Preface

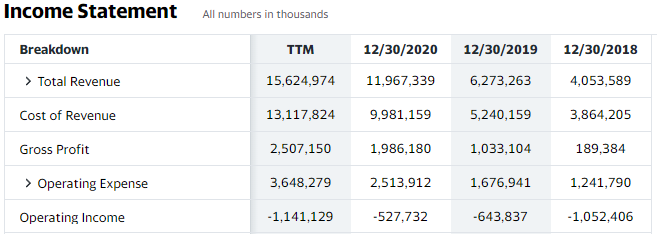

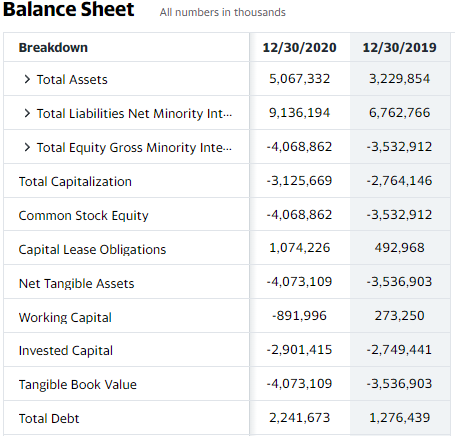

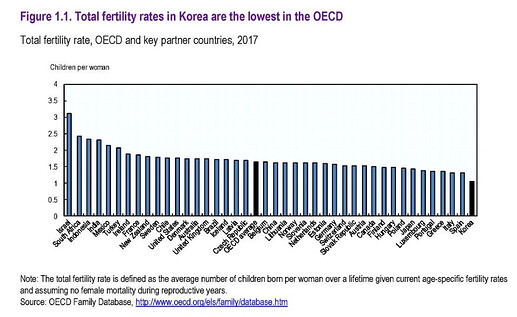

I recently stumbled upon Coupang watching one of Rareliquid’s stockpick videos and was immediately entranced (if you don’t know him, watch him ASAP; at 7:40 he speaks about Coupang https://youtu.be/nwc1ZE3rcvs). Their product is ecommerce and they do a damn good job at it. A reason why they’re so huge in South Korea is because of how tech crazy and compact Korea is. Many don’t have the luxury to walk to the grocery store and rely on ecommerce to thrive (I explain their product in detail further down). Looking from a technical analysis, many here will be immediately turned off. Yet, I believe it’s at a low that it’ll never go down to again in it’s history. A reason it dropped so much from it’s hot IPO is because of how the company runs financially. They take a page right out of the Amazon textbook and use blitzscaling to grow at an EXTREMELY fast past (great article on wtf it is: Blitzscaling). Because of their grow at all cost mindset, they’ve missed their past earnings and the stock has fallen because of it (this is the overall consensus I’ve gathered but there’s most likely more). All in all, I’m a 18 year old college student with just enough money for booze, Taco Bell and of course investing. So take what I’ve written with a grain of salt and don’t sue me.

Why No One Does It Like Coupang (not even Amazon)/Business Description

How did I ever live without Coupang?’ is Coupang’s bold mission statement. Their mission statement perfectly represents the daring and ambitious this growing South Korean ecommerce business has. The main product that Coupang sells is their signature ecommerce delivery: Rocket Delivery. Unlike Amazon’s Prime shipping, Rocket Delivery ensures that the customer if their order is placed before midnight then they will receive their item the next morning. With Coupang’s Rocket Direct Service, customers can also buy goods from foreign marketplaces and receive them in 3 days. It’s because of this exceptional service that Coupang’s user base is almost half the size of South Korea’s population. Moreover, Rocket Delivery also provides an extraordinary return system. For instance, a customer can simply just place the item they wish to return on their front door and Coupang will pick it up for you. Like Amazon Prime, Coupang also has a paid subscription service, Coupang Wow, that provides subscribers with free shipping along with benefits in the plethora of Coupang services.

Outside of their premier delivery service, Coupang also has a multitude of other business ventures. Their newest being Rocket Fresh, an overnight grocery delivery service (similar to Instacart) where customers can receive their food by 7 A.M. They also have their own UberEats spinoff with Coupang Eats. Similar to UberEats and Doordash, customers order their food through Coupang Eats and have it picked up by a ‘Coupangfriend’(Coupang’s delivery staff). Perhaps the most unique of Coupang’s services is Coupang Flex. With Coupang Flex, Coupang pays anyone 18 years or older to pick up Coupang packages from logistical centers and deliver them themselves (Uber except with delivery services). Coupang also has a video streaming service called Coupang Play that’s available to Coupang Wow members.

As of right now the services listed above stand as Coupang’s primary services. Even with these services, Coupang still has plans for growth. The biggest being Coupang’s expansion into the international market. Coupang recently has already begun to test international waters by piloting their Rocket Delivery service to Tokyo, Singapore, and Taiwan. Coupang has also talked of venturing into the Fintech sector and merchant services.

A Diversified, America Experienced Leadership

Another area where Coupang shines is their diverse leadership. Bon Kim, Coupang’s Harvard dropout founder and CEO, lived in the United States for a majority of his life until transitioning to South Korea and beginning Coupang. Coupang’s CFO and CTO, Gaurav Annand and Thunan Pham, worked for major U.S companies like FoodCart and Uber before joining Coupang. Through this experience, Coupang has been able to innovate and dominate the South Korean ecommerce market.

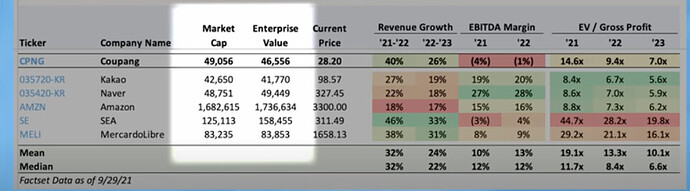

Competition/Financial Analysis

Rareliquid does a way better job of explaining this better than I can do (he’s an ex JP Morgan IB Analyst) so watch his video. Basically, their biggest challenger to expanding into Asia is obviously SEA. Yet, Ben (rareliquid) provides a convincing argument for why he’s bullish.

My Position/Conclusion

Shares that I’ll hold for a while. Will transition my shares into next year leap calls once I learn more about how to do so. If there’s people out there who trade leap calls and are bullish on Coupang please reach out to me.

I firmly believe in Coupang and love their product and leadership. They are still in their early stages and I don’t see this company regressing based on the info above. Their earnings are coming up November 12th and I do not see this company falling any further given it’s fundamentals. I will be sure to be watching closely and just wanted to write this DD so CPNG could get some traction by more smarter people than me. Peace