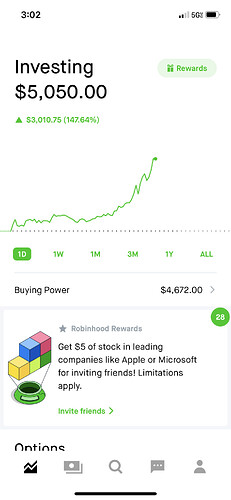

Here we go. Started the challenge with 1k on February 8th the week Conq started it. Even though the first week was more of a try out I actually ended up taking a big loss due to AFFRM earnings, therefore my account went to $258 if I’m not wrong. Made couple of other wrong trades but still broke even to around $258. Then, the second week of the challenge I decided to deposit fresh $10k for the challenge. Since I’m trading from RH, I was given $5k instant deposit to use right away while the other 5k it’s still being cleared and should clear the account this Wednesday, March 2nd. So basically I started last week with $5,250. Followed Conq’s plays but obviously at different play sizes and made about $1,029 by Wednesday. On Thursday decided to play some Earnings play such as Tdoc & Meli. Lost all the realized money I made the previous day. So back to square 1 of $5,250. I only played $4,300 out of $5,250 on Friday, followed the challenge plays Ozone, RSX, UNG, UUU, WHEAT, LNG, IRNT & (SPY puts exp today) Sold everything at open Spy, RSX, LNG, WHEAT all for profits. Sold UUU, UNG & IRNT for a loss. I’m still holding OZON due to halting. Made $3,100 in profit. Then decided to play quick TSLA calls for $500 profit. That brought the winning day to $3,600 around 67% for the day. Re-entered RSX &Tesla puts. Did average down on Tsla so that brought the account to 64% profit for the day so far.

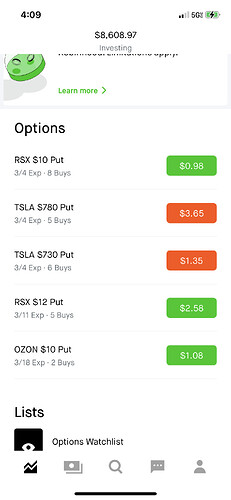

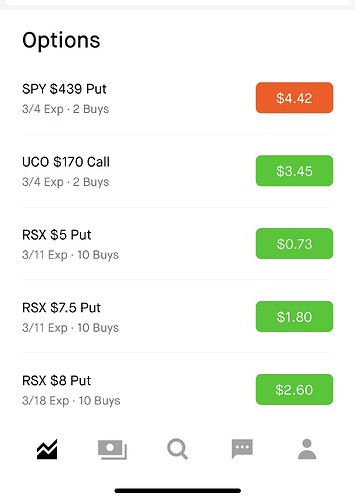

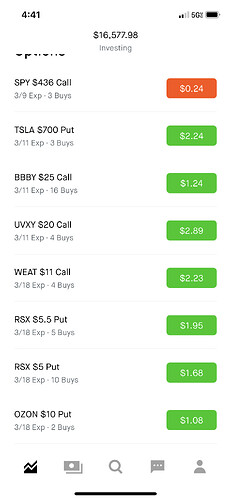

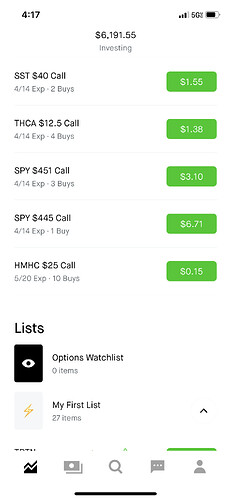

My current positions for tomorrow

RSX $10 strike exp 3/4 - 8 puts

RSX $12 strike exp 3/11 - 5 puts

Tsla. $780 strike exp 3/4 - 5 puts

Tsla $730 strike exp 3/4 - 6 puts

Ozon $10strike exp 3/18 - 2 puts

I’ll try to stay away from FDs on this challenge. Did take my chances with TSLA being it kinda ran $60 today so my guts tell me it would gap down the next couple of days. Time will tell my guts were right. But other than that will be following mostly Conq picks unless I see an interesting profitable quick play. Planning to get this account over 25k so I can have unlimited day trades.

