Yeah that was my thoughts as well. So they are willing to put up like 1/10th of that they have already pillaged. Add that on top of the increase in the float and the awful earnings and I can’t imagine why they’d even be able to generate the 1 billion In preferred shares revenue or who’d be willing to throw money at that

Was able to fill some 80p April 29 guess gonna see how this goes.

I also grabbed one of these this morning - 80p 04.29.22

Nice, @jjcox82 @EV1 - it is a continued theme that my job will keep me poor(er)… as I keep missing the morning moves.

Nevertheless, joined the party with 5/20 60Ps. Doubling down a bit, adding to the current 5/20 80Ps.

Am still quite confident this should keep falling for the foreseeable future as I have not seen any new positive angle, but two things to keep in mind:

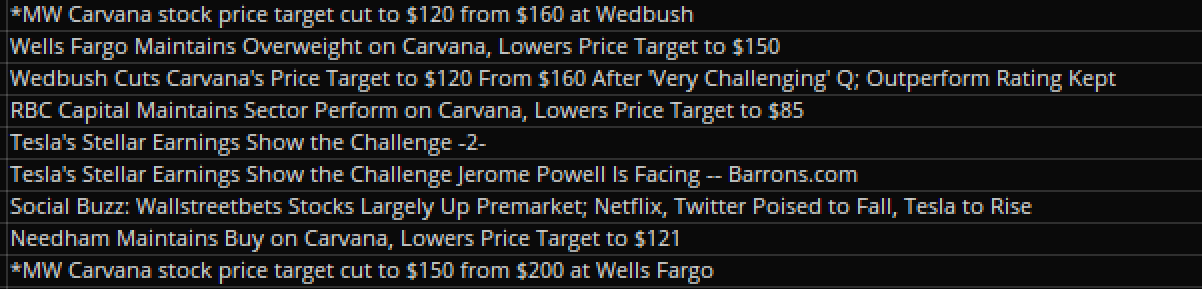

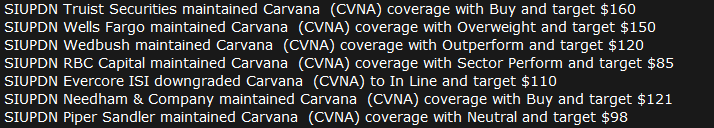

- there are some who are still maintaining a $360 price target and others promoting it, so this could be contributing to the buying we are seeing

- there is also a possibility that there is a bit of price propping happening to maximize the intake of cash from the offering

Taking 5/20s as want to give time for support to shake out. Their low cash position and the urgency to close the Adesa puts them on a clock that should work in our favor.

Feel like I got a bad fill on my 80p but did grab a 75 and 65 and already got out of those up 80%. Still holding the 80s. Because as I agree essential the price is being propped up. I will probably look to take profit on them and then roll out to lower strikes at big downturn. @The_Ni thanks for all your help on this thread. I tend to read charts like Ray Charles so your knowledge and expertise has been greatly appreciated.

Looks like they realized then need even more money over the last 24 hours:

Carvana Co. (“Carvana”) (NYSE: CVNA), the leading e-commerce platform for buying and selling used cars, today announced the upsize and pricing of its public offering of 15,625,000 shares of its Class A common stock at a price to the public of $80.00 per share. Ernest Garcia, II, along with Ernie Garcia, III, Carvana’s Chief Executive Officer, and entities controlled by one or both of them, will purchase an aggregate of 5,400,000 shares of the Company’s Class A common stock in the offering. The offering was upsized from the previously announced offering size of $1 billion of Class A common stock. The offering is expected to close on April 26, 2022, subject to customary closing conditions.

(PR)

That’s $1.25B, up from $1B.

Maybe because they are realizing demand for their crappy corporate debt will be less than stellar, not least because JPM walked away from the previous financing deal all this is replacing.

Looks like they lowered the price per share amount from original offering as well correct ?

I had closed my put for now and I’m looking for re-entry, but I’m curious if the sentiment around this for the next week or two won’t hold it above 80, seeing the Garcia’s purchase 5.4m shares

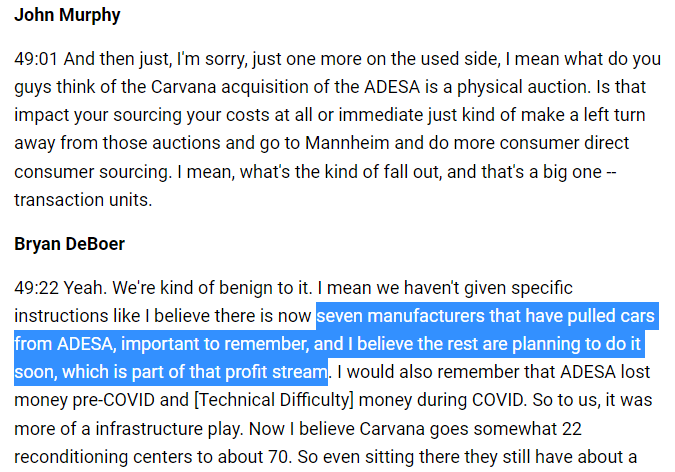

Interesting I hadn’t heard it was up to that many manufacturers. To put that into context F remarketing estimates are 100-150k a year over next 3 years. Average buyer fee on a 25k transaction (or average used car price) is 795 seller fee is around 600. That’s 1400 a car in revenue they would be out per car by 7 manufacturers.

