This thread is for general discussion and analysis of the listed commodity.

Underwhelming Iowa Corn Crop Sets Stage for More Food Inflation

I’ve been following weekly crop reports, and every week they keep getting worse and worse due to drought across most of the country.

Recent bloomberg article talking about how bad it is, especially the recent report in Iowa.

Iowa is critical to corn output in the US, the world’s top producer and exporter. Without a bumper harvest in the Hawkeye State it’s unlikely that acres from the eastern half of the crop belt will be able to make up for the losses recorded earlier this week in the west. All that adds up to the possibility of a national production deficit and more global food inflation.

After four days of measuring the yield outlook in Iowa, Illinois, Nebraska, Minnesota and South Dakota, the scouts are coming back with discouraging news for a world that’s dealing with high grocery bills and rising levels of hunger.

Bloomberg (paywall): https://www.bloomberg.com/news/articles/2022-08-26/underwhelming-iowa-corn-crop-sets-stage-for-more-food-inflation

Archived (no paywall): https://archive.ph/APkZ8

This corresponds to what I have been hearing through the industry, and hopes of spectacular yields in the eastern corn belt will fall short. I will start corn silage appraisals soon so I will have a better take on what is actually in the field. I suspect it will be good but not fantastic. At the very least it will most likely provide support for current prices. If I had to guess the harvest low floor for corn will most likely be around $6.25 for the DEC futures. This in turn will provide support for both wheat and soybeans near these price levels, barring any major surprises.

Don’t load the port with CORN SOYB or WEAT though. Probably the most effective way to play these would be to mirror the “GOD TIER EARNINGS STRAT” that has emerged in the last three weeks. Monitor the release dates for the UDSA crop reports and enter for a quick scalp following release. Releases occur during market hours, usually between 11:00-12:30 EST. I doubt these can be consistent 3x-5x plays but the do have the potential to be 25-50% gains. ITM/ATM options safest.

Also, short crops lead to higher prices which will in turn provide good support for the other Ag stocks. Play safe Vallhalla!

Harvest has been starting in SD, and it looks like Corn & Soybean is looking pretty disappointing. Going to be interesting over the next month or so as more harvest reports come in.

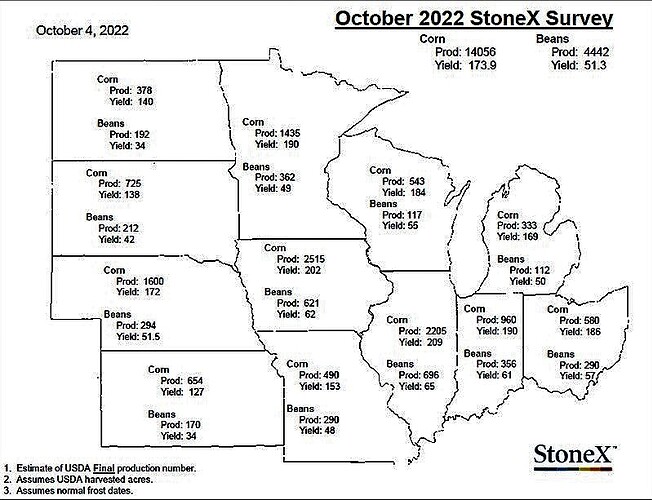

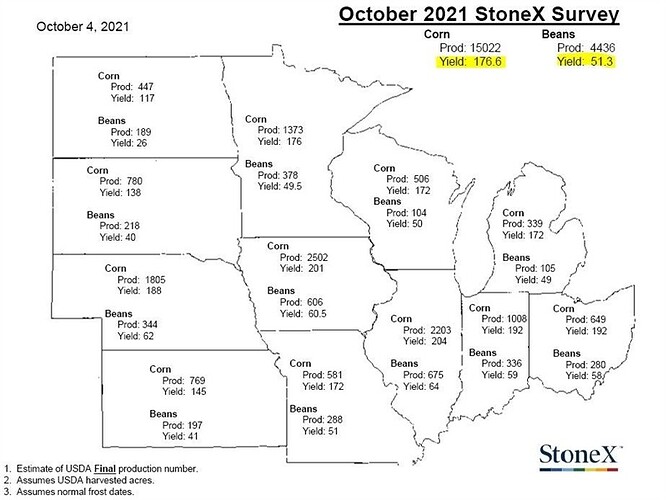

I have attached an estimate from StoneX Brokerage for 2022 corn and soybean yield and total production by state. I also found one from this time last year for comparison. I need to look and see how these numbers compare to the USDA finals from 2021.

Highlights:

Corn yield down and production down, less planted and harvested acreage for '22 as opposed to '21.

Soybeans basically flat YOY.

2022

2021

Seems more of a status quo number than a big mover either way. USDA estimates come out 10/12 so we will get more information at that time.

Good luck folks

I had been wondering why the grain market had been off the last few days, especially with the slight pullback in the dollar and surging oil prices. Part of it can be attributed to the “harvest low” that usually occurs for both corn and soybeans during October and November but an additional factor is probably this:

Currently barges are operating under load restrictions, which slows exports and creates a short term surplus. The grain “pipeline” is starting to back up.

While looking around I found this website for a financial planning company that focuses on agriculture. The have a marketing newsletter that they post to their website and it really give a pretty good summary of what’s going on in Ag. I’ve posted a link and will check back in to see what they have to say. Anyways, here is a summary from 09/29/2022

https://www.agperformance.com/post/update-for-september-29th-2022

This topic was automatically closed 3 days after the last reply. New replies are no longer allowed.