Account Balance $8,608

4 Likes

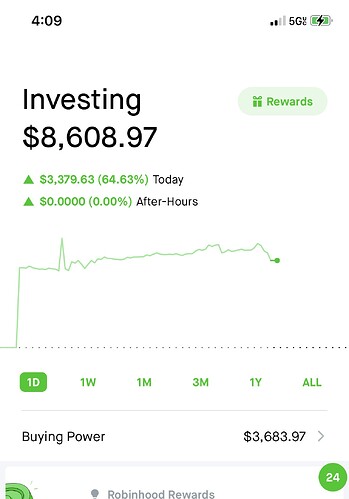

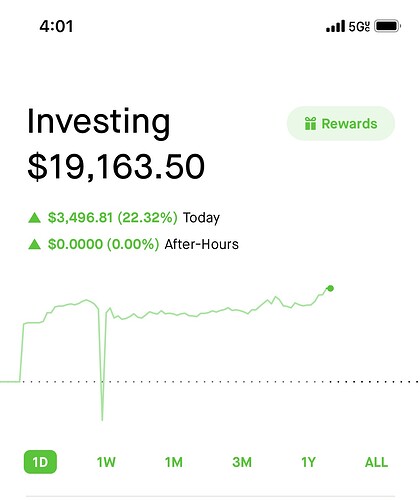

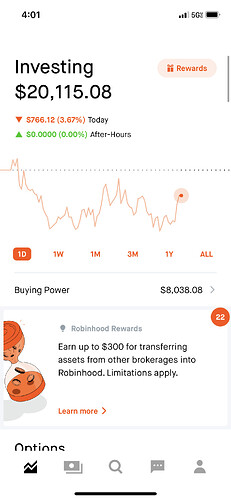

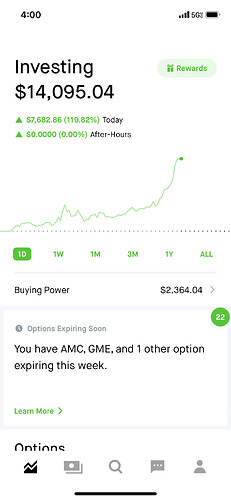

Today’s update!

Sold yesterday’s RSX positions for profit this morning. Re-entered RSX puts for March 18.

Sold TSLA puts half profit and half for loss so it kinda squared out for a small profit on TSLA. Bad judgement on my side for not selling everything for a profit instead of opting out to hold for longer. Lesson learned. Also my 5k that was waiting to get cleared hit the account today (did not trade with it).

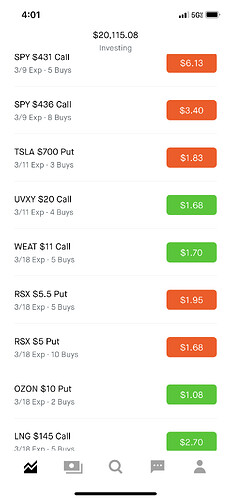

My current positions that I entered today along with the profit for the day. Thank you Valhalla!!

1 Like

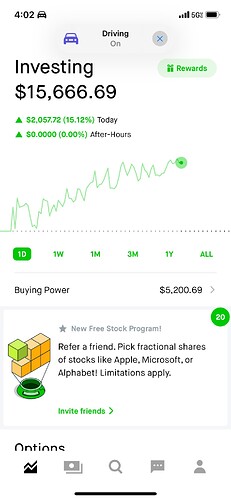

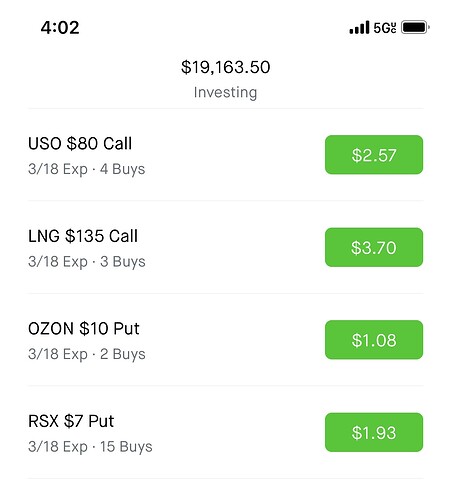

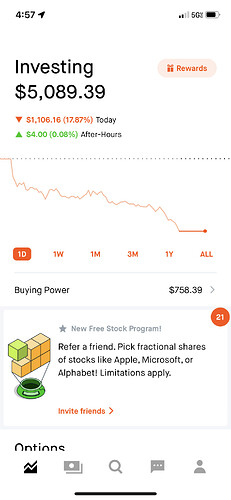

Today’s trading update. Good day again.

