Everyone this week loved the shit storm from earnings, so let’s let this ride and talk about Cerence, Inc, based out of Burlington, Mass. They have Q4 earnings coming up on Monday, November 22 at 7AM EST and to not mince words they have a history of killing it.

I wanted to get this out tonight because obviously if this ends up being a slower moving train, the ideal time to jump in may be tomorrow. As always, do your own DD and contribute in line!

Summary and Thesis

I’m both near and long-term bullish on the company as it seems that they already have a foundation built with established car manufacturers, and they note that “more than 50% of global auto production today includes Cerence technology”. They appear to be a disciplined organization with a strong track record of exceeding expectations.

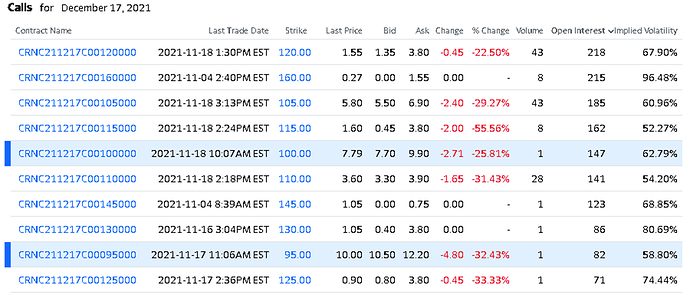

Technical analysis lends belief to be at the end of the ‘second’ wave of Elliot Wave, which would signal near term growth likely triggered by a dependably strong performance in earnings. The options chain spread is wild right now, so it may be prudent to review those bid/asks prior to jumping into it, but minimally it would seem that even holding shares could garner upwards of 25% gains should historical performance hold true. If EWT holds true, we could see up to a 30% increase.

Important Disclaimer

In trending, however, it is important to note that the clearest picture is painted in daily intervals. This may be a marathon runner rather than a sprinter, and it could take the duration of December 17 options to reach potential. Historical earnings for this company, when they have panned out well,

Company Background

Cerence is a provider of AI solutions for vehicles and have a heavy focus on augmentative technologies for autonomous vehicles. Historically they have provided IoT solutions for brands like Hyundai and Mercedes-Benz, and you can view some of their work at the following sites:

https://www.hyundainews.com/en-us/releases/3259

Their revenue is generated by their software platform which allows customers to build virtual assistants for their brands. This can be found in their most recent ESG report, published today November 18, 2021:

Our principal offering is our software platform, which our customers use to build virtual assistants tailored to their specific brands and vehicles. We generate revenue primarily by selling software licenses and cloud-connected services, and secondarily from our professional services to OEMs and their suppliers during vehicle design, development and deployment

Moreover, despite economic conditions they were able to exceed pre-COVID-19 full-year guidance and increased revenue by 9.1%. This can be viewed in their ESG report below:

https://cerence.com/static-files/747938ac-5cd5-4425-896b-d24a0e23b8b3

Technical Analysis

I always want to reiterate that EWT is a compass, not a map. It points us in the right direction but may not always tell us where we’re going. Take any charting with a grain of salt.

Let’s talk about the most recent multi-day price action, starting on October 6th and running through to November 4th. At this point in time the volume was abysmally low which is one of the precursors of Wave 1 of Elliot Wave theory. RSI also signaled undersold, and the result was a jump from ~$82 to $116 (41% increase).

The following correction leading into November 11 saw the price drop to roughly $98, or approximately a 50% retracement of the first wave. Wave 2 tends to demand a 50-61.8% retracement to occur. If this is a simple retracement, then we could be starting Wave 3 which would be considered significant and could point to continued growth up to $135.00.

Looking to historical earnings, it always runs after but not always with the most consistent of timing. To provide a chart of how these current earnings may play out. It’s important to see that these changes do span multiple days, or over the course of a month:

| Quarter | Surprise | Close Before Earnings | Peak | % Change | Days to Peak |

|---|---|---|---|---|---|

| Q3 2021 | + 0.08 | $105.50 | $125.50 | ~19% | 3 |

| Q2 2021 | + 0.17 | $89.25 | $120.00 | ~34% | 28 |

| Q1 2021 | + 0.08 | $114.28 | $138.07 | ~21% | 10 |

| Q4 2020 | + 0.27 | $65.82 | $95.54 | ~45% | 18 |

The stock itself does not have much OI on the chain, and the current spread between bid and ask is outrageous. If this matter does not resolve itself by the end of the day tomorrow, I would recommend looking into a shares play with a moderate hold time (1-3 weeks to pan out based on historical performance).

Short interest is also insignificant – with low OI and low ITM short interest, I would not expect this stock to squeeze.

Financials

Alongside Q4 earnings we should have a better picture of the 2021 financials of CRNC however TTM compared to those released in 9/30/2020 give us the following insights for the year:

- Revenue and Gross Profit increased by likely a minimum of 10%

- Operating expenses have increased, however seems to be linked to R&D

- EBIT appears to be on track to increase significantly

- Free cash flow appears to have nearly doubled

Overall Opinion

I’m bullish heading into earnings on Monday and optimistic for the outlook of this company as IoT and AI applications continue to become more relevant. I like December 17 calls, but I hate the options chain right now. If it self corrects tomorrow as November strikes expire I may jump in, otherwise I could be looking at a shares play and monitor options into Monday.