https://www.barrons.com/articles/carvana-stock-analyst-downgrade-51649171871

CVNA downgraded talks a little about its acquisition of Adesa. Continues to slide

https://www.barrons.com/articles/carvana-stock-analyst-downgrade-51649171871

CVNA downgraded talks a little about its acquisition of Adesa. Continues to slide

I just seen this, and it made me think of CVNA, although I havent been following it, I imagine this may affect those that deal with used cars

https://twitter.com/unusual_whales/status/1512128219545161748?s=20&t=xcCNbXfelhpRf29GzcaV2Q

This is probably accurate I know at my store in particular we have had our thumbs on the market daily trying to turn as fast as we can to avoid a total market collapse in value which will happen.

Here’s where this hurts CVNA the most. They don’t sell new cars. New cars generate the nicest and best used cars via trade in. Most cars traded on used cars tend to be on their last legs. CVNA has been acquiring cars via purchase and trade for last year and getting heavy in them. With the massive amount of inventory they have and have in recent year very much overpaid for any drop in used car prices will affectively put them underwater in their inventory.

For long term outlook on CVNA not just recent events I’d point to their debut as some shiny new process that’s cutting edge. I can personally say the same process has been going on at leading edge dealers since 08 range. And becomes easier and easier everyday. You can now buy a car from across the country I can remotely have paperwork done and paid by the bank that did financing in matter of minutes and never leave your couch. The marketing was what pumped CVNA and general public not knowing any mom and pop dealer can provide the same experience. Couple that with bad publicity for license and title issues and very poor acquisitions and already bleeding their investors money. This company is doomed and more than likely headed to the ground.

Nice work on the 100p those hopefully worked out nicely! One other note on the continued demise of #CVNA. Rising rates can play a factor here. Inflated used car prices with inflated rates equals high payments which makes people shelter in place essentially in regards to upgrading their current rides. Most brick and mortar dealers have local CUs that are their biggest lender CVNA doesn’t have that benefit they are relying on national banks with rising rates to provide their financing.

They have added new put strikes to the May 20th expiry down to where I feel it belongs in the 50 range. I’d expect continued downward sentiment as it seems to have bucked the brief unfortunate broader markets run ups and continued to slide.

Earnings could be a bloodbath with slightly slowing demands in Q1 rising rates and the bad acquisition of now a relatively abysmal auto auction.

They worked out nicely indeed, but “sadly” got limit sold at 2x. Will probably use half the proceeds to get puts again shortly. Agreed that all signs point to a continued slump!

Looks like CVNA earnings moved up to this Wednesday from May the 5th can’t find any reason why but not expecting much of anything positive reporting the quarter that includes January and February slowest retail automotive months of the year always. I’d expect some conversation about the adesa acquisition announced last ER.

Thanks @jjcox82 very curious that CVNA moved the earnings up. There has to be time sensitive stuff that could not wait 3 weeks. It cannot be good, right?

That’s my assumption. I know Ford last day utilizing Adesa is the 10th of May. So maybe trying to beat the news with that acquisition. Or to put some spin on it

@The_Ni looks as if our thesis was correct I sold outs before close though to take the premium gains but will look to pick up some more tomorrow.

Thank you for your continued insights - without it, would very likely not be in the play!

Held mine because of the July expiry.

Ooof that’s a bad miss on the EPS and gross profit. Especially being in the business retail profits are up huge right now. We have had our most profitable 18 months in 60 years of business.

Thanks to algos who read things literally, the entire 26% drop (~$23) in price that happened in the first 30 mins was retraced in the subsequent 30 mins.

That jump at 4:51pm was caused by the release of the following information:

Carvana Co. (NYSE: CVNA), the leading e-commerce platform for buying and selling used cars, today announced its intention to offer, subject to market and other conditions, $1 billion of its Class A common stock in a public offering registered under the Securities Act of 1933, as amended (the “Securities Act”).

Ernest Garcia, II, along with Ernie Garcia, III, Carvana’s Chief Executive Officer, and entities controlled by one or both of them, have indicated an interest in purchasing up to an aggregate of $432 million of the Company’s Class A common stock in the offering, based on their pro rata ownership.

Here is the prospectus.

CVNA shrewdly pinned the estimate of the number of shares to a price of $101.77, which algos seem to have picked up and run with. (Note that it’s just a hypothesis that it’s the algos doing this, but that’s usually how reactions to earnings work and we’ll have to wait to see what humans decide tomorrow.)

Our Class A common stock is listed on the New York Stock Exchange (the “NYSE”) under the symbol “CVNA.” On April 19, 2022, the last reported sale price of our Class A common stock was $101.77 per share. Based upon an assumed public offering price of $101.77 per share, the last reported sale price of our Class A common stock, > we expect to offer 9,826,078 shares hereby.

There is a sweetener, even - the CEO and fam will partake in this offering in a big way:

The Garcia Parties have indicated an interest in purchasing up to an aggregate of $432.0 million of shares of our Class A common stock offered pursuant to this prospectus supplement in this offering at the public offering price, based on their pro rata ownership.