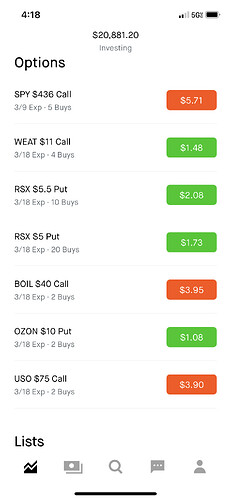

Current positions

1 Like

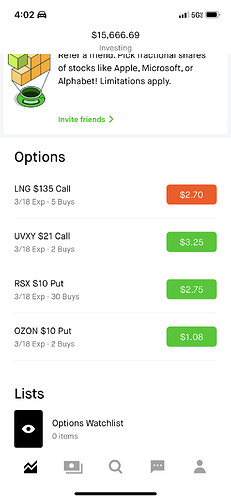

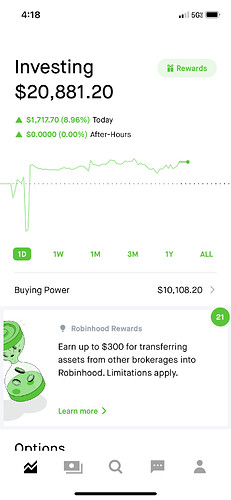

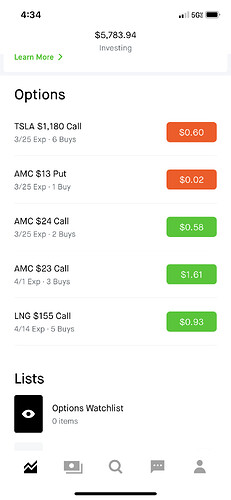

Today’s trading overall good. Current positions

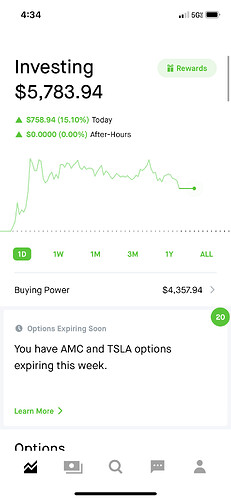

Today’s trading balance and current positions.

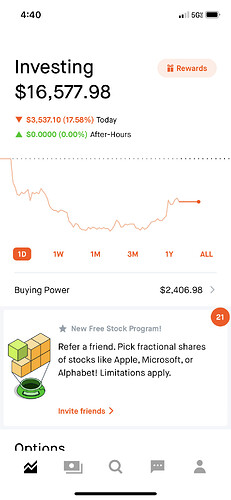

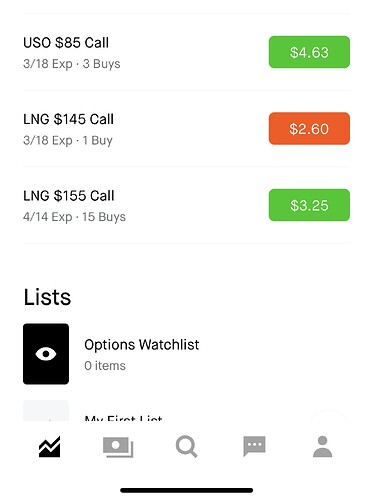

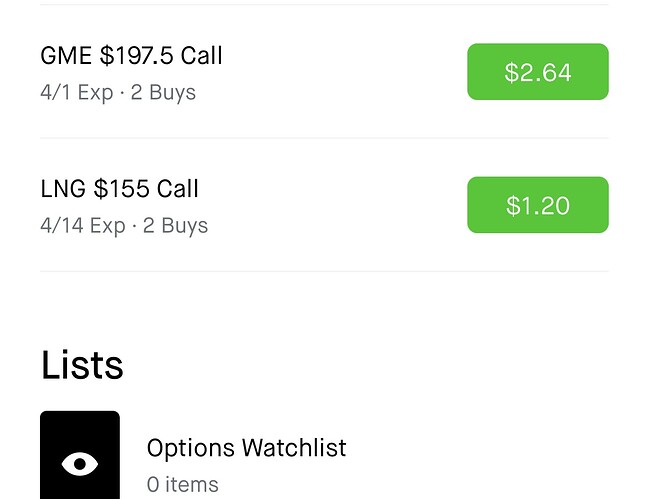

Today’s trading journal. Sold 10 spy calls for a 60% loss. Sold 3 LNG calls for a profit and re-entered for a later exp date. Overall day wasn’t good.

Today’s balance and current positions.

