TLDR: Buy calls because Squishy did Einstein theory of relativity level DD.

Also because Yong thought puts at first and since he’s 0/3 on CHGG earnings based on gut feelings, literally cannot go tits up inversing and buying calls.

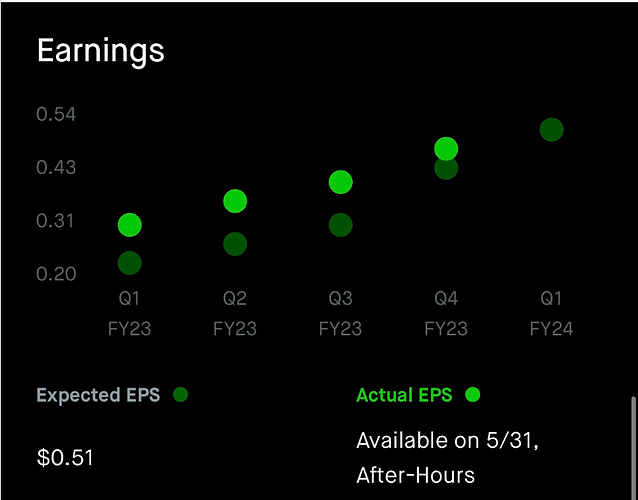

Earnings is AH 5/31/2023

CRWD:

Founded in 2011, Crowdstrike has grown into one of the number one faces of cybersecurity with big competitors in the cloud like Microsoft (MSFT) and Palo Alto Networks (PAWN). They are set to report Q1 earnings on 5/31 after hours.

Financials:

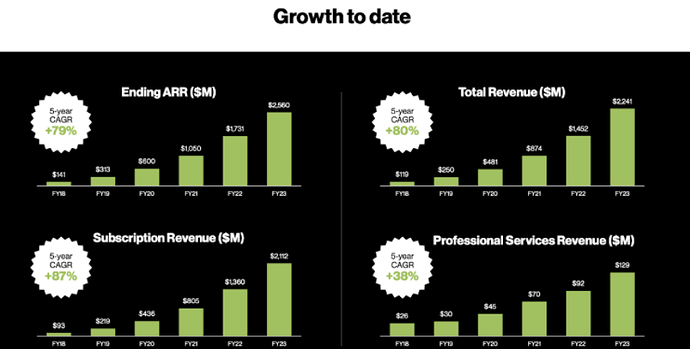

In its most recent quarter, CRWD delivered 48% YOY revenue growth, closing out a year in which the company grew revenue by 54%.

-Revenue has been steadily increasing every earnings call, net income has been decreasing since last June-ish, but net profit margin has been increasing for a year. Operating income has been drastically decreasing, showing that they were not able to get enough customers to offset the costs.

- Exceeded 120% dollar-based net revenue retention rate every quarter since 2018

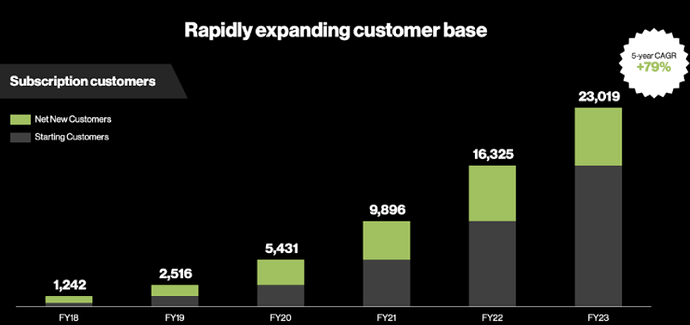

- Total subscriptions customer base (94% of revenues) has grown at a 5-yr CAGR of 79%

- 5 years ago, had only 400 customers with greater than $60k ARR, now a customer needs to spend more than $1M in ARR to be considered top 400

- 556 of the global 2000, 271 of the Fortune 500, and 15 of the top 20 U.S. Banks are customers

- Customers are increasing every year, showing potential and its place as the leading cybersecurity stock.

