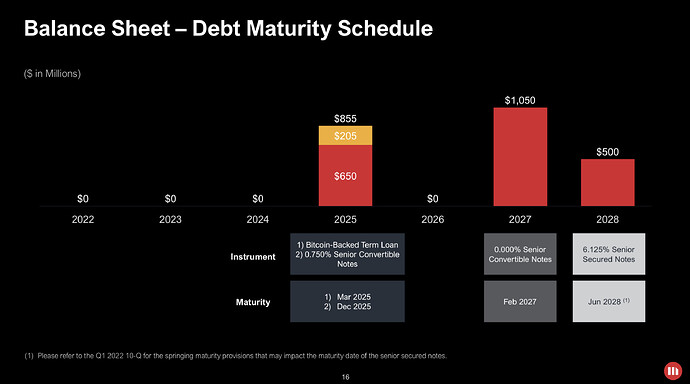

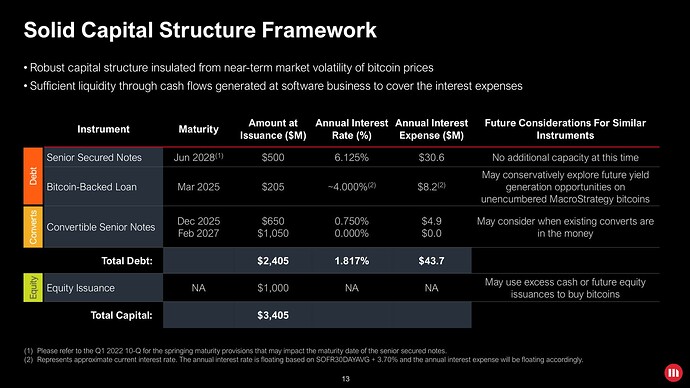

We all know the MSTR and SI issue by now. If BTC drops to 21k, MSTR is in default on its loan with SI. What I don’t know, and want to see, is what other loans MSTR has that may not be collateralized by BTC. The reason for this is that the loan documents for MSTR’s other loans almost certainly all have cross-default provisions: a default under MSTR’s loan documents with one lender is a default under MSTR’s loan documents for all its other lenders. This could further push down the price of MSTR if BTC continues to fall. In addition, SI reported approximately $1.6 billion in loans as of Q1 2022, so this loan represents more than 10% of SI’s loan portfolio. A potential charge off or writedown on the MSTR loan would have huge implications on SI as well. Please keep in mind that SI is the bank holding company, not the bank. This means that its value is entirely dependent on the solvency of the bank. If the bank fails, SI is worth zero. Don’t get too excited about that, the chances of that happening are slim, but they are no longer out of the realm of possibility.

NVDA dropped today mostly with SPY but also because it is the largest manufacturer of crypto-mining GPUs. If that market dries up, NVDA’s sales and profits will be impacted significantly. This is why NVDA was down 7.82% today while INTC was only down 3.60%.

One anomaly here is AMD: it got whacked by the news today. However, AMD doesn’t have the same risks as NVDA when it comes to the crypto market. AMD’s prior earnings and guidance were outstanding, so I’m going to see if there’s an opportunity to buy LEAPs or shares for AMD. I might consider a CSP at a lower strike.

Finally, BITO and COIN. BITO was blown up today being down 20%. I will be interested to see its revised NAV calculation tomorrow morning. If, as I suspect, it is down more than 20% from the prior reporting period, it will continue to fall. COIN will continue to be a good put play as the worse the crypto market gets, the fewer transaction fees COIN receives, the worse COIN’s performance will be.

Cheers and good luck tomorrow!

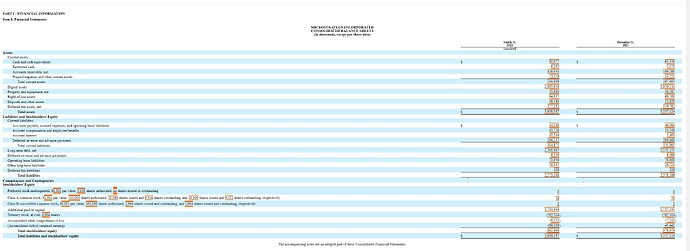

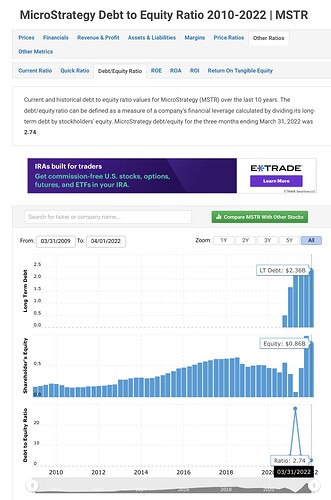

So I did some digging on MSTR a little this evening. This could get very, very bad for the company. While they famously have that $200 million loan with Silvergate Bank, the company’s total long-term debt as of 3/31/22 was $2.3 billion. Total equity of $862 million. So if they have lost $1 billion in BTC, that means they are insolvent. As in might stop existing.

Look at those numbers. Even at $22k this company might be proper fucked.

Right but all those notes are cross-defaulted. A default under any loan is a default under all loans.

I would be careful for Nvidia. A lot of the drop in sales were already pretty much factored in I would guess as crypto already took a massive hit in early Q1. Inventory wise at least retail wise, starting in February alot of stores started to have tons of GPUs in stock.

What I would think is pushing NVDA down more lately is the fact that there was rumors leaked yesterday that Nvidia will have to delay their next gen GPUs the rtx 4000 series cards at least a month due to supply issues. (delay launch based on a leaked embargo letter).

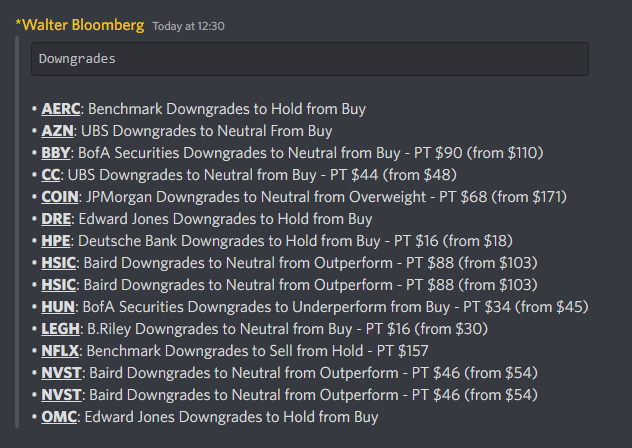

COIN downgrade

I went with the Jan. 2023 100p for MSTR. Premiums are expensive so be careful. Will probably cut and re-position out further with the (hopeful) profits I make off this one.

Took profit on SI & MARA puts as they’re both down decently today. BTC is holding somewhat well against the market in these levels but it also has a habit of consolidating before larger downward moves.

Holding greatly reduced positions but still personally expecting some downside.

BITF news:

“Crypto mining company Bitfarms Ltd. has made an about-face on its holding strategy and sold 3,000 Bitcoin for $62 million over the past week to boost its liquidity amid the record-breaking bear market. It’s one of the first self-proclaimed Bitcoin hoarding miners to turn away from accumulating mined coins.”

I noticed that MARA, MSTR & SI aren’t really absorbing any bullish movement from the markets.