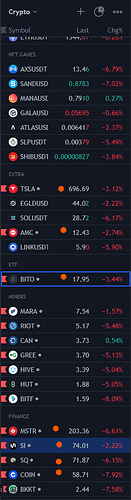

Let’s gather our thoughts for crypto dip plays for tomorrow (Monday 6/13) and potentially longer if the catalyst continues.

GREE and BKKT as well. I know th3 condiment company MOGO has a significant holding of BTC after a press release last year.

I’m highly interested in $COIN myself - as it is seems like it’s a bigger version of Celsius, which is “pausing withdrawals”. I’m not super educated on COIN, but if I were an investor I’d be worried about COIN having similar issues. Anyone more educated with them that could confirm or deny their similarity?

https://twitter.com/CelsiusNetwork/status/1536169010877739009

So I’m looking at puts on crypto miners like RIOT and MARA. Also, the three largest holders of BTC that are publicly traded: MSTR, TSLA and GDH.

Also pay attention to NVDA tomorrow. This could indirectly have a significant negative impact along with the SPY drop.

According to CNN, TSLA likely is holding a lot of BTC still as of February 2022

(Copied from TF)

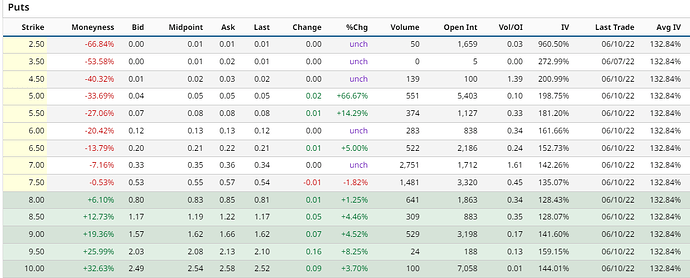

MARA seems to have enough meat on the bones for puts. For 6/17:

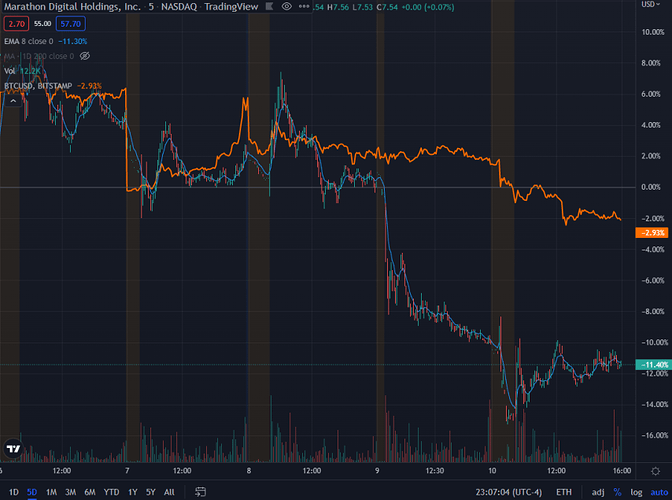

Worse-than-BTC performance on Thu and Fri too, owing to the weakness of other crypto.

Should pay for broad based crypto weakness on Monday.

Excellent find

As of April 2022, it looks like $SQ holds 8,027 BTC. That’s just a few less than was reported by $MARA at the same time. May be worth a look.

