I think one of the things that people do too often is overtrade. I think people get caught up in the notion of “trading being a full-time job” and they think “well, that means I should be trading full time”, well, no, you shouldn’t. That’s gambling folks (unless you’re adept at scalping). You should be researching full time.

Trading is less active combat and more precision sniping. This morning, people watched me make a couple trades and now I’m going about my day, working on community projects, reviewing applications. In between I’ll be reading the forum, news, etc. looking for the next entry that I’ll scope in on.

Sometimes you have to be willing to step back and watch. You might just find that you’ll watch yourself become more profitable as a result.

EDIT: I’m locking this topic to keep it just my posts. Feel free to react to these in TF in discord.

42 Likes

Today I made a couple trades as a part of my practice run:

- I averaged down by WEBR puts a little bit and acquired to closer to ITM ones. While I’m currently down on this position, I’m fairly confident I’ll end green. Overall, there wasn’t much risked so I’m not too worried about it.

- I re-entered SENS. At close today, I ended up +13.5% for a profit of $66.50. I’m still holding the position as I’m in this for the potential FDA approval.

- I entered PYPL. I assumed that PYPL was near at least a temporary floor, later identified as a falling wedge. I made two entries and decided I wouldn’t average down anymore. Ended the day +9.45% for a profit of $36.00.

- Bought SPY calls off my signal that the market wouldn’t likely care about GOOGL’s dilution very long. Ended up cutting them intraday for a profit of $57.00. I’m unsure of the percentage because TD is awful, but I believe it was close to 30%.

- Last but not least I took at FB call to play their earnings sentiment/IV spike directionally, I cut it right after this screenshot for a profit of $20.00.

Started today with a balance of $1,061.39 and ended with a balance of $1,173.89 which is a gain of the day of 10.59%.

I’ll be working on the delivery method for these updates a little, but for the first few I think this will suffice. Hope everyone had a great day and I’ll see ya tomorrow.

19 Likes

I have a dentist appointment this morning at 9:30 so I won’t be on until a little later today. PYPL is the only position in holding that I’m somewhat concerned about, but overall I think it’ll be fine and I will most likely hold it.

4 Likes

Today will be a good example of why emotional trading is wrong. When I got out of my dentist appointment I was down… a lot. Balance went from $1173 to $907 due to the market being down over FB earnings. Now, this is something that I know a lot of people do, I see people just sell everything because they’re down. The thought process is something like “I suck, I’m wrong on this trade, so every other trade I’m in is probably wrong too”. You think it’s “healthy” to just get out of all your positions and start fresh. This is wrong.

The reason its wrong is because you entered all those trades for different reasons. Just because the market is down, doesn’t mean SENS wouldn’t get an FDA approval. Also, the market is going down, which helps my WEBR puts.

I’m still even holding PYPL for the time being because I have longer out calls and this is a singular red day. I’m not in that trade for today I’m in that trade for the bigger picture over the next week.

As of typing this, my account is back over $1,100 due to SENS taking a run on FDA approval hype. If I had cut my plays and “took a break”, I’d be sitting at $900.

Something to think about.

19 Likes

Daily Review

This was an interesting day to say the least. As I said earlier, I had a dentist appointment at 9:30 and by the time I got out, I was down to almost $900 from a close of $1,173 yesterday. If you haven’t, read my previous entry for a rundown of the thought process when I saw this.

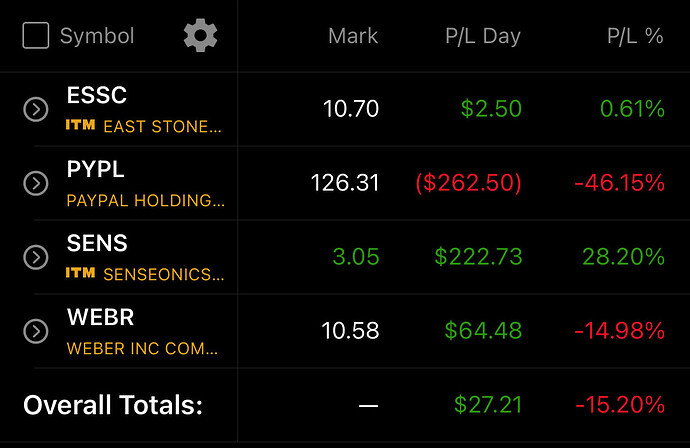

My current positions:

Gawt dammit FB. So obviously the FB earnings miss wrecked my PYPL calls which is unfortunate because it was a great entry and a play I was optimistic about. However, today shows a skill that is sometimes undervalued; “being able to hover”. What I mean by hovering is, having flat days in your portfolio, absent my other solid plays I would’ve been deeply red, however, since I didn’t drop my extra plays due to some misguided assumption they’re wrong because I was wrong on PYPL, my account was able to recover and finish right around where it started the day. This is fucking beautiful. I took a massive loss, but it didn’t wreck my account because I’m in a diversified amount of plays with different factors pushing them. Being a successful trader isn’t just making crazy gains, its also being able to mitigate crazy losses.

- ESSC - I parked my extra money in this trade for the day since it’s trading near NAV and the market is super volatile. Since it’s not going anywhere, I was able to take my time and acquire at a cost basis of only .70 for my three 10 strike calls and .25 for my six 12.5 strikes using the small affect SPY seemingly had on the underlying to my advantage. With these fills, the chances are high that I’ll be able to offload these calls quickly tomorrow for a decent profit without much downside risk.

- PYPL - Diamondhands baby. So why am I still in this trade? The answer is, I probably shouldn’t be and provided a time machine I would’ve likely dropped these calls at open given FB’s earnings miss. Looking at the pricing chart, I wouldn’t have been down that bad and this day would’ve been seriously green had I done so, but, hindsight is 20/20. – So focusing on the trade. Considering how down I was, I assumed it wouldn’t go much further, and I was right for the most part. Assessing why I was even in the trade in the first place is the fact that I think PYPL’s earnings weren’t that bad and that a recovery would take place. That recovery, which we were seeing to some extent was derailed by outside circumstances, so at the end of the day, the original thesis (my opinion) is unchanged. Looking at the overall market conditions, I was willing to take a bet that AMZN’s earnings would be bullish for the market and provided a SPY recovery, PYPL would follow suit. As a result, I doubled down on my position today and gained back a little ground from bottom as a result. With AMZN’s earning beat, I would expect PYPL to start somewhat of a recovery again and I think this trade should be fine in the end as I gave myself some room by taking 02/18’s.

- SENS - What a fucking day for SENS. In a sea of red, hype surrounding its potential FDA approval (the reason we’re in the play) took this one for a ride. Seeing the early momentum, I was able to add more calls during the run, maximizing my gains. Considering I needed the money to end somewhat even, I sold off all my 3.5c’s at the intraday peak and rolled them down into 3 strike calls at the $3.00 support level after it held reasonably well. This allowed me to capture the profit of that run fully and reinvest it in a higher number of safer calls to preserve that profit far better than if I’d simply held the 3.5cs. That move today was essential in keeping my account afloat and is an example of why you must be willing to daytrade to be an effective trader.

- WEBR - “Do you see what I seeee?”, my WEBR puts, slowly but surely have been creeping up in value and the extra near-ITM puts I bought have been doing work to help pull back this trade from the depths. Current price action is absolutely in line with what we’ve seen in other share unlock plays and I’m excited to continue to watch this one pan out. A lot of times all that is needed is patience and that is exactly what a lot of us lack.

Today my finishing balance was $1,166.22 off a starting balance of $1,173.89, a decrease of 0.65%. Considering SPY was down 2.35% today, I’m going to call that a win.

After thoughts

Something else that isn’t often thought of is the value of free cash. I always try to keep some sort of cash balance uninvested so I can strategically average down or average up to capitalize on market volatility. If I didn’t have free cash on hand today, I would’ve missed on some SENS profits and would’ve ended a little more red than I did.

After seeing some problems that people are having, I think I’m going to work on some education content on placing orders and getting optimal fills. I think a lot of people are getting wrecked by chronically slapping the ask and selling the bid.

See you guys tomorrow.

17 Likes

Out and about again this morning. Will provide some updates in threads as I get time.

3 Likes

For those that saw me run a MKT order, what I will do from time to time is if the bid is stacked on a stock I’m looking for an entry on (because it’s in a flag, etc.), I’ll test where MKT orders are filling because sometimes they’ll fill at the mid and even at the bid due to NBBO, so if its a preferable fill, I’ll quickly run a larger order to try to “cut the line”.

2 Likes