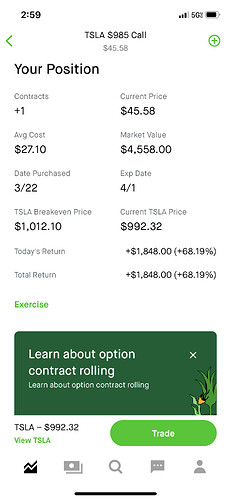

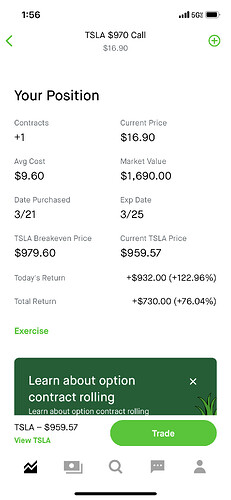

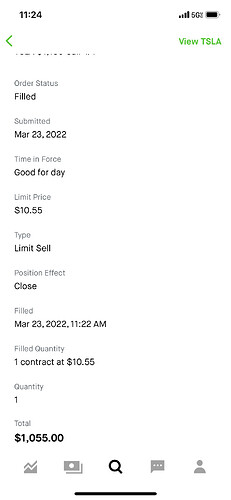

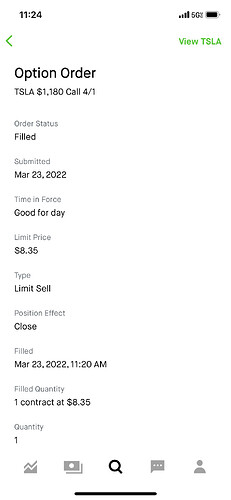

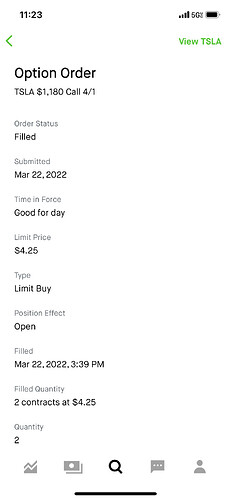

After being down from 20.8k to 1.8k with RSX and som spy calls &puts, got back on track with TSLA calls I bought. One yesterday and one today and sold both for profit.

3 Likes

Another solid day with 2 TSLA calls I bought yesterday and sold for around 150% profit.

Currently on AMC put & calls both sucking at the moment. Lol

I’ll see for a possible re-entry on TSLA. 1-2 weeks out. It’s getting riskier but I’m willing to take a risk with little money.

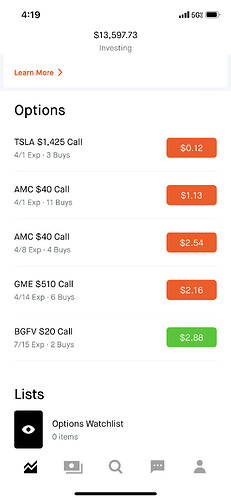

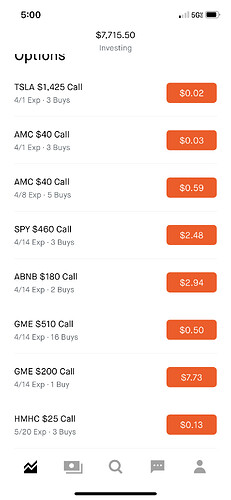

Today’s balance and positions.

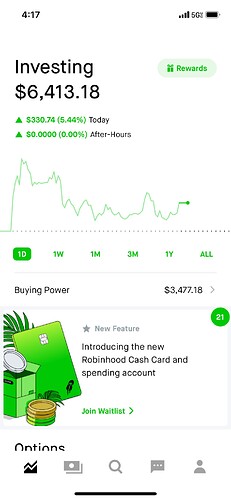

Today’s trading journal. Kinda slow day but as long as I wasn’t down, It still feels good.

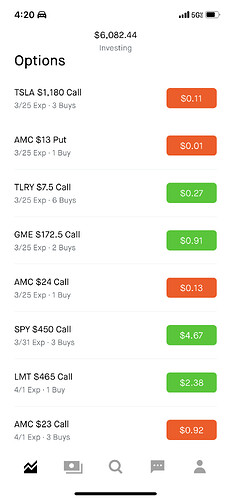

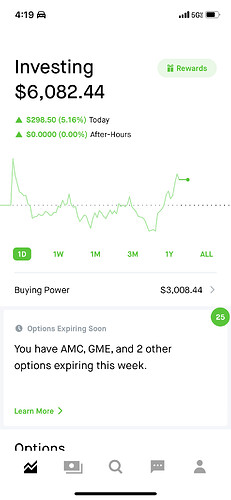

Today’s trading journal. Did great with GME & Spy calls from yesterday. Re-entered today again.

