Thanks for sharing, @jjcox82! This looks like the product of a recent graduate from a Tier-2 business school who got 15 mins with one of the Garcias as they were waiting to take their private jet to Cancun, and then put some numbers together based on that, that they thought the other Garcia would want to see.

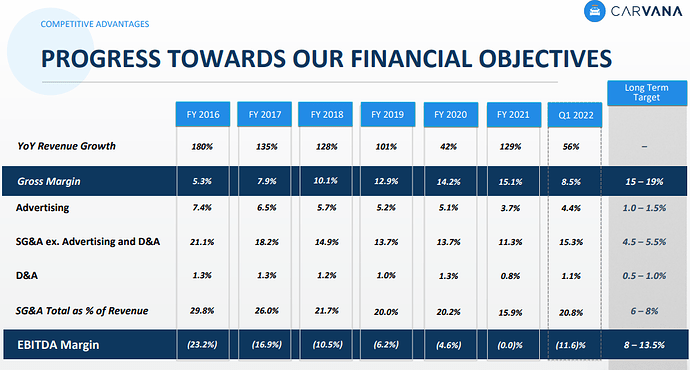

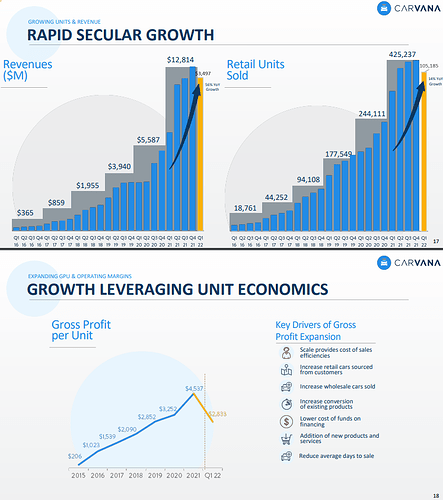

They actually released an Intro to CVNA in April that has the following chart. They hope to reduce both marketing and SG&A to a third or even a quarter to where they are now (slide 21). Unless there is some fundamental change in how they do customer acquisition or in their distribution channels, it is almost inconceivable how they will do this in the next few years.

This May presentation is probably an attempt to explain how they would do it

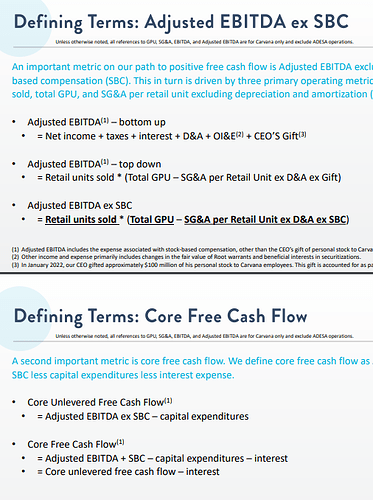

For starters, when one has to define their own accounting metrics, you know something’s up (slides 11 and 12). E.g. they take out capex and interest from FCF to come to “core” FCF. If capex is truly a one-time item, then sure, we could consider this alternative view. (It’s not - slide 13) But interest? That 10.25% coupon ain’t going anywhere. And it’s ~$300M too.

In Slide 21, they show where the SG&A cuts are coming from. Sure, they can fire people, like they did, to bring comp down. And they can reduce ad spend. However, that will affect revenue - they have been buying growth so far, and it doesn’t seem like they are a word-of-mouth stage yet.

That big, fat “Other” costs “include all other selling, general and administrative expenses such as IT expenses, corporate occupancy, professional services and insurance, limited warranty, and title and registration.” (Source) Unclear how they’ll reduce it by a third just like that.

A lot of this is based on anticipated synergies from the ADESA acquisition. (Starting slide 41.) If the company had a history of executing well, I would be willing to entertain that this could happen. But given what we know, this feels unlikely to pan out this way.