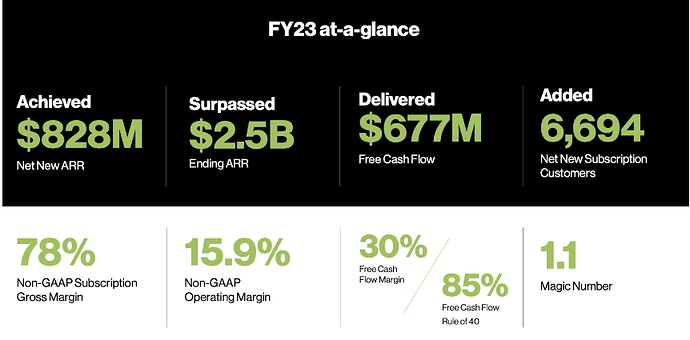

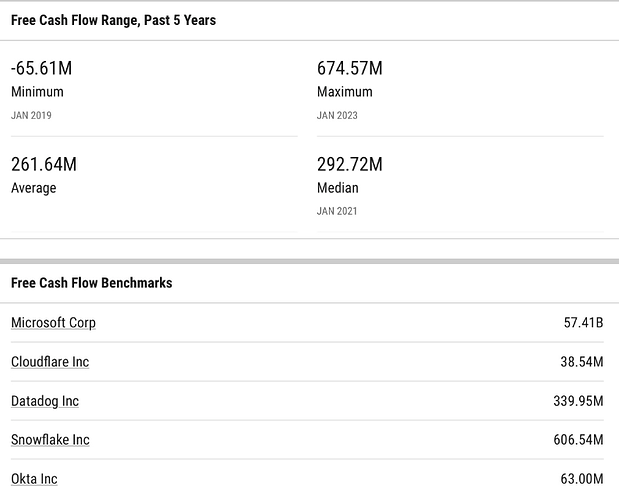

In addition to their ever-growing consumer base, CRWD has one of the healthier balance sheets in comparison to their competitors which gives them the edge to continue funding their advancements in the field of cybersecurity

This gives them the advantages against their competition to advance their company while still maintaining healthy finances.

Competition:

“Continued product development and the leveraging of existing competitive advantages solidifies CRWD as the best play within cybersecurity.” One of CRWDs main competitors is the very well known mega cap, Microsoft. Although it is a lot more familiar and has a wide range of, not only cybersecurity aspects within its company, but an array of products aimed at the average consumer as well, MSFT seems to be losing the upper hand when compared to CRWD in a number of areas.

Investors think that MSFT is its main competition even though CRWD denies these claims. But a partnership with Dell in March, which can help the competition with MSFT. If CRWD gives a good presentation on why they’re on the same level as MSFT or how they’re planning on going past their competition, then it could also help boost their stock.

Future Goals:

“The company’s AI or Machine Learning (‘ML’) model trains itself on first- and third-party data of all breaches, attacks, or instances. Each occurrence learned results in an improved model, able to better predict and defend against future attacks.”

AI seems to be the talk of the town as of late, with everyone trying to hop on the bandwagon. Both MSFT and CRWD have dipped their innovative toes in the sea of AI:

“Microsoft Defender uses machine learning and behavioral AI to detect and block threats. Machine learning systems take sample data and identify patterns that match, such as identifying suspicious behaviors by malicious attackers. Today, most advanced security systems must include some level of behavioral AI and machine learning algorithms, as threats are dramatically changing from hour to hour.

CrowdStrike also uses machine learning and behavioral AI to detect threats, but according to user reviews, its machine learning systems have a higher false-positive rate. On one hand, this can result in more notifications for the security team to investigate, but it can also help administrators remain vigilant to potential threats that may reside within a gray area.”

“CrowdStrike is excited to continue harnessing the combined power of AI and the cloud to enhance defense, upend adversary tradecraft and help our customers stay one step ahead of adversaries to stop breaches.”

CrowdStrike Advances the Use of AI to Predict Adversarial Attack Patterns.

Given the recent AI burst, this talk of using more AI in their defense can pump this stock.

“CrowdStrike’s primary offering focuses on a subset of cybersecurity known as endpoint protection. This area is about protecting any device that accesses a network, like phones or laptops. By securing these devices, businesses can avoid the vast majority of threats that cyber attackers attempt to exploit. The reason CrowdStrike’s offering is so good is that it uses AI to monitor all the signals within a network continuously and evolves the program to adapt to an ever-changing environment. When it detects a threat, it can automatically respond and shut that access point down before any damage is done.”