And now they are already broke and losing money and financing the acquisition of another failing business. Can’t really end well in my opinion.

A fair amount of used dealers aren’t using Adesa anymore since Carvana bought them. I personally never used Adesa prior to due to high fees.

You see where the Garcias are buying like 33% of the 15 million new shares offered? I guess they are trying to retain their spot as the top shareholders.

430 million worth pennies in comparison to the billions they’d made selling near the top. But also do probably want to keep their super vote majority

I think they held 85% of the voting rights

Interesting read here below. Got out of some 80p today grab one at open on the bounce to average down because I believe in the continued down slide here. Picked up about 20 percent. Have one I held through weekend that’s currently up 40. Got what I felt like was a really good fill.

My plan here is to keep riding this all the way to the ground. I think they had some sentiment bounce with Garcia fellas portraying their measly investments back in as some kind of buyback. However I think we will see the continued decline especially if the market continues to slide or tank however you’d like to think. Essentially they have no positive catalysts coming and I’m of belief that the offering is a bearish move and as more news continues to come about the Adesa acquisition and their struggles to pay for it will be a downward catalyst I think I’m going to keep flipppng weekly’s even OTM seem to do well. Everything these guys touch seems to blow up so here’s to that happening yet again.

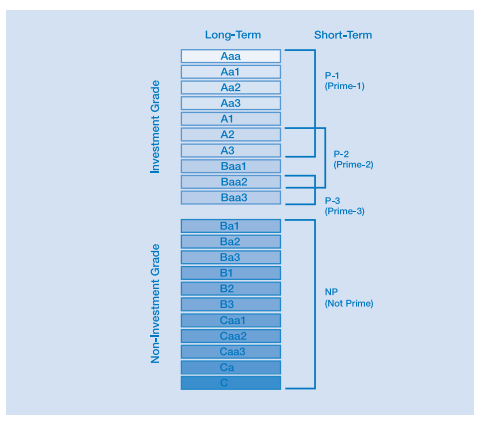

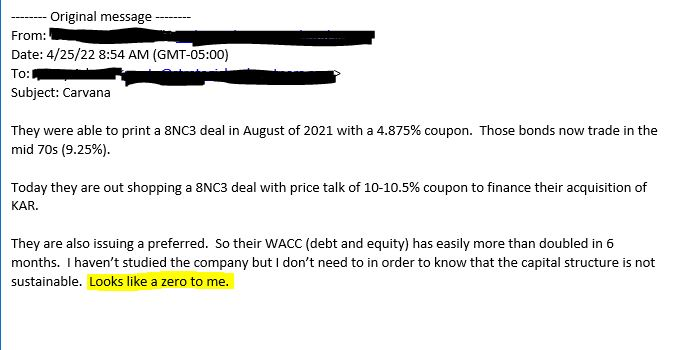

Incidentally, they are going to have to offer bond buyers an almost-10% coupon if they have any hopes of raising 2.25B in senior unsecured debt. This is their current outstanding bond portfolio, where yield is already at the 9-handle:

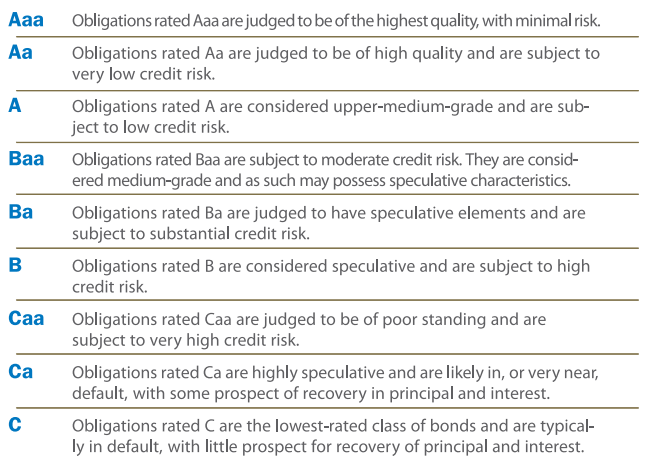

Their Moody’s rating is Caa2, which is not investment grade and just a few notches above absolute shit. No wonder JPM walked away.

It is quite possible that they upsized the stock offering by about 50% (~9M to ~15M shares) at a discount from the initial price ($101.77 to $80) because not many are nibbling at the debt offering.

They will likely raise the equity. If the debt is undersubscribed, or pulled completely, does the Adesa deal still go through? If it doesn’t will the Garcias just secured another 2B in lifeline?

https://www.businesswire.com/news/home/20220424005108/en/

Not a done deal yet but they are trying to raise this now

The 5/20 80 ran up almost 40% today so took profits. Still holding 60P.

It is possible that if they successfully raise the debt and/or the equity, it may cause a bump up, as there clearly is a segment of the market who does not share our pessimism. So I could get another opportunity to short more again.

Closed my April 29th 80p this morning up 50 %. Then was able to get a fill on may 6th 65p picked up 4. Hopefully keeps falling. I think maybe the market is starting to realize all the offerings and such isn’t bullish. Also helps that market in general is blowing up.

Take with a pinch of salt as always but I think we all have a hunch it will be hard to secure attractive financing