Today’s balance and positions for next week.

1 Like

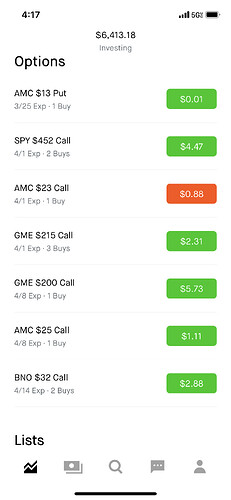

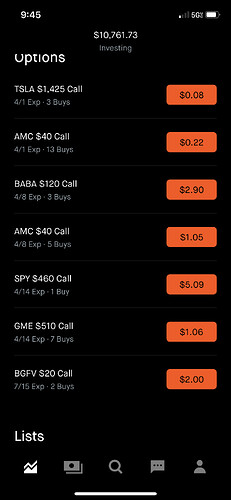

Today’s trading journal. Wish me luck tomorrow lol These are positions I entered today.

Today’s trading journal and positions

1 Like

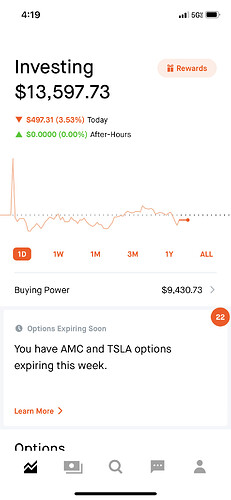

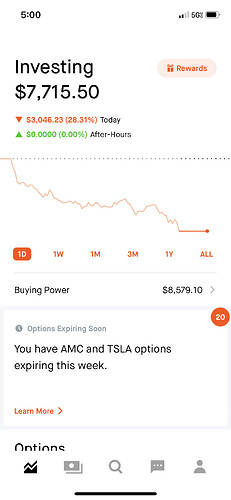

Today’s trading journal. It’s been a red day today. Hopefully a better day tomorrow

My current positions.

1 Like

Today has been another red day. Hopefully tomorrow will be a good day.

Today’s positions and balance.

1 Like

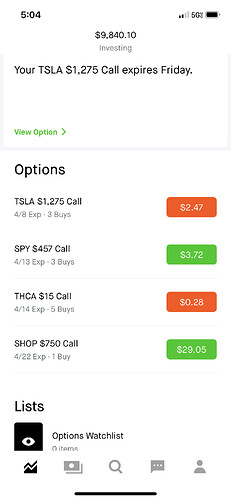

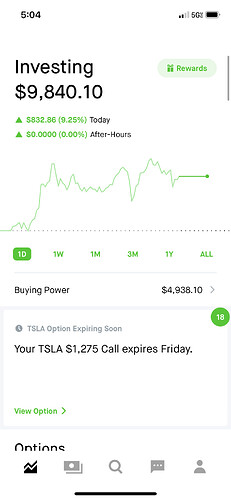

Today’s trading journal.

Sold a $450 spy call this morning that I bought on Friday at 5.20 & sold at 6.84.

Sold, 3 MOS calls for $50 loss.

Sold 1TKAT call that I bought at 0.72 and sold at 0.85

Today’s entered positions

3 Spy $457c at $3.20 Exp 4/14

3 Tsla $1,275c at $0.95 exp 4/8

5 THCA $15c at $0.45 exp 4/14

1 SHOP $750c at $27.50 exp 4/22

1 Like

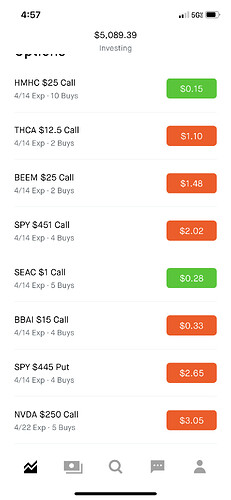

Today’s trading Journal.

Sold Beem for $275 loss this morning i May re-enter later.

Sold 2 tsla FDs for $80 loss.