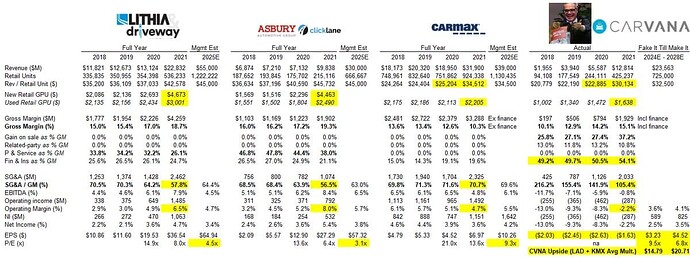

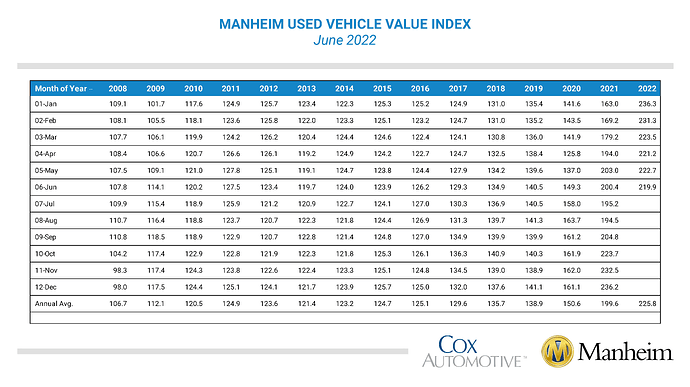

Final point - most of this is not consistent with recent figures - that GPU drop…:

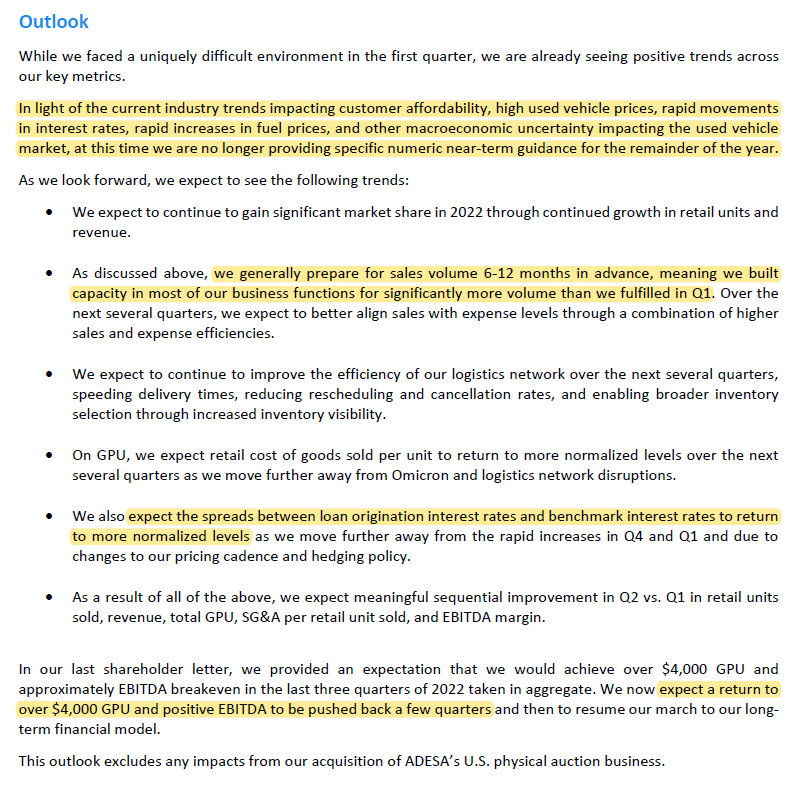

And the stuff they shared in their Q1 shareholder letter:

If anything, it seems that they recognize market headwinds, yet built up inventory at even higher levels and are counting on a bunch of things improving at the same time to save their behind.

Nothing in this made me feel any better, and makes this seem like an even bigger short.