Again, the talk of AI and how CRWD is using AI as its foundation may help boost this earnings call. Additionally, this endpoint protection can allow CRWD to be used in any technology, further boosting its usability and reach. AI is also being used to track every access points and whatever which can help its safety even more. I think during this next earnings call, CRWD is going to focus largely on its participation in the AI sphere which may help boost its company and stock price.

Earnings Play:

With earnings being released next week, I have a bullish view on the outcome for CRWD. Of course, it’s always safer to play earnings before and after, so to each their own, but I am thinking of taking some calls Tuesday and seeing how that plays out the day before earnings. If I profit a good amount, I’ll sell to cover cost basis and may let some ride through earnings since I am confident in how their call may go.

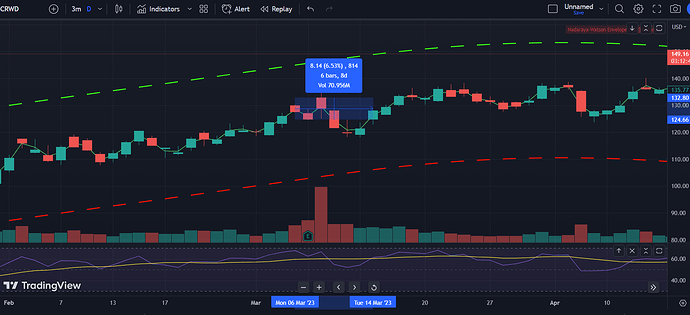

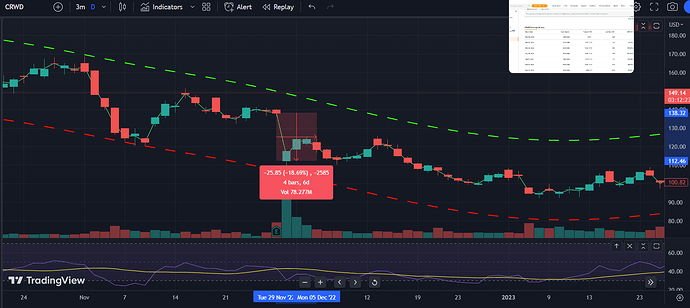

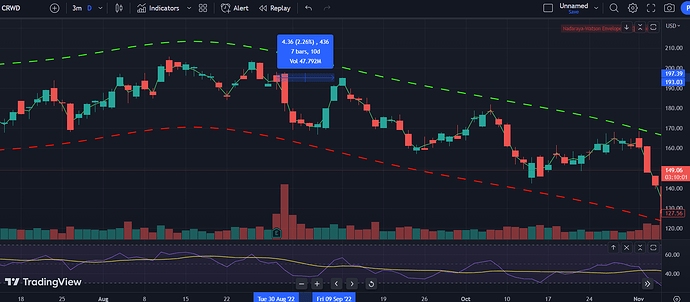

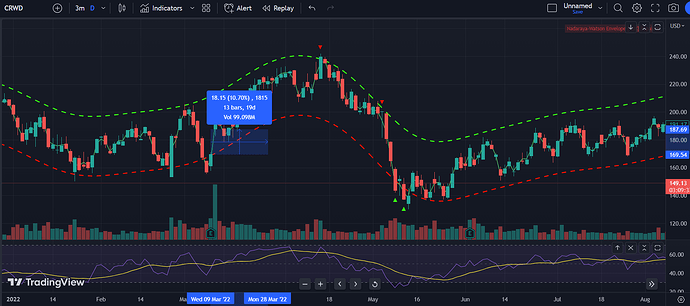

Previous earnings moves:

Overall, it seems like CRWD has pretty volatile earnings reports with its stock moving $6+ frequently. There’s enough of a move for me to want to play earnings, esp with its 10%+ moves sometimes, which with this AI craze, there is potential for CRWD to reach 10%+ earnings move overnight. I’m betting on up by like 10%+, but we’ll see if I want to take that gamble based on the options price.

My current levels for CRWD are these. I’m mostly looking at the 169 level since I’m bullish. If the earnings so well with the AI and go to the next major resistance level, that would be around a 12% move from now. We’ll see if CRWD can break its resistance here, if not then I would expect a little dip closer to the 140 level. Seems like it has a red day on the day of earnings so there should be a better entry incoming

Overall, we have good reason to believe in good earnings and combined with the AI craze and how any stock related to AI runs hard, we expect this to run hard too. Good luck all and play along if you can or believe in the same logic.