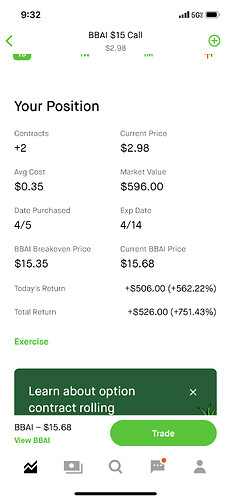

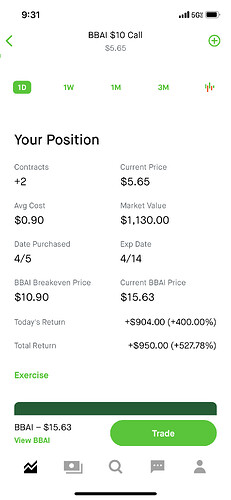

Sold $ BBAI calls for a decent profit which covered my loss from BEEM and TSLA.

The day started red -5% had mostly Spy calls, and 4 BEEM. Ended the day +14% overall. Sold most of my SPY calls between 35-60% in profits. Re-entered 3 more exp 4/14. Sold BEEM for 70% profit. Sold BBAI for -5% loss. Bought 4 THCA.

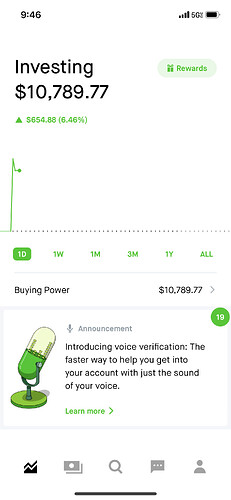

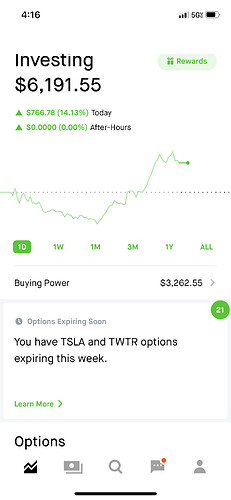

Took out 5K from the account and initiated a transfer to TD which will be available on 4/13. Once the cash settles in TD account, I plan to transfer the remaining balance from RH to TD, so I won’t be stuck with no trades until the other account is good to go. Got approved for options trading and cash account on TD.

1 Like

Today was a red day. Didn’t sell just added to my positions for next week.

1 Like

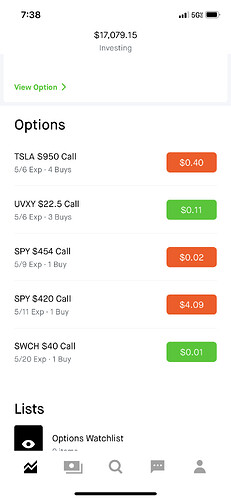

Haven’t updated my journal in awhile. Today was a great day thanks to TSLA puts. I was 3k down and ended the day with 2k up.

Had 1TSLA call that I bought 2 days ago exp 5/20 $965 call at $35.40 and sold for $26.50 this morning at market open. Sold 4 tsla $1015 call exp 5/6 and $1045 call exp 5/6 Took a loss on all the calls I had. I’m glad I got out early enough to by puts while TSLA was just $10 down around 10am.

Bought 2 tsla $925 puts @14.30 exp 5/6

Sold one at $15.70 and the other one at $31.10

Then re-entered 2 TSLA $895 puts at $38.50 exp 5/13. Sold them 20 minutes before market close at 55.35

My TD account on the other hand went all downhill within 2weeks. From 5k to $11. Thanks to spy calls where I over leveraged and couldn’t average down. My fault so no funds there except $11. I’ll be sticking to RH due to great UI for me. And doing better there. The bad part PDT restrictions until I get my account to over 25k, which hopefully will be soon. I’ll day trade when I have the day trades available otherwise all plays will be 1-3 weeks out depending on the bearish or bullish market movement.

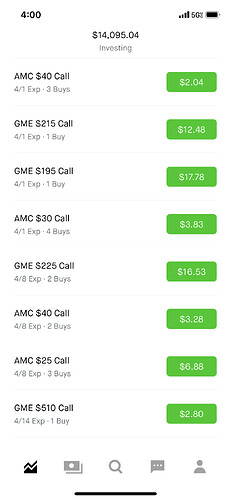

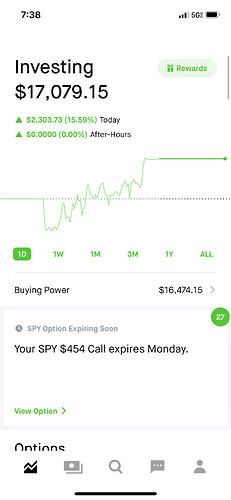

Today’s balance and took some lotto plays for tomorrow. Nothing biggie. I have 1 day trade available until next Thursday so I’ll be using it wisely.