I think that we’ve seen the bottom or close to the bottom on SPY today. Closed above the 8 EMA strong and the RSI MA has bottomed out and is curving up with the rsi lines above the MA and bounced off. I would do a call scalp if I had free cash

If anyone did take calls to scalp, I would consider cutting at 418.8 - 419 or earlier to be safe. If not, you can risk that we recover to 420

The more I research this JETS play the more I like it. It moves with the market but on days like today, if the market AND oil are green it stays flat.

Airlines lost 52 billion last year and although demand is high right now they are still not back to pre covid levels.

I see airlines hurting from inflation, russia, oil, covid, shipping, discretionary income, real wages, & monetary policy.

Thank you for this, I had grabbed 5 $16.86c for a June in early March and has been doing pretty well given the climate. I do agree that those impacts are real to the airline industry and will look into similar ETFs like XTN and IYT, as well as individuals that are having the same concerns. That said I do follow your excellent DD’s and am of like mind in the bearish sentiment approaching and/ or continuing in the future. I will average down and monitor for a good p entry. Cheers

Sold my JETS calls on Friday to help recover my challenge account. Going to monitor it early this week for some puts if the market shows some clouds of slow down. Cheers

just picked up three 03/24 YINN 4.5c for $0.30. super-risky as it’s a 3x leveraged ETF and any geo-political news can move this 5-10% either way. just attractive at these prices and don’t see any real negative news coming out of China either than real estate bubble

In with you on shares and $5c at the dip.

thanks, took a 4/14 5c also

I decided to join the crowd - went with 4/14 5c

picked up 10 TSLA 1100c 3/25 @ .65

Friendly reminder that Google is doin a 20-1 stock split on July 15th so for every 1 share u own before July 1st, you’ll get 19 more so 20. Throwin this out there for all the covered call writing people.

Picked up one more tsla call ![]()

Picked up 1 3/25 QCOM 165c @ .55 - picked this up as a sympathy play for NVDA since NVDA is too pricey for me, will cut today if I see profit

Spy looks to be bull flagging on the 5 min. Also the 8 and 21 EMA crossed, which typically means a bullish up trend. I’m looking to take a call at 443

Getting a starter position in CTXR today. This is a pharma company that is releasing a lot of bullish news within the next year or two. I posted a DD on it a while ago but it has been popping up on my radar as it looks like it’s volume is steadily increasing day by day. Position I took today is 2 2.5c 1/2023 exp. It’s up about 10% today so you could always wait until a pullback to start a position. Shares are always a good play and it’s cost is currently 1.84

i felt more conviction in this play when i saw thots_and_prayers take some LEAPs on BABA earlier in the trading day. thanks so much, thots! very surprised that there were more like-minded people in this community that had the same sentiment/analysis as i am always in awe of all of you (and happy that i wasn’t a complete idiot).

called into a meeting midday, where the 4.5c were priced at $0.45 for about an hour which would have been a 50% gain. my stupidity for not setting a stop/loss when AFK. but i did manage to sell one call at $0.40 for 33% gain, did not get filled on my other two. unfortunately, JPow wasn’t the upward cataylst i thought he’d be but YINN did recover more than SPY did in the afternoon session.

unfortunately, these options trade in $0.05 increments so i sometimes have to wait for the underlying to move $0.10 or more to be able to sell. very risky holding onto these until tomorrow but i do like the late price action. i think as long as there’s no bad news, especially COVID related to China tonight, i should be able to exit the last two calls at $0.45 by tomorrow (let’s hope it gaps up lol). hope everyone’s trades worked out well today.

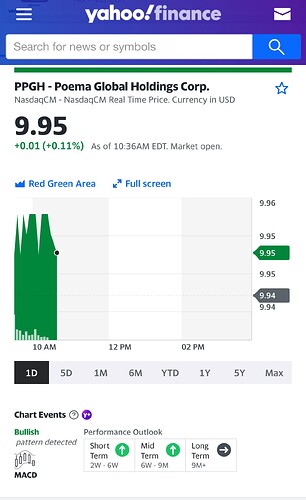

I started some PPGH DD here: PPGH | SPAC Merger with Gogoro Global - Taiwanese Startup Battery Swap + Electric Scooters

Traded the warrants a while back 0.80 → 1.60. Haven’t been keeping up since.

If Spy dips to 443-444, I’m taking calls and will average down if needed, will also take calls if SPY breaks 446.3 level. Those are big supports/resistances

Per chatting in TF yesterday and as @fash pointed out - Spy 446.50+ should shake out sellers as @Yongsooyuk6 mentioned if it pops could go silly - but still very risky