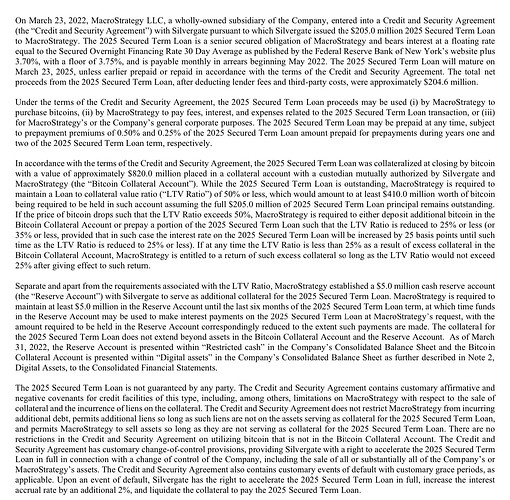

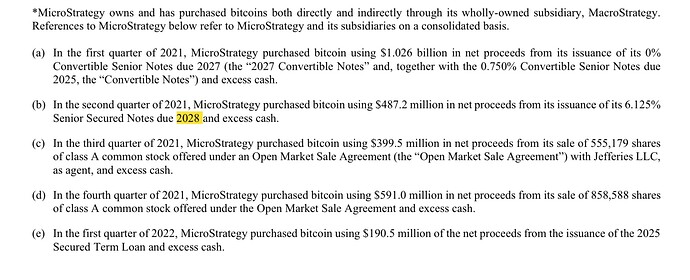

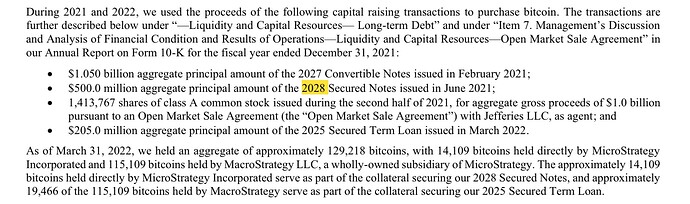

Average MSTR price on their BTC is $30,700. They have 129,218 BTC as of Q1 2022. As of today’s BTC price of around $26,500, they are down $542,715,600 (loss of 4,200 per BTC). Their bitcoin backed loan requires $820 Million in collateral in BTC, the collateral they put up for the loan (around 19,466 BTC) is now valued at around 37% less than that ($515,849,000). Their LTV is now around 40% (collateral of $515,849,000 divided by loan of $205,000,000). According to their 10-Q, “While the 2025 Secured Term Loan is outstanding, MacroStrategy is required to maintain a Loan to collateral value ratio (“LTV Ratio”) of 50% or less, which would amount to at least $410.0 million worth of bitcoin being required to be held in such account assuming the full $205.0 million of 2025 Secured Term Loan principal remains outstanding. If the price of bitcoin drops such that the LTV Ratio exceeds 50%, MacroStrategy is required to either deposit additional bitcoin in the Bitcoin Collateral Account or prepay a portion of the 2025 Secured Term Loan such that the LTV Ratio is reduced to 25% or less (or 35% or less, provided that in such case the interest rate on the 2025 Secured Term Loan will be increased by 25 basis points until such time as the LTV Ratio is reduced to 25% or less).” If LTV goes above 50%, which would mean BTC at $21,062, their BTC would become much more illiquid due to them having to post more collateral (I would assume they wouldn’t pay cash in exchange for a higher interest rate on their loan of SOFR plus 3.70%).

FYI SOFR is basically the Fed Funds Rate so their woes aren’t over after one night of a BTC dip:

Ignore the 2018 QT spike in SOFR.

Anyways, they’re literally hurting themselves financially/bending over backwards in order to buy all the BTC they can:

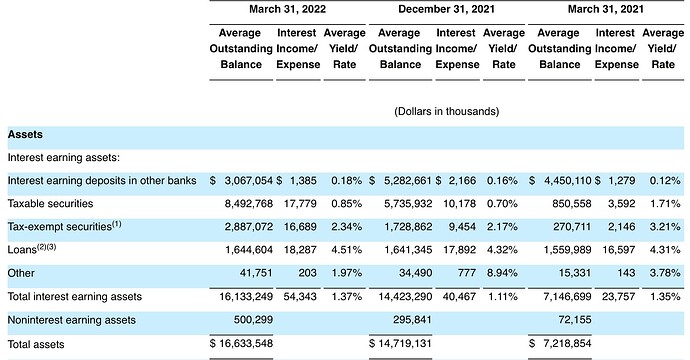

Who made this loan and how much of a percentage is it of their total assets? Might be worth looking at the lender if it’s publicly-traded.

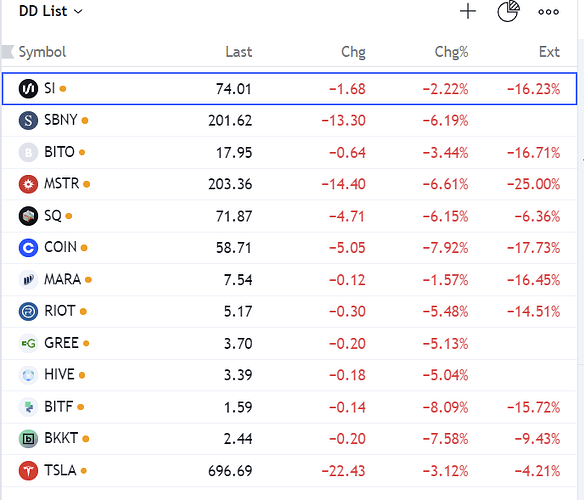

Silvergate Bank (NYSE:SI)

That actually is a big portion of assets for a financial institution. For banks, it’s important to understand their value calculation which is Value = Assets - Deposits. Assets usually don’t exceed deposits by a significant amount, so a swing to the downside on assets causes much more volatility.

That loan, if it had to be charged off, would result in a massive increase in capital reserves because that loan represents more than 10% of the entire loan portfolio at the bank. I will be look at SI tomorrow too.

SI is a great callout. They have a blockchain that is heavily in ETH and dabble in a bit of BTC. Their cash flow is based on ETH and BTC transactions between Crypto firms.

SBNY is also another great ticker. They have a proprietary blockchain system called SIGNET which allows you to move crypto and cash funds in real time without having to wait the typical 3 day wire transaction closing days. However, their method is not like SI where they charge per transaction, they require firms/people to have x amount of deposits in their bank. SIGNET also follows heavily in ETH and a bit in BTC.

Both firms tend to follow ETH’s price flow to their stock charts.

Both firms are great calls/puts plays.

Also… Where is all the money thats come out of crypto going today?

Pockets of billionaires.

Well. I think we’re too good at this.

Here’s how we are this morning. I’m not sure there’s meat left on any of these bones, but I’ll be watching closely.