There’s a twist:

To the extent the Garcia Parties purchase any such shares in this offering, the number of shares available for sale to the public will be reduced accordingly. Because these indications of interest are not binding agreements or commitments to purchase, the Garcia Parties may elect to purchase fewer shares in this offering than they indicated an interest in purchasing.

Note that the offering is for $1B of stock, not a specific number of stocks:

We are offering $1.0 billion of shares of our Class A common stock, par value $0.001 per share (our “Class A common stock”).

How will this play out? Well, barring new information coming to light, it’ll probably be some kind of race between:

In the long run though… there was nothing redeeming in the earnings, so it should float down to lower levels.

Quite an interesting thread(s) to read:

https://twitter.com/WallStCynic/status/1516894547686662145

https://twitter.com/rschmied/status/1516890322973851648

I’ve been doing a little reading and thinking I’m regards to the earnings and the subsequent shelf.

I believe @The_Ni is correct with the algo buying theory as there were huge candles in AH they only average about 3 million in volume a day normally.

We had discussed above the fact that #cvna moved their earnings up several weeks. I believe this company is struggling for cash they have huge real estate debt with their fancy car dispensing machines all over major metro areas most of these areas property is not cheap. Now how this thread started an acquisition of Adesa at 2.2 billion dollars. With news of most legacy manufacturers pulling their lease returns repos etc that is going to be a major cash drain purchase. CVNA actual business model requires huge sums of cash on hand. They buy cars from auctions from everyday consumers with their online purchasing tool. These are all major cash drains. I personally think the earnings and offering were moved up as they are running on fumes. Also released in share holder letter they have stated they won’t be giving short term guidance to their earnings. This is very bearish to me.

In summary a company bleeding money while continuely spending and essentially being forced to do an offering at 1/3 of their ATH screams trouble. I would not expect Q2 to be any better as they are undoubtedly heavy in their inverntory and rates rising making consumers less likely to buy over priced inventory. As well as rates rising on any borrowed debt they need to acquire to help them get buy.

As much as I was wanting to see anyone with puts printing big. At least when the sell off does begin it will be during market hours so the profits can be taken! Going to look for June 50p entry

Seconding the notion. I would definitely pick a longer expiry just to shield from any shenanigans their management may pull off.

Check out our friend Ernest Garcia II previous history seems he’s been involved in several nefarious business ventures.

Also these guys started with Drivetime which is a buy here pay here car franchise. Meaning they determine the rate and write the loans. Notorious for ridiculously high rates and essentially charging the consumer whatever they want for the car as there are no loan to value caps because they write the loans. Don’t pay they just take the car and resell to someone else. He’s also happened to have sold of 3.6 billion in CVNA shares as of September of 21. It was trading at 250-300 range then. Seems to me the writing may have been on the wall.

Haha wow… track record of funny business.

@jjcox82 agree with your prognosis that they moved the date up by 3 weeks because they are probably running out of cash. They especially don’t have cash to close the Adesa transaction.

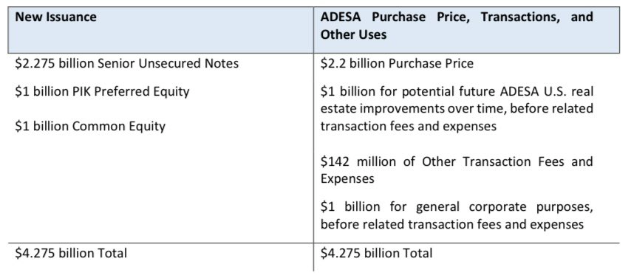

One of the tweets @hansolo shared has this image:

Couple of interesting things here:

The Adesa transaction is supposed to close in May. That leaves about a month to raise this money. What happens if they are unable to by then?

May implies just a month of runway. This should get quite interesting.

In my reading I also happened to stumble upon a previously filed proxy. They have an annual shareholder meeting set for May 2nd I couldn’t get through the entire proxy when I found it. But may try to read more of it this evening.

One of the lawsuits they have previously faced was due to not paying off the loans on customers trade ins in timely fashion. Running a large dealership even a mom and pop one requires a tremendous amount of cash flow as you have what’s called contracts in transit this is when a consumer Finances a car and then all proceeding docs are sent to the lender that said dealer works with. There can sometimes be funding issues however the dealer is required to pay off that car once sold by their floor plan lender. As well as payoff the customers trade in vehicle if it has a payoff to receive the title to then in turn sell it. If CIT is large which I am assuming it is as they do some major volume in total units they are probably struggling with cash flow there as well on top of their excessive losses. I genuinely could see a bankrupt company in the future.

Another amusing datapoint… Insiders, mostly the Garcias, have sold about $1.5B in shares in the last 12 months, when prices were much higher than where they are now. That is monumental amount… Puts the “up to” $